📈 Top 10 Fastest Growing Economies in 2025

Despite inflation headwinds, energy volatility, and war-related uncertainty, several European countries are leading the recovery in 2025 with resilient GDP performance, surging exports, and dynamic sector growth. From the green energy push in Portugal to Ireland’s tech-fueled surge, this year’s economic growth map shows unexpected leaders — and new power centers.

As discussed in Europe’s stock market trends and sectoral growth drivers, these top-performing economies are not only recovering — they’re outpacing expectations. Here's our deep dive into the top 10.

📷 Visual: Europe’s Fastest-Growing Economies in 2025

📚 Article Overview

- 🇮🇪 Ireland – Multinational Tech Power & Pharma Growth

- 🇲🇹 Malta – Tourism and Finance Rebound

- 🇪🇸 Spain – Consumer Demand + Export Strength

- 🇱🇹 Lithuania – Industrial Services & IT Outsourcing

- 🇨🇿 Czech Republic – Consumption-Led Expansion

- 🇭🇷 Croatia – EU Funds & Tourism Surge

- 🇸🇰 Slovakia – Automotive Engine of Central Europe

- 🇷🇴 Romania – Dual Growth from Tech and Agri

- 🇵🇱 Poland – Infrastructure and Exports Hold Strong

- 🇵🇹 Portugal – Green Energy Meets Tourism Resilience

- 📝 Conclusion + Takeaways + Growth Insights

1. Ireland – Multinational Tech Power & Pharma Growth 🇮🇪

In Q1 2025, Ireland recorded a 3.2% GDP growth rate — one of the highest in the eurozone — driven largely by the performance of foreign multinational corporations in the tech, pharmaceuticals, and medtech sectors. Despite global tax pressures on Big Tech, Ireland remains a global hub for companies like Google, Pfizer, Meta, and Apple due to its low corporate tax environment, talent pool, and eurozone stability.

Exports in life sciences and ICT services remain strong, with the pharmaceutical industry alone contributing to over 39% of national exports. Meanwhile, FDI inflows continue to rise as Ireland strengthens bilateral trade ties with North America and ASEAN. Local job markets are tight, with wage inflation in Dublin and Cork reflecting demand in fintech, AI, and supply chain engineering roles.

- 📈 GDP Growth (Q1 2025): 3.2%

- 💊 Key Sectors: Pharmaceuticals, ICT, Business Services

- 🌐 Trade Drivers: U.S.–EU corporate flows, ASEAN-EU deals

- 📊 FDI Inflow: +8% YoY from 2024 → 2025

Related: What’s Driving Sectoral Growth in Europe? (Gazett.eu)

📷 Visual: Ireland’s GDP Growth Sectors – Tech, Pharma & FDI Surge (2025)

2. Malta – Tourism and Finance Rebound 🇲🇹

Malta is projected to achieve a 4.0% GDP growth in 2025, placing it among the eurozone’s top performers. The rebound is fueled by a dual-sector surge: tourism — returning to 95% of pre-pandemic capacity — and a reinvigorated financial services industry that has modernized via digital asset regulation and EU passporting privileges.

With increased airline routes, Mediterranean cruise arrivals, and boutique hotel expansion, Malta’s tourism-driven employment has hit a 5-year high. Meanwhile, financial hubs in Valletta are seeing renewed international trust following 2024’s compliance reforms, positioning the island as a niche hub for regulated crypto, fintech, and SME financing.

- 📈 Projected GDP Growth (2025): 4.0%

- 🧳 Key Sectors: Tourism, Financial Services, Digital Assets

- 🏨 Travel Recovery: 95% of 2019 levels (air & cruise traffic)

- ⚖️ Policy Reform: AML-compliance & crypto frameworks (2024)

Related: 2025 Global Trade & Tourism Recovery: Who’s Winning?

📷 Visual: Malta’s Growth Engines – Tourism Revival & Digital Finance

3. Spain – Consumer Demand + Export Strength 🇪🇸

Spain is projected to grow by 2.6% in 2025, outperforming many large EU peers. The growth is led by household consumption, domestic demand, and export resilience, particularly in the automotive, agri-food, and renewable energy sectors. Despite global supply chain frictions, Spain has capitalized on strong intra-EU trade and a rebound in Latin American demand.

Madrid has maintained fiscal stability through smart tax reforms and EU-funded green industrial programs, helping reduce inflation while still boosting investment. Key regions such as Catalonia, Andalusia, and Valencia are showing fast growth in logistics, ports, and clean energy clusters — reinforcing Spain’s position as a southern European economic anchor.

- 📈 Projected GDP Growth (2025): 2.6%

- 🚗 Key Sectors: Auto exports, agri-food, renewables, tourism

- 🏛️ Policy: Green stimulus via EU NextGen Funds + domestic tax credits

- ⚙️ Industrial Hotspots: Valencia (batteries), Andalusia (ports), Catalonia (tech)

Related: Spain’s Startup Surge – Tech Cities of the South

📷 Visual: Spain’s Growth Engine – Trade, Domestic Demand, and EU Recovery Funds

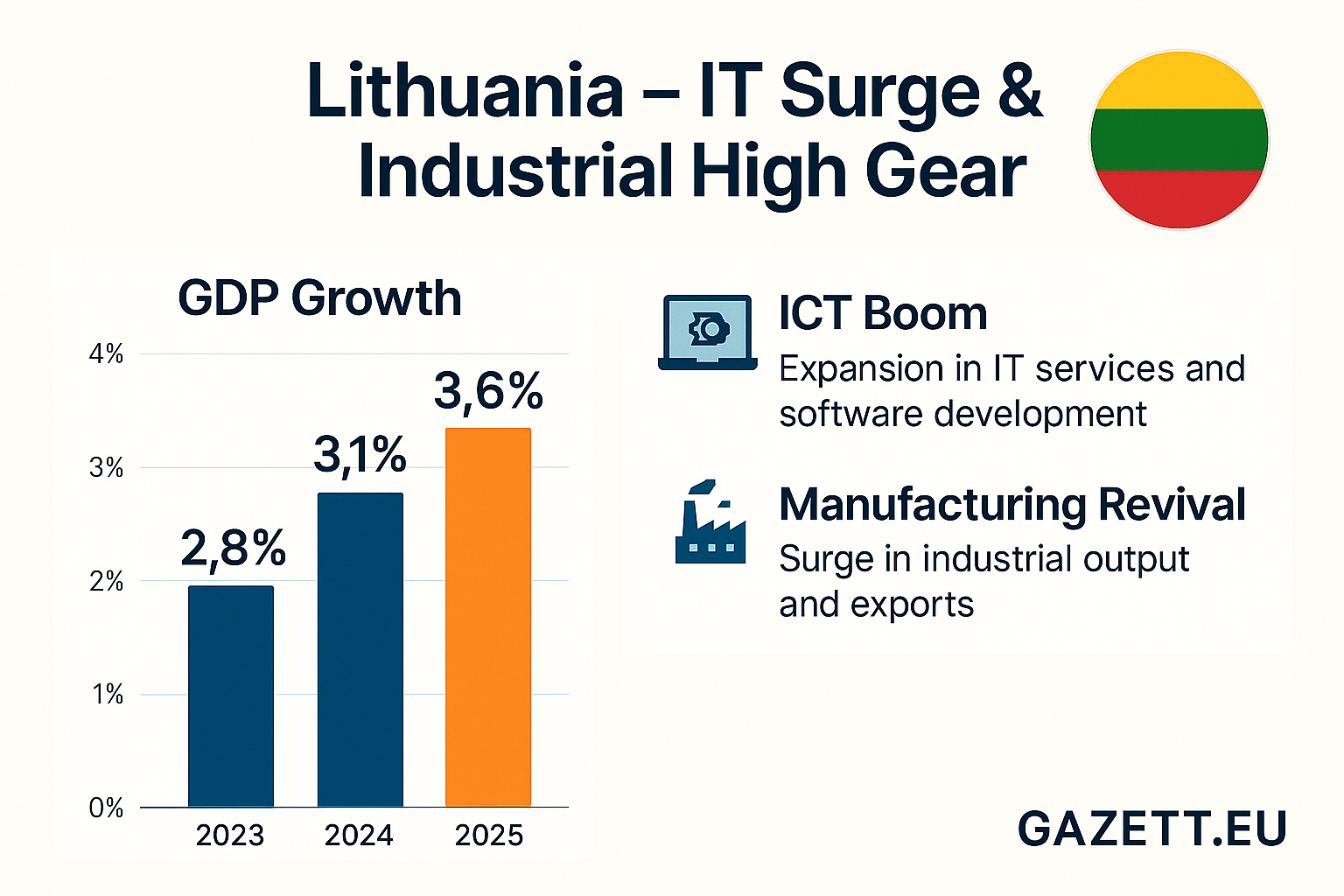

4. Lithuania – Industrial Services & IT Outsourcing 🇱🇹

Lithuania recorded a 0.6% GDP growth in Q1 2025, marking a modest but stable recovery for the Baltic state. The growth is driven by manufacturing services, fintech outsourcing, and nearshoring shifts from Western Europe. The country’s competitive tax regime and digital infrastructure have positioned Vilnius and Kaunas as tech outsourcing hubs for German, Swedish, and Dutch clients.

Export recovery is strongest in industrial equipment, IT support services, and precision engineering. Meanwhile, Lithuania’s €1.3B recovery fund (co-financed by the EU) is fueling logistics and education infrastructure in rural regions, supporting a balanced and inclusive economic rebound.

- 📈 Q1 GDP Growth: 0.6% (Eurostat, 2025)

- 💼 Key Sectors: Outsourced IT, BPO services, equipment manufacturing

- 🌐 Clients: Sweden, Germany, Netherlands (B2B service flows)

- 🏗️ EU Recovery Funding: €1.3B into digital + regional infrastructure

Related: Eastern Europe’s Factory Rise: Nearshoring & BPO Growth

📷 Visual: Lithuania’s IT and Industrial Services Driving 2025 Growth

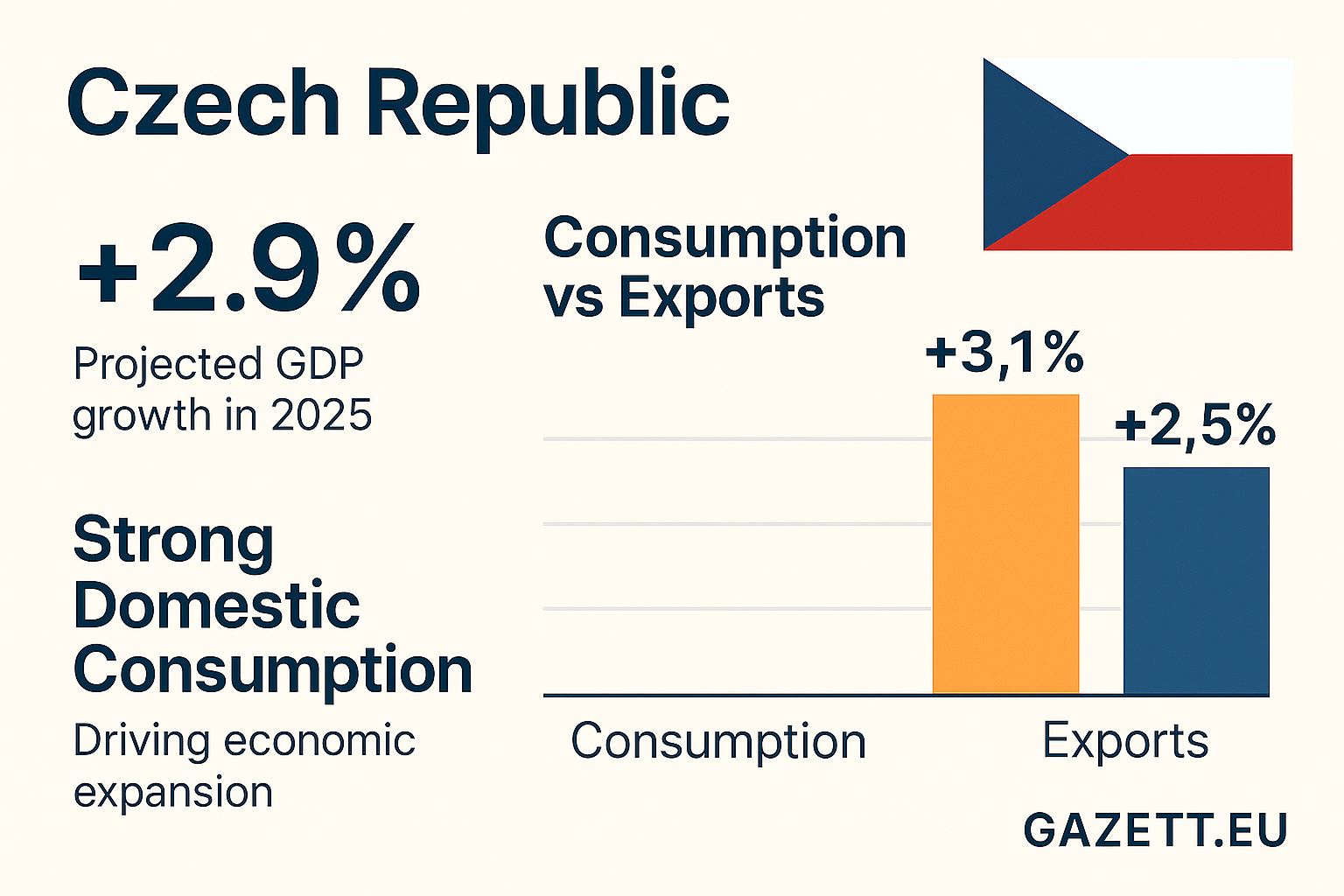

5. Czech Republic – Consumption-Led Expansion 🇨🇿

The Czech Republic posted a 2.0% year-on-year GDP growth in early 2025, anchored by a rebound in household consumption and domestic retail spending. Lower inflation rates and rising wages have increased consumer confidence, especially in Prague, Brno, and Plzeň — where middle-class growth is fueling demand in housing, electronics, and green mobility.

Industrial production remains strong, with auto components, batteries, and electronics manufacturing continuing to feed cross-border supply chains with Germany and Austria. Retail credit and mortgage approvals are also up, with real estate activity rising in urban satellite towns and logistics corridors.

- 📈 2025 GDP Growth: 2.0% YoY

- 🛒 Growth Drivers: Private consumption, local retail, housing

- 🏭 Export Links: Automotive & electronics → Germany, Austria

- 🏘️ Mortgage Uptick: +6.3% (urban & mid-tier cities)

Related: Germany’s Industrial Revival – Why the Czech Link Matters

📷 Visual: Czech Republic’s Consumer-Driven Economic Upswing (2025)

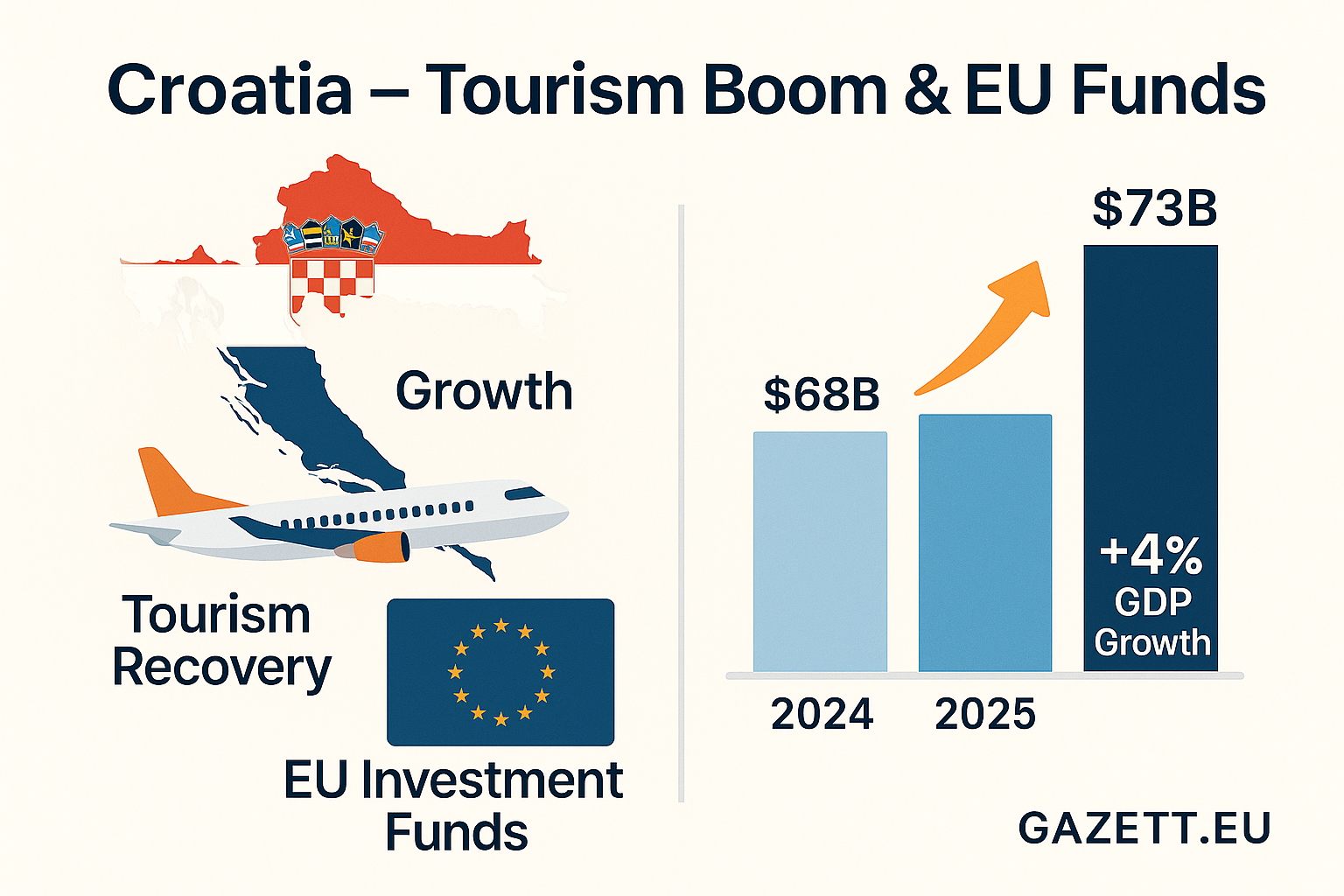

6. Croatia – EU Funds & Tourism Surge 🇭🇷

Croatia is forecast to grow at 1.8% in 2025, with strong momentum in tourism, EU-funded infrastructure, and digital modernization. After joining the eurozone and Schengen Area in 2023, Croatia has seen a spike in cross-border visitors and digital nomads — especially along the Adriatic coast and in cities like Split, Dubrovnik, and Zadar.

Croatia is efficiently deploying EU Recovery and Resilience funds toward transport, clean energy, and e-governance projects. Local entrepreneurship is also on the rise, especially in tourism tech, cultural startups, and agri-innovation. Unemployment is down to 6.4%, and the country is now positioning itself as a modern Balkan gateway to EU growth.

- 📈 2025 GDP Growth: 1.8% (IMF/EU estimates)

- 🌊 Key Drivers: Tourism, infrastructure, green energy, digital services

- 🏗️ EU Funds: €6.3B allocated through 2026 (Recovery Facility)

- 👩💻 New Economy: Remote workers, tourism tech, and e-governance startups

Related: Remote Work’s Impact on EU Growth Hubs

📷 Visual: Croatia’s Tourism Recovery and EU Funded Growth Strategy (2025)

