🌍 Where to Set Up a European Branch Office – 2025 Guide for Non-EU Companies

As global business accelerates in 2025, Europe remains a prime destination for foreign expansion — offering access to a 450 million–strong consumer market, deep financial infrastructure, and robust trade ties. For companies from the United States, India, and the UK, establishing a presence in Europe is not just a strategic choice — it's often a compliance necessity.

This guide explores the most effective ways to set up a branch office in the EU, focusing on legal frameworks, documentation, tax implications, and top jurisdictions. Whether you’re weighing the pros and cons of a branch vs. subsidiary, or identifying which country aligns with your structure — this article delivers a data-rich, founder-friendly roadmap.

Backed by real-world compliance data, country-level analysis, and emerging regulation insights for non-EU entities, this resource is ideal for growth-stage companies, legal advisors, and international CFOs charting their entry into the EU single market.

📷 Infographic: Gazett.eu's 2025 Guide to Opening a Branch Office in the EU

📚 Article Overview

- 1. Introduction – Navigating European Expansion in 2025 💡

- 2. What Non-EU Businesses Need to Know Before Setting Up 📄

- 3. Branch vs Subsidiary – Which Is Better in 2025? 🏛️

- 4. Best Countries to Set Up a Branch Office in the EU 🌍

- 5. Local Agents, Compliance & Reporting Rules ⚖️

- 6. Setup Timelines, Fees, and Documentation Requirements 📁

- 7. Use Cases: US, UK, and Indian Firms Expanding in 2025 🔍

- 8. Country Comparison Matrix + Decision Guide for Founders 📊

- 9. Conclusion + Key Takeaways for Global Entrepreneurs 🧭

📄 What Non-EU Businesses Need to Know Before Setting Up

📷 Infographic: Key Legal, Financial, and Regulatory Basics for Non-EU Businesses in 2025

- Legal Structure Options: Whether to open a branch (extension) or subsidiary (separate legal entity) affects compliance and liability.

- Substance Requirements: Countries like Ireland, the Netherlands, and Germany require proof of genuine business activity, not just a mailbox company.

- Local Representation: In most EU countries, having a tax representative, