🌍 Introduction – Why Europe’s Tech Hubs Matter More Than Ever in 2025

The European tech landscape is experiencing a powerful renaissance in 2025. As digital transformation reshapes every industry, Europe is emerging not only as a fast follower—but as a global leader across AI, cybersecurity, climate tech, and blockchain regulation. From Amsterdam to Tallinn, from Barcelona to Vilnius, a new wave of innovation is taking shape through universities, accelerators, and policy-backed digital clusters.

Boosted by flagship programs like Horizon Europe, the Digital Europe Programme, and national-level tax breaks and startup visas, the continent’s smartest cities are now among the most competitive places for tech founders, VCs, and skilled digital professionals. In parallel, the EU’s push for digital sovereignty and ethical innovation is creating distinct advantages over U.S. and Asian counterparts.

This Gazett.eu special report presents our independent rankings and deep-dive profiles of the Top 10 European Tech Hubs in 2025—evaluated by startup density, talent ecosystem, sector specialization, government incentives, and investment growth. Whether you’re a founder, policymaker, or student, this guide unpacks where the next wave of European tech breakthroughs is happening.

🌐 Infographic: Europe’s Digital Hubs, Startup Trends & Innovation Hotspots – Source: Eurostat, Startup Heatmap, Horizon Europe

🗂️ Article Overview

- 🌍 Introduction – Why Europe’s Tech Hubs Matter More Than Ever in 2025

- 📋 Ranking Methodology – How We Evaluated the Tech Ecosystems

- 🏆 Top 10 European Tech Hubs in 2025

- 🚀 Emerging Tech Cities to Watch

- 🔬 Sectoral Strengths – AI, Fintech, Biotech & More

- 🏛️ EU & National Policies Fueling Innovation

- ⚠️ Challenges, Talent Gaps & Infrastructure Needs

- 📌 Conclusion + Matrix + Takeaways

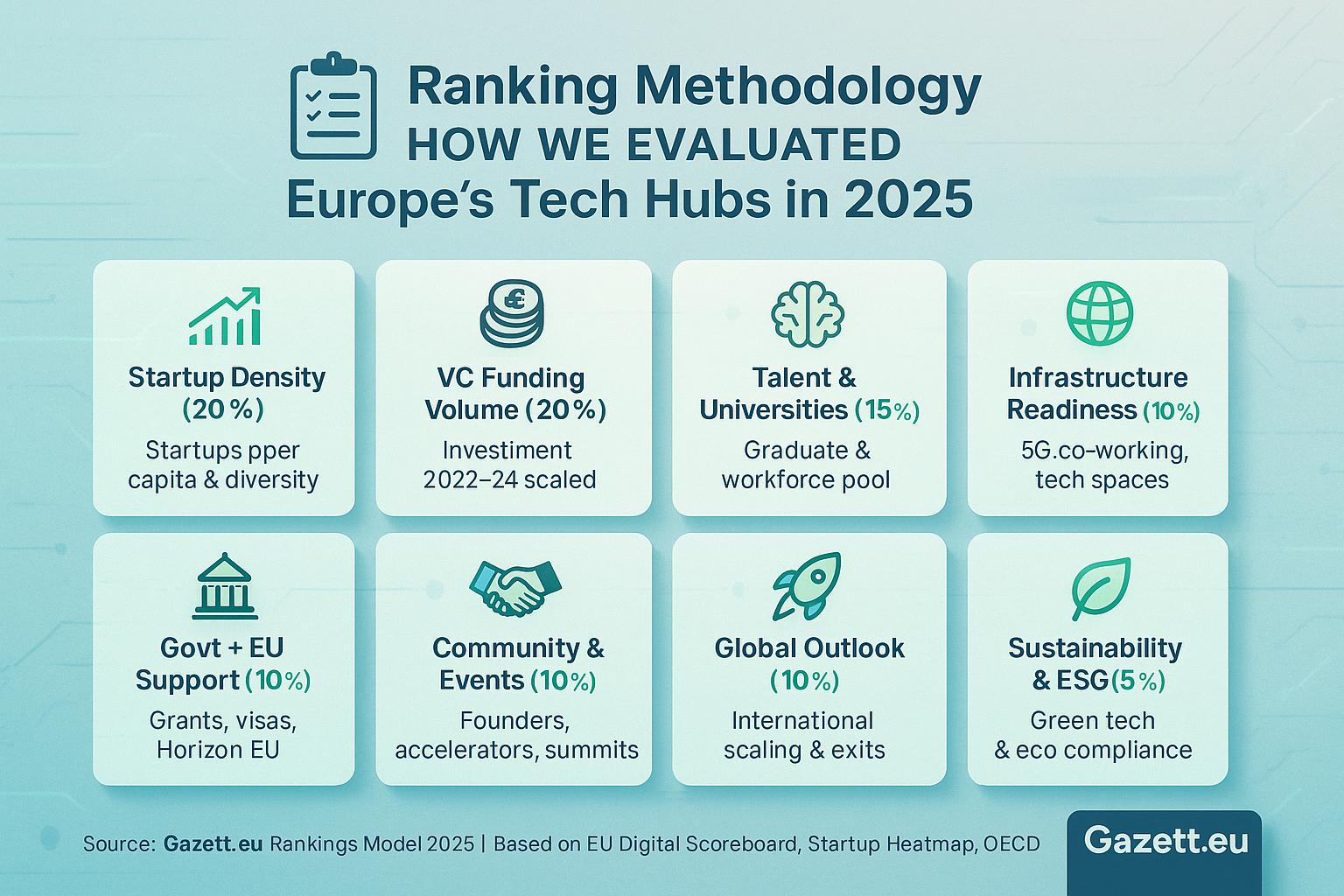

📋 Ranking Methodology – How We Evaluated the Tech Ecosystems