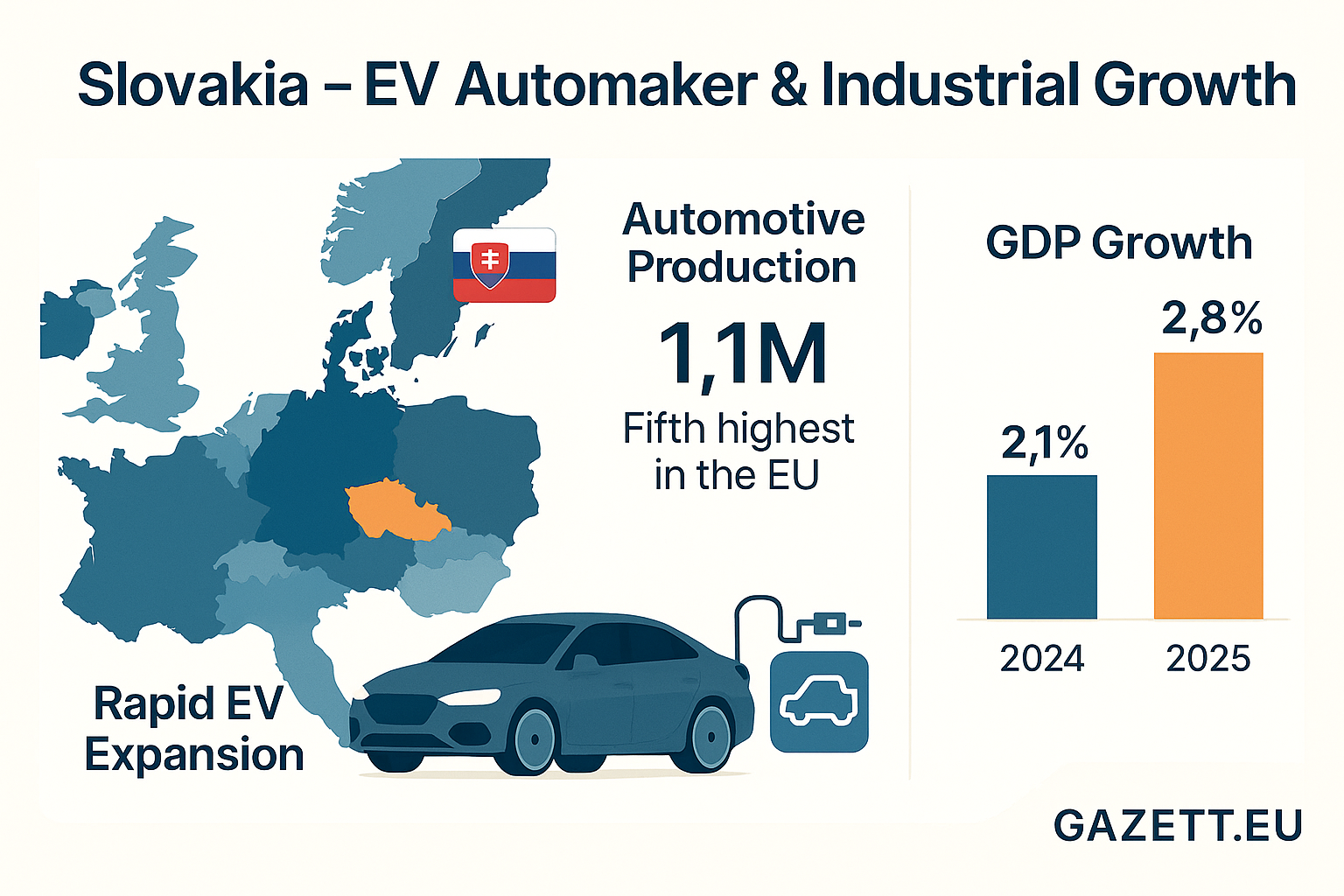

7. Slovakia – Automotive Engine of Central Europe 🇸🇰

Slovakia is projected to grow by 1.7% in 2025, powered by its position as a key manufacturing and automotive export hub for Central Europe. The country remains one of the highest car producers per capita in the world, hosting major plants from Volkswagen, Kia, Stellantis, and Jaguar Land Rover.

New investments in EV battery production and automation technologies are boosting industrial output and R&D employment. With strong cross-border logistics to Austria, Czechia, and Hungary, Slovakia’s export machine continues to drive growth despite Europe’s broader demand fluctuations.

