🏦 Top 10 EU Fintech Startups in 2025

The European fintech ecosystem is entering a new era in 2025 — one defined by hyper-personalized banking, embedded finance, AI-powered credit systems, and sustainable digital wallets. From London to Paris, Stockholm to Madrid, a new wave of fintech innovators are not just disrupting traditional banks — they’re reimagining the very infrastructure of European finance.

As explored in Europe’s Economic Engines 2025 and Europe’s Global AI Race, these startups are leading the charge in reshaping consumer finance, SME lending, and payment systems across the continent.

📚 Article Overview

- 🇬🇧 Revolut – From Super App to Lending Giant

- 🇬🇧 Zopa Bank – The P2P Pioneer Goes Prime

- 🇫🇷 Green-Got – Eco Finance That Goes Beyond Offsetting

- 🇫🇷 Swan – The BaaS Backbone of EU Startups

- 🇸🇪 Qred – AI Lending Engine for Europe’s SMEs

- 🇪🇸 Bizum – Spain’s Real-Time Payment Gamechanger

- 🇬🇧 Allica Bank – Digital-First Banking for SMEs

- 🇫🇷 Wero – The European Wallet Challenging Big Tech

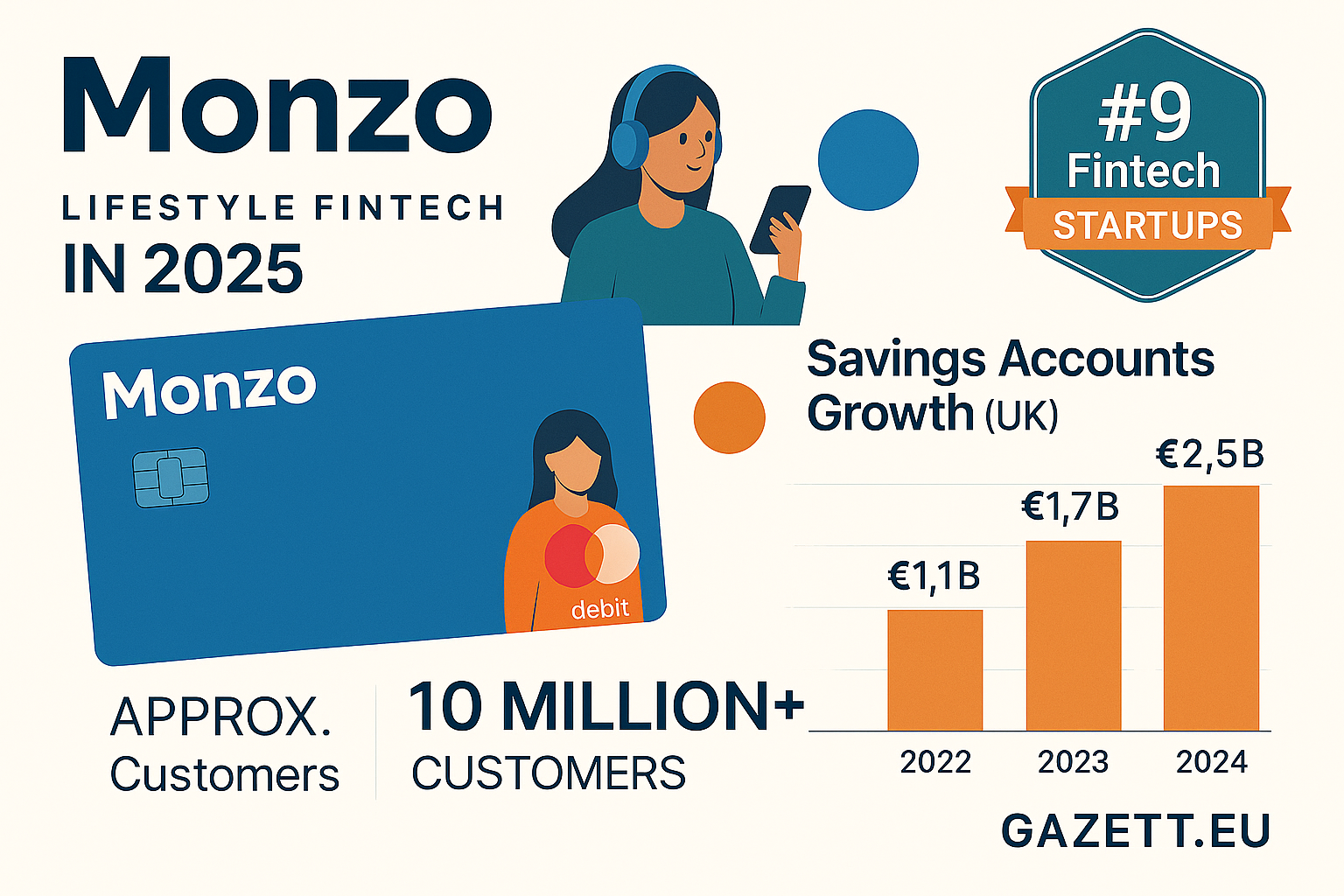

- 🇬🇧 Monzo – The Lifestyle Bank That Just Keeps Growing

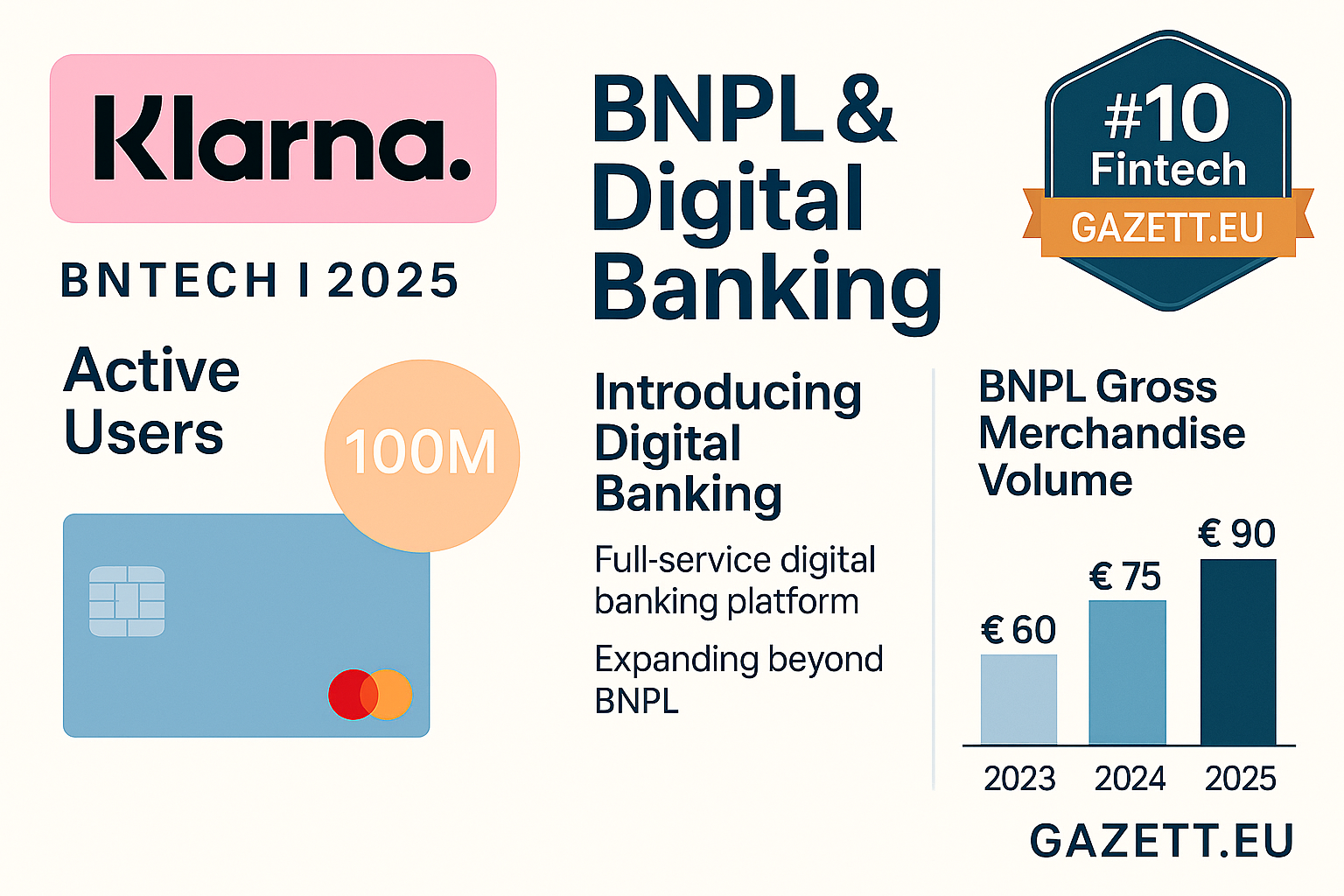

- 🇸🇪 Klarna – BNPL Meets Banking in 2025

🇬🇧 Revolut – From Super App to Lending Giant

In 2025, Revolut has fully transcended its identity as a digital wallet — becoming a full-stack financial superapp and one of the most profitable fintechs in Europe. In April 2025, the company posted a staggering £1.1 billion in pre-tax profits, up 149% from the previous year, cementing its leadership position in the neobank sector.