To determine the Top 10 European Tech Hubs in 2025, Gazett.eu applied a proprietary scoring model that balances quantitative metrics and qualitative insights across a consistent, multi-dimensional framework. We sourced data from the latest Startup Heatmap Europe, OECD Digital Economy Outlook, EU Commission’s Digital Economy Reports, and national startup ecosystem trackers to rank cities across eight core parameters.

Each city was scored from 1 to 10 across the following categories. Scores were then normalized and weighted to arrive at our final rankings. The aim is to highlight hubs that are not just big — but also sustainable, future-ready, and strategically aligned with Europe’s innovation vision.

📈 Startup Density (20%)

Total number of active startups per 100K population, sector diversity, and founder activity.

💶 VC Funding Volume (20%)

Total VC raised in 2022–2024 adjusted for city size and median investment round.

🧠 Talent & Universities (15%)

Access to skilled workforce, tech graduates, coding academies, and research universities.

🌐 Infrastructure Readiness (10%)

Quality of broadband, 5G coverage, co-working spaces, and business parks.

🏛️ Government & EU Support (10%)

Startup laws, visa policies, EU grants (Horizon, EIC), and smart city programs.

🤝 Community & Events (10%)

Presence of accelerators, networking events, angel investors, and co-founder platforms.

🚀 Global Outlook (10%)

Export potential, unicorn exits, cross-border growth and international VC participation.

🌱 Sustainability & ESG Culture (5%)

Focus on green innovation, carbon-neutral campuses, cleantech startups, and ESG initiatives.

📊 Infographic: How European Tech Hubs Were Scored – Source: Gazett.eu, EU Digital Scoreboard, Startup Heatmap Europe

🏆 Top 10 European Tech Hubs in 2025

Based on our comprehensive scoring model, the following cities represent the leading technology ecosystems in Europe for 2025. These hubs balance startup energy with infrastructure maturity, global outlook, and sustainability performance — making them key destinations for founders, investors, and governments shaping Europe’s digital economy.