- 📈 Projected GDP Growth (2025): 1.7%

- 🚗 Core Sector: Automotive & EV supply chain manufacturing

- 🔋 New Growth: Battery factories & smart robotics in Trnava & Nitra

- 🌐 Export Links: Germany, Austria, France, Italy

Related: Eastern Europe’s Factory Future – Slovakia's Strategic Role

📷 Visual: Slovakia’s Automotive & EV Sector Fuelling 2025 GDP Growth

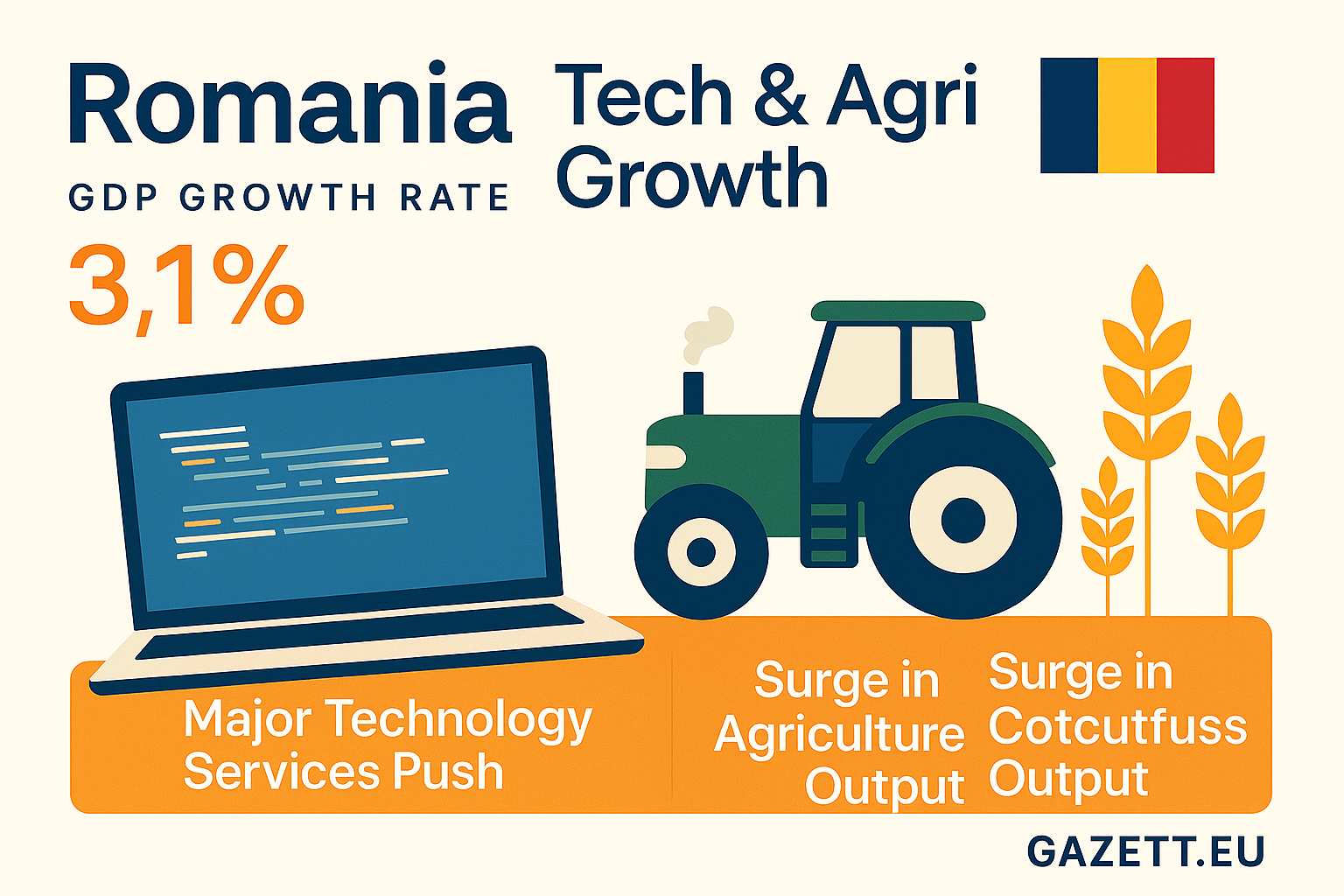

8. Romania – Dual Growth from Tech and Agri 🇷🇴

Romania’s economy is projected to expand by 1.5% in 2025, powered by two contrasting growth engines: a booming tech services and software export industry, and strong performance in agriculture and agri-processing. Bucharest, Cluj-Napoca, and Iași are emerging as regional digital hubs for EU and U.S. clients.

Meanwhile, the Danube region and southern provinces have benefited from mechanization, EU farm subsidies, and improved rail logistics, making Romania a key agri-exporter within Eastern Europe. The country’s ability to combine rural productivity with urban innovation is making it a versatile player in EU growth.