With over 52 million users globally and operations in 38 countries, Revolut is now pushing aggressively into consumer lending, mortgages, and savings accounts. Its recent acquisition of a mortgage brokerage platform has positioned it to challenge incumbents in long-term credit products, while still dominating retail payments and crypto trading.

- 📊 2024 Revenue: £1.8 billion | Users: 52M+ | Active Markets: 38

- 🏦 Launched: Revolut Lending Division & Home Loans UK in Q1 2025

- 🌍 New markets: Mexico, India, Japan expansion in pilot phase

Related: The Case for English in European Startups (Gazett.eu)

📷 Visual: Revolut’s Transition into Lending and Global Markets (2025)

🇬🇧 Zopa Bank – The P2P Pioneer Goes Prime

Once a peer-to-peer lending pioneer, Zopa Bank has now fully matured into one of the UK’s most profitable digital banks. In 2024, Zopa doubled its pre-tax profits to £31.6 million, driven by strong demand for its fixed-term savings products and personal loans. As of 2025, it has served over 1.4 million customers and continues to grow its product portfolio.

With plans to launch investment products and current accounts, Zopa is positioning itself to become a fully diversified challenger bank — combining trust built from years of lending with a modern, mobile-first banking experience. A London IPO is under consideration as the bank targets five million users by 2028.

- 📈 2024 Pre-Tax Profit: £31.6M | Customer Base: 1.4M

- 💳 Focus Areas: Loans, savings, credit cards, soon to expand into investments

- 📍 Target: 5M users by 2028 | IPO plans being explored

Related: Explore the full Fintech Disruption Landscape (Gazett.eu)

📷 Visual: Zopa Bank’s Growth Roadmap – From Lending to Full Banking (2025)

🇫🇷 Green-Got – Eco Finance That Goes Beyond Offsetting

Green-Got has emerged as the face of sustainable fintech in France. Unlike traditional banks that fund fossil fuel giants, Green-Got invests 100% of its customers' money into climate-positive sectors — from renewable energy to biodiversity conservation. With its mobile-first app and transparent impact tracking, it’s redefining the ESG banking playbook.

In 2024, Green-Got expanded its services to Belgium and launched a premium account with carbon impact visualizers, eco insurance, and ethical savings tools. Its growing user base is a mix of climate-conscious Gen Z professionals and sustainability-driven corporates. It’s more than banking — it’s a mission.

- 🌱 Core Offering: Green payment accounts, impact life insurance, ethical investments

- 🌍 Expansion: Launched in Belgium in Q4 2024, France scaling past 100K users

- 📊 Visual Tools: Carbon dashboards, ecosystem impact badges, donation integrations

Explore more: The Green Future of Europe – Policy & Banking

📷 Visual: Green-Got’s Eco-Finance Platform — Climate-Positive Banking Tools

🇫🇷 Swan – The BaaS Backbone of EU Startups

Swan isn’t a bank consumers see — but it powers the ones they use. Based in Paris, Swan is Europe’s fastest-scaling Banking-as-a-Service (BaaS) platform, helping over 150 startups and scaleups embed payment, account, and card functionality into their apps. From SaaS platforms to crypto wallets, Swan’s APIs are quietly reshaping EU fintech infrastructure.

In January 2025, Swan raised €42 million in its Series B round, led by Lakestar and Accel. It’s licensed across the EU, with major deployments in Germany, Italy, and France. As fintech verticalization grows — from HR platforms to green finance — Swan is becoming the “Stripe for banking” in Europe.

- 🏗️ Core Product: Embedded banking APIs for cards, IBANs, payments, lending modules

- 📊 Funding: €42M Series B raised in Jan 2025 (Accel, Lakestar)

- 🌍 Reach: 150+ fintech clients across France, Germany, Italy

See also: Top Startup Cities in Europe – Who’s Leading in Fintech?

📷 Visual: Swan’s Embedded Finance Infrastructure Powering EU Startups (2025)

🇸🇪 Qred – AI Lending Engine for Europe’s SMEs

Swedish-born Qred is one of the fastest-growing SME lenders in Europe. After receiving its banking license in 2023, Qred entered 2025 with an aggressive push into AI-powered lending for small businesses. The company’s machine learning algorithms approve micro-loans in under 10 minutes — offering fast, risk-adjusted capital to merchants across Sweden, Finland, and the Netherlands.

In early 2025, Qred launched the Qred Visa credit card for SMEs and secured a €10M strategic investment from Nordic Capital. With over €1 billion in issued loans and default rates under 1.5%, Qred is proving that AI lending can be fast, fair, and financially sustainable.

- 🤖 Core Model: AI-driven SME loans, decisions in minutes

- 💳 New Product: Qred Visa Card for small business payments

- 📊 Backers: Nordic Capital | Issued loans: €1B+ | Default rate: ~1.5%

Also read: How SME Tech Is Reshaping EU Work & Growth

📷 Visual: Qred’s AI-Powered SME Lending Platform in Action (2025)

🇪🇸 Bizum – Spain’s Real-Time Payment Gamechanger

Bizum has evolved from a peer-to-peer payment tool into one of Europe’s most successful domestic fintech platforms. Backed by major Spanish banks, Bizum now serves over 27.6 million active users and processed nearly 1.5 billion transactions in 2024 alone. It’s deeply embedded in everyday life — from splitting dinner bills to e-commerce checkouts.

In 2025, Bizum is launching Bizum Pay, enabling NFC-based mobile payments and linking with the European Payments Initiative (EPI). This will allow cross-border instant payments in Spain, Portugal, Italy, and Andorra — making Bizum a true bridge between national and pan-European payment rails.

- 📱 Users: 27.6M+ (2024) | Transactions: 1.5B

- 💡 2025 Innovation: Bizum Pay (NFC) + EPI integration

- 🌍 Reach: Spain, Portugal, Italy, Andorra (cross-border launch Q3 2025)

Related: Spain’s Tech Rise – From Energy to Fintech

📷 Visual: Bizum’s 2025 Expansion with EPI & Contactless Payments

🇬🇧 Allica Bank – Digital-First Banking for SMEs

Allica Bank is quietly becoming the go-to digital banking platform for UK small and medium-sized enterprises (SMEs). Built around the needs of growing businesses, Allica combines human relationship managers with a fully digital loan and savings platform. In 2023, it recorded its first full-year profit — with a net income of £19.2 million.

By 2025, Allica has passed £2 billion in business lending, following its acquisition of specialist lender Tuscan Capital. The bank’s focus on underserved SMEs — often too small for Tier 1 banks but too complex for neobanks — gives it a strong niche in the UK’s fintech banking landscape.

- 🏦 Focus: SME banking, secured loans, digital savings

- 📈 Lending: £2B+ | Profit: £19.2M (2023) | Target: £3B lending by end-2025

- 🤝 Acquisition: Tuscan Capital (commercial lending, 2024)

See also: How Europe’s SMEs Are Financing Growth in 2025

📷 Visual: Allica’s SME Lending Strategy and UK Fintech Position (2025)

🇫🇷 Wero – The European Wallet Challenging Big Tech

Wero is Europe’s most ambitious public-private fintech project — a digital wallet designed to reduce reliance on U.S. payment giants. Backed by major French and EU banks under the European Payments Initiative (EPI), Wero is launching across France in 2025, offering secure real-time payments via phone numbers, emails, and QR codes.