| Rank | City | Country | Total Score | Startups | VCs | Talent | Infra | ESG |

|---|---|---|---|---|---|---|---|---|

| 🥇 | Berlin | 🇩🇪 | 91 | 10 | 9 | 9 | 8 | 9 |

| 🥈 | Amsterdam | 🇳🇱 | 89 | 9 | 9 | 10 | 9 | 8 |

| 🥉 | Stockholm | 🇸🇪 | 86 | 9 | 8 | 9 | 9 | 8 |

| 4 | Paris | 🇫🇷 | 85 | 9 | 10 | 8 | 8 | 7 |

| 5 | Barcelona | 🇪🇸 | 82 | 8 | 9 | 9 | 8 | 8 |

| 6 | Dublin | 🇮🇪 | 80 | 8 | 8 | 10 | 7 | 7 |

| 7 | Lisbon | 🇵🇹 | 78 | 8 | 7 | 8 | 7 | 8 |

| 8 | Vienna | 🇦🇹 | 76 | 7 | 8 | 8 | 8 | 8 |

| 9 | Helsinki | 🇫🇮 | 75 | 7 | 7 | 9 | 8 | 8 |

| 10 | Munich | 🇩🇪 | 74 | 7 | 9 | 8 | 7 | 8 |

🇩🇪 Berlin

Berlin dominates as Europe’s top innovation capital, with over 4,000 active startups and a thriving venture capital ecosystem. Government-backed programs like EXIST and university accelerators from TU Berlin continue to grow the pipeline. The city’s talent diversity and affordable living are central to its edge in Germany’s tech-led economy.

Key Sectors: AI, Fintech, SaaS | Top Score: Startup Density

🇳🇱 Amsterdam

Amsterdam offers one of the most advanced digital startup ecosystems in Europe, backed by multilingual talent and a high concentration of tech headquarters. Known for data science, green logistics, and fintech, the city benefits from EU startup visa schemes and strong public-private R&D support. Its position in the Benelux innovation corridor keeps it future-ready.

Key Sectors: SaaS, CleanTech, Analytics | Top Score: Talent & English fluency

🇸🇪 Stockholm

Often called the “Unicorn Factory” of the north, Stockholm combines social infrastructure with cutting-edge startup output in sectors like e-health, fintech, and climate innovation. Sweden’s transparent business laws and strong ESG standards give the city a sustainable edge. Creative industries and fashion tech also thrive here.

Key Sectors: HealthTech, Fintech, ClimateTech | Top Score: ESG & Ecosystem Maturity

🇫🇷 Paris

Paris is on track to become the AI capital of Europe, with major state-led investments via La French Tech and strategic ties to the EU’s digital sovereignty vision. Its ecosystem has evolved beyond fashion and luxury into a high-growth zone for AI, deeptech, and robotics. University R&D collaboration also adds to its IP strength.

Key Sectors: AI, Cybersecurity, Robotics | Top Score: Government Funding

🇪🇸 Barcelona

A rising Mediterranean tech hub, Barcelona blends quality of life with fast-growing innovation in mobility, smart cities, and gaming. Events like the Mobile World Congress and EU urban labs have positioned it as a digital sandbox. Public Wi-Fi, 5G expansion, and EU climate resilience funding help support its digital infrastructure.

Key Sectors: Smart Mobility, VR/XR, UrbanTech | Top Score: Infrastructure Readiness

🇮🇪 Dublin

As a major gateway for US tech giants into Europe, Dublin’s ecosystem is driven by enterprise-scale players and tax-efficient policies. It leads in enterprise SaaS, cloud computing, and regtech. Post-Brexit, Ireland has become a vital HQ alternative — fueling both FDI and local startup acceleration.

Key Sectors: SaaS, Fintech, Cloud | Top Score: Talent Pool

🇵🇹 Lisbon

Lisbon has emerged as one of Europe’s hottest digital nomad and Web3 destinations. With affordable cost of living and simplified residency rules, Portugal continues to attract global remote startups. Initiatives like Web Summit and digital nomad visa reforms have further strengthened its international appeal.

Key Sectors: Remote Tech, Blockchain, TourismTech | Top Score: Global Openness

🇦🇹 Vienna

Vienna leads in edtech, cybersecurity, and public sector innovation, bolstered by its position in the Central European region. The city’s commitment to sustainability and inclusive digital governance adds to its tech maturity. It’s also gaining ground as a testbed for EU e-governance pilots and green infrastructure tech.

Key Sectors: EdTech, GovTech, AI Ethics | Top Score: ESG & Public Policy Alignment

🇫🇮 Helsinki

Helsinki is a quiet powerhouse in the Nordic innovation ecosystem. Known for AI, gaming, and deeptech, it offers a high R&D spend-to-output ratio. The city has an active climate-tech startup base and is often involved in Horizon Europe and EIT projects. It’s also one of the most transparent governance cities in tech policy.

Key Sectors: Gaming, AI, Deeptech | Top Score: Research-to-Innovation Efficiency

🇩🇪 Munich

Munich combines Germany’s industrial heritage with a strong high-tech research base. It’s a leader in robotics, mobility-as-a-service, and industrial IoT. With TUM and other leading research centers, the city channels deeptech into enterprise partnerships — ideal for scale-ups seeking B2B validation in manufacturing or automotive.

Key Sectors: Robotics, Industry 4.0, MobilityTech | Top Score: Deeptech & Enterprise Integration

🚀 Emerging Tech Cities to Watch

While Europe’s tech giants dominate headlines, several lesser-known cities are quietly building niche innovation hubs. These emerging cities are attracting VC attention, launching deeptech accelerators, and aligning with EU green or digital goals. Here’s who to keep an eye on in 2025.

🇪🇪 Tallinn, Estonia

Known for its e-governance leadership and startup visa framework, Tallinn is now investing in AI ethics, cybersecurity, and public digital infrastructure.

Edge: Digital state + startup friendliness

🇨🇿 Brno, Czechia

Brno has rapidly grown into a research cluster for biotech, semiconductors, and precision robotics, with EU Horizon-funded incubators.

Edge: Deeptech R&D + low-cost base

🇮🇹 Bologna, Italy

Now home to Europe’s most powerful AI supercomputer (Leonardo), Bologna is positioning itself as a national hub for data science and green innovation.

Edge: AI infrastructure + academia

🇷🇴 Cluj-Napoca, Romania

Often called the “Silicon Valley of Eastern Europe,” Cluj excels in IT services, software engineering, and outsourcing with a growing local VC scene.

Edge: Software dev + youth talent

🇬🇷 Thessaloniki, Greece

Thessaloniki is gaining traction in climate tech and renewable R&D through smart mobility programs and startup campuses supported by EU regional funds.

Edge: Green tech + mobility testing

🇱🇹 Vilnius, Lithuania

With one of the most fintech-friendly legal systems in the EU, Vilnius is home to 250+ registered fintechs and is now expanding into DeFi and regtech.

Edge: Fintech laws + digital licensing

🔬 Sectoral Strengths – AI, Fintech, Biotech & More

Every European tech hub brings a different strength to the table. Some are global leaders in AI and robotics, while others are rising in fintech, green mobility, biotech, and creative tech. Here’s how the top 10 hubs stack up across the most dynamic sectors in 2025.

| City | AI | Fintech | Biotech | Mobility | ClimateTech | Cybersecurity | EdTech |

|---|---|---|---|---|---|---|---|

| Berlin 🇩🇪 | ✅ | ✅ | ⚪ | ✅ | ⚪ | ✅ | ❌ |

| Amsterdam 🇳🇱 | ⚪ | ✅ | ⚪ | ✅ | ⚪ | ✅ | ⚪ |

| Paris 🇫🇷 | ✅ | ⚪ | ✅ | ⚪ | ✅ | ✅ | ❌ |

| Lisbon 🇵🇹 | ⚪ | ✅ | ❌ | ✅ | ✅ | ⚪ | ❌ |

| Stockholm 🇸🇪 | ✅ | ✅ | ⚪ | ✅ | ✅ | ⚪ | ⚪ |

| Vienna 🇦🇹 | ⚪ | ⚪ | ⚪ | ⚪ | ✅ | ✅ | ✅ |

| Helsinki 🇫🇮 | ✅ | ⚪ | ✅ | ⚪ | ✅ | ✅ | ⚪ |

| Barcelona 🇪🇸 | ⚪ | ⚪ | ❌ | ✅ | ✅ | ⚪ | ❌ |

| Dublin 🇮🇪 | ✅ | ✅ | ❌ | ⚪ | ⚪ | ⚪ | ❌ |

| Munich 🇩🇪 | ✅ | ⚪ | ✅ | ✅ | ✅ | ⚪ | ⚪ |

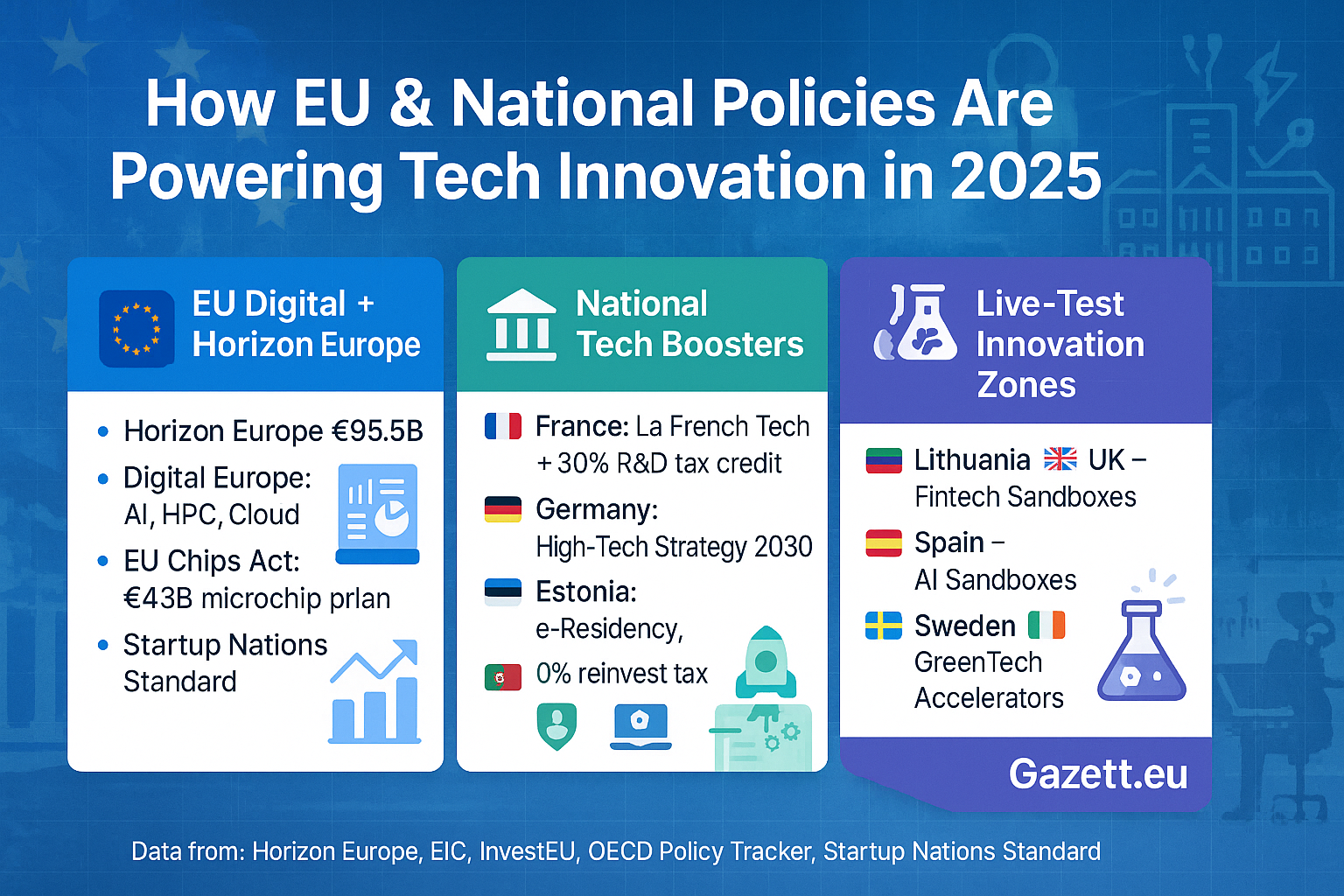

🏛️ EU & National Policies Fueling Innovation

Europe’s rapid tech transformation is deeply policy-driven. While cities compete globally for startup capital and talent, it’s often government policies that lay the groundwork for innovation. From EU-wide digital strategies to local tax breaks and R&D funding, these public levers shape how ecosystems scale.