- 📈 Projected GDP Growth (2025): 1.5%

- 💻 Urban Drivers: Tech outsourcing, SaaS startups, telecoms R&D

- 🌾 Rural Strength: Agri exports, processing plants, food security corridors

- 🚄 Infrastructure: EU-backed rail upgrades & intermodal logistics

Related: Why Romania’s Hybrid Economy Model Is Working

📷 Visual: Romania’s 2025 Growth Split – Tech Exports and Agricultural Power

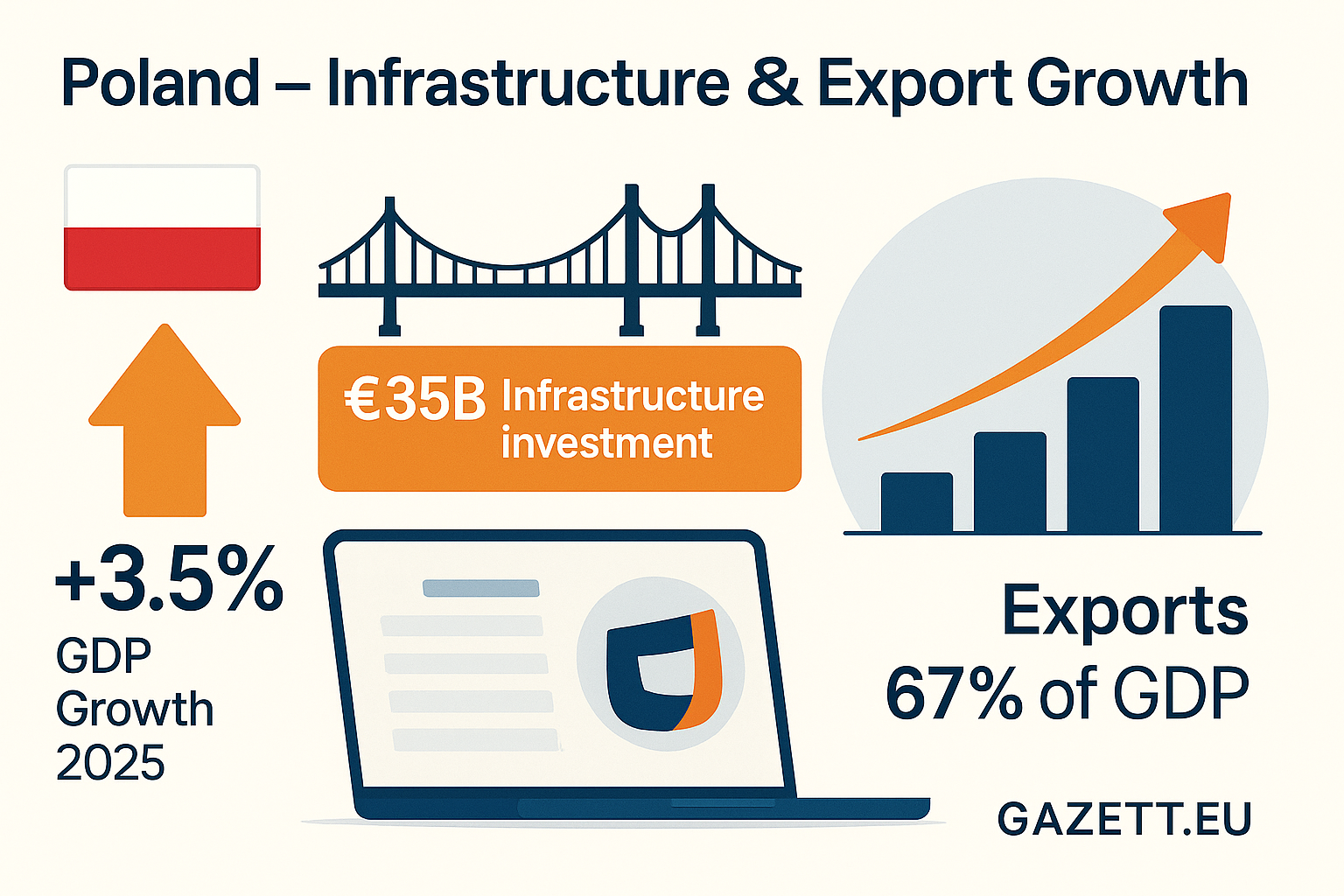

9. Poland – Infrastructure and Exports Hold Strong 🇵🇱

Poland is expected to grow by 1.4% in 2025, maintaining its role as a logistics and industrial engine for Eastern Europe. With major infrastructure projects underway — including high-speed rail, inland ports, and industrial corridors — Poland continues to strengthen its export resilience and manufacturing productivity.

The country’s industrial exports (machinery, electronics, vehicles) remain strong, especially toward Germany, Czechia, and Scandinavia. Poland’s “Three Seas Corridor” strategy is also driving foreign investment in warehousing and cross-border e-commerce, positioning the country as a central node in Europe’s trade web.

- 📈 Projected GDP Growth (2025): 1.4%

- 🏗️ Key Drivers: Logistics, industrial exports, infrastructure investment

- 🚚 Strategic Focus: Three Seas Corridor (Baltic → Adriatic freight)