Wero isn’t just a payment solution — it’s a sovereignty play. With rising regulatory pressure on Visa, Apple Pay, and PayPal, the EU wants a homegrown solution that prioritizes data privacy, interoperability, and cross-border transfers. Early integrations are underway with French e-commerce platforms and public service portals.

- 💶 Core Offer: P2P & P2B instant payments via phone/email/QR

- 🇪🇺 Backed By: EPI, BNP Paribas, Crédit Mutuel, Groupe BPCE

- 📍 Launch: France Q2 2025 → Germany, Belgium, Spain by 2026

Related read: Europe’s Digital Trade Infrastructure & Economic Realignments

📷 Visual: Wero’s Digital Wallet Ecosystem & EU Payment Strategy (2025)

🇬🇧 Monzo – The Lifestyle Bank That Just Keeps Growing

Monzo has gone from challenger bank to lifestyle enabler — with over 8 million users in the UK and plans to launch in Europe in late 2025. What makes Monzo unique is its community-driven product development: features like shared tabs, savings pots, and budget-friendly auto-categorization have turned it into the go-to app for modern money management.

In 2025, Monzo is doubling down on financial wellness by expanding into investment tools, AI budgeting assistants, and mental health support modules. Its user-first approach — powered by slick UX and transparency — keeps it one of the most trusted fintech brands in Europe.

- 📱 Users: 8M+ in UK | EU rollout (beta) starts Q4 2025

- 💼 New Features: Smart investing, AI money coach, mental wellbeing add-ons

- 🏆 USP: Community-led product design + gamified budgeting experience

Read more: How Fintech is Redefining Lifestyle Banking in Europe

📷 Visual: Monzo’s Lifestyle Banking Model – Smart Finance Tools for 2025

🇸🇪 Klarna – BNPL Meets Banking in 2025

Klarna remains one of Europe’s most iconic fintech brands — evolving beyond its roots in “buy now, pay later” (BNPL) into a broader suite of digital banking, budgeting, and savings products. In 2025, Klarna introduced Klarna Cash — a hybrid spending and savings tool — and expanded its in-app marketplace to include AI-powered product discovery and subscription control.

The company has doubled down on its commitment to consumer financial wellness, integrating spending insights, credit visibility, and carbon footprint tracking. Klarna now positions itself as “the calmest wallet in Europe” — offering control, clarity, and convenience across e-commerce, personal finance, and embedded banking.

- 🛒 New Feature: Klarna Cash (hybrid account) + AI-powered marketplace UX

- 🌿 Wellness Layer: Budget insights, carbon tracking, smart nudges

- 📍 Expansion: Available in 20+ EU markets and launching Klarna Card 2.0 in 2025

Also check: Nordic Startups Leading EU Innovation

📷 Visual: Klarna’s Expansion Beyond BNPL – Smart Wallet Tech (2025)

📝 Conclusion & Key Takeaways

From AI-powered lending engines to eco-banking and wallet sovereignty plays, Europe’s fintech startups are transforming the future of banking in 2025. Whether serving SMEs, digital nomads, Gen Z investors, or mission-driven savers — these 10 disruptors represent a new financial infrastructure: inclusive, intelligent, and innovation-first.

| Startup | Key Innovation |

|---|---|

| Revolut | Full-service superapp, mortgage + global lending expansion |

| Zopa | Transition from P2P to diversified digital bank |

| Green-Got | Eco-focused banking with carbon dashboards & ethical investing |

| Swan | BaaS platform powering 150+ fintechs in EU |

| Qred | AI micro-lending engine for SMEs, Visa card for business |

| Bizum | Real-time payments & NFC via EPI integration |

| Allica | Digital-first commercial banking for UK SMEs |

| Wero | EU-backed wallet for payments & sovereignty |

| Monzo | Lifestyle banking UX with AI coach & wellbeing tools |

| Klarna | BNPL → smart wallet + AI commerce engine |

Sources: Reuters, Le Monde, Wikipedia FR, Financial News London, EPI