📊 Infographic: Public Innovation Frameworks across the EU – Source: EU Digital Compass, EIC, InvestEU, Startup Nations Standard

🇪🇺 EU-Level Innovation Drivers

- Horizon Europe (2021–2027): €95.5 billion R&D budget with deeptech, healthtech, and green tech priorities

- Digital Europe Programme: Boosting AI, quantum, and high-performance computing infrastructure

- EU Chips Act: €43 billion allocated to boost microchip production by 20% market share goal

- Startup Nations Standard: Streamlining cross-border startup scaling and founder-friendly regulations

🏛️ National Policies Boosting Tech

- France: 30% R&D tax credit + €5 billion startup stimulus (La French Tech)

- Estonia: 0% reinvested profit tax + full digital incorporation in < 30 mins

- Germany: High-Tech Strategy 2030 + tax write-offs for innovation clusters

- Portugal: Tech Visa + Non-Habitual Residency tax regime for digital nomads

🧪 Sandbox & Fast-Track Models

- Fintech Sandbox: Lithuania, Denmark, and the UK offer EU-recognized live test environments

- AI Sandboxes: Spain and France launching frameworks for AI/robotics experimentation

- GreenTech Accelerators: Ireland and Sweden fund cleantech startups through national energy boards

For a deeper breakdown of public investment flows, read our full analysis on EU Green Deal & Horizon Education Trends.

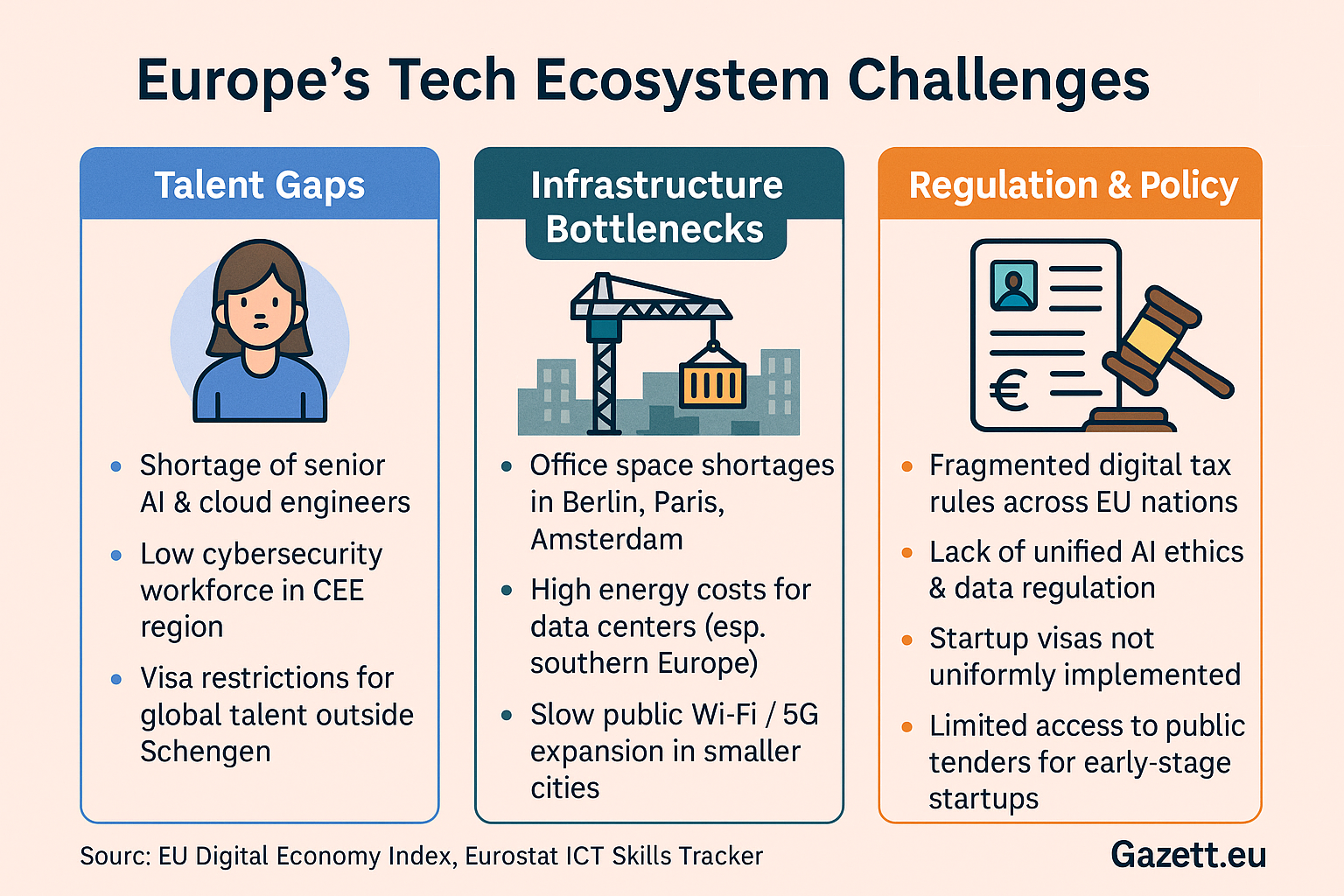

⚠️ Challenges, Talent Gaps & Infrastructure Needs

While Europe’s tech hubs are growing rapidly, they still face key structural and operational roadblocks. These include shortages in advanced digital talent, underdeveloped infrastructure in emerging cities, and policy delays in tech regulation harmonization. These challenges could slow the continent’s ability to compete with North America and East Asia.

⚠️ Infographic: Top obstacles across Europe’s tech ecosystems – Source: EU Digital Economy Index, Eurostat ICT Skills Tracker

👩💻 Talent Gaps

- Shortage of senior AI & cloud engineers

- Low cybersecurity workforce in CEE region

- Visa restrictions for global talent outside Schengen

- Startup hiring lagging behind BigTech salaries

🏗️ Infrastructure Bottlenecks

- Office space shortages in Berlin, Paris, and Amsterdam

- High energy costs for data centers (esp. southern Europe)

- Slow public Wi-Fi / 5G expansion in smaller cities

- Limited industrial land zoning in urban hubs

📜 Regulation & Policy

- Fragmented digital tax rules across EU nations

- Lack of unified AI ethics & data regulation

- Startup visas not uniformly implemented

- Limited access to public tenders for early-stage startups

📌 Final Summary + Score Matrix + Key Takeaways

Europe’s leading tech hubs offer a unique combination of talent, infrastructure, sectoral depth, and supportive public policy. From Berlin’s deeptech ecosystem to Lisbon’s affordability advantage, these cities represent the cutting edge of innovation in 2025. However, scaling challenges remain—from talent shortages to inconsistent regulatory landscapes.

This matrix summarizes each city’s relative strengths across key dimensions, offering a quick reference for investors, founders, and policy makers looking to tap into Europe’s diverse innovation landscape.

| City | Talent Pool | Startup Support | Sector Focus | Cost Advantage | EU Policy Alignment | Overall Score |

|---|---|---|---|---|---|---|

| Berlin | 9 | 10 | AI / Deeptech | 7 | 9 | 45 |

| Paris | 9 | 9 | AI / GreenTech | 6 | 10 | 44 |

| Barcelona | 8 | 9 | Creative Tech | 8 | 8 | 41 |

| Lisbon | 7 | 9 | Fintech | 10 | 7 | 40 |

| Amsterdam | 9 | 8 | AI / HealthTech | 6 | 9 | 40 |

✅ Key Takeaways

- Berlin leads on deeptech and government funding channels.

- Paris is rising fast due to policy support (La French Tech) and AI labs.

- Lisbon is gaining momentum due to cost benefits and digital visas.

- Amsterdam and Barcelona balance talent access with lifestyle and soft infrastructure.

💼 Curious how these cities compare on startup success metrics? Don’t miss our full breakdown: “Europe’s Top Startup Cities in 2025”

📚 Sources – Verified 2025 Tech Ecosystem Data

This article is based on an independent editorial review of publicly available data from over 50 sources. We used government portals, EU commission reports, global startup databases, and official university and incubator directories. No sponsorships, paid placements, or influence from agencies or institutions shaped the rankings.

External data referenced from: Eurostat 2025, EU Digital Economy & Society Index, OECD Science & Tech Policy Tracker, StartupBlink Global Rankings, Crunchbase, InvestEU Reports, Horizon Europe Funding Dashboard, Dealroom Intelligence, and EIT Digital.

Explore national portals and funding bodies:

La French Tech (France) |

High-Tech Strategy (Germany) |

Startup Estonia |

Portugal Ventures

🧭 Looking for deeper comparisons across industries? Read our expert study: “Germany’s Sector-Wise Business Market Size – 2025”