- 🌍 Export Clients: Germany, Czechia, Sweden, Netherlands

Related: How Poland Is Redefining EU Supply Chains

📷 Visual: Poland’s Export Infrastructure & Industrial Economy in 2025

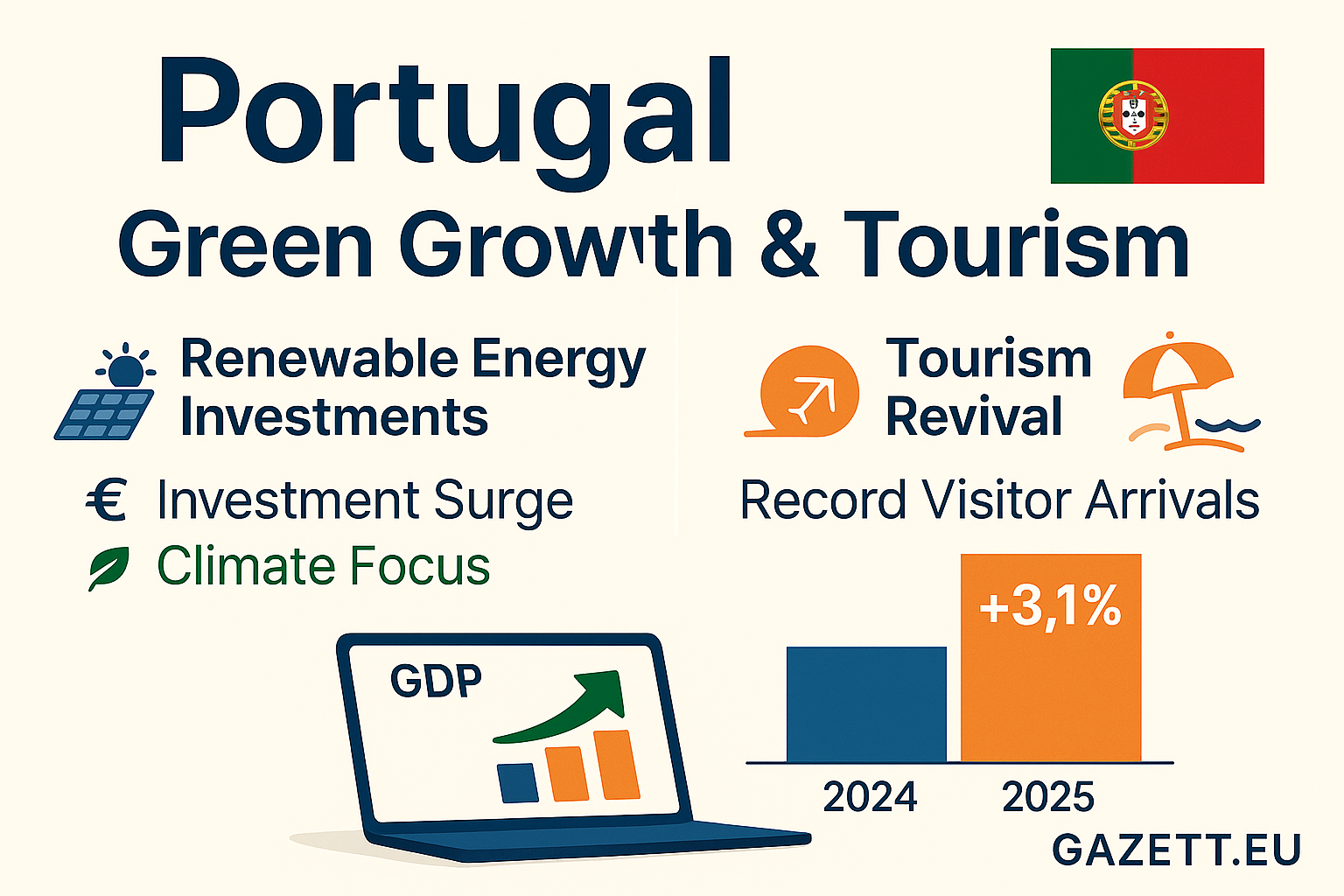

10. Portugal – Green Energy Meets Tourism Resilience 🇵🇹

Portugal is forecast to grow by 1.3% in 2025, closing the top 10 list with a mix of renewable energy leadership and stable tourism recovery. With over 65% of electricity now generated from renewables — especially wind and solar — Portugal is attracting clean tech investors and scaling domestic battery storage innovation.

At the same time, Lisbon and Porto have seen a near-full tourism rebound, with cultural tourism, digital nomadism, and boutique stays driving service sector momentum. Meanwhile, the southern Algarve coast is seeing renewed property investment and sustainable coastal infrastructure projects.

- 📈 Projected GDP Growth (2025): 1.3%

- ⚡ Key Drivers: Renewable energy, tourism, real estate

- 🌞 Energy Milestone: 65% of electricity from clean sources (2025)

- 🧳 Travel Recovery: Nomad & eco-tourism fueling Lisbon–Algarve corridor

Related: Portugal’s Green Energy Leadership – A Climate Case Study

📷 Visual: Portugal’s 2025 Growth Drivers – Clean Energy + Resilient Tourism

📝 Conclusion & Key Takeaways

From tech powerhouses like Ireland to climate-forward economies like Portugal, the 2025 growth story in Europe is far from uniform. Smaller nations — agile in tech, trade, tourism, and clean energy — are often outperforming the traditional giants. As EU funds, supply chain shifts, and digital exports take center stage, these 10 economies are shaping a more decentralized but resilient European growth narrative.

| Country | GDP Growth (2025) | Main Growth Drivers |

|---|---|---|

| Ireland 🇮🇪 | 3.2% | Tech exports, Pharma, FDI |

| Malta 🇲🇹 | 4.0% | Tourism, Financial services |

| Spain 🇪🇸 | 2.6% | Domestic demand, Auto exports |

| Lithuania 🇱🇹 | 0.6% | IT outsourcing, Manufacturing |

| Czech Republic 🇨🇿 | 2.0% | Retail consumption, Exports |

| Croatia 🇭🇷 | 1.8% | Tourism, EU infrastructure funds |

| Slovakia 🇸🇰 | 1.7% | Automotive, EV supply chain |

| Romania 🇷🇴 | 1.5% | Tech services, Agriculture |

| Poland 🇵🇱 | 1.4% | Logistics, Industrial exports |

| Portugal 🇵🇹 | 1.3% | Green energy, Tourism |

Sources: IMF World Economic Outlook, Eurostat, Reuters Europe, EY Europe Outlook, Financial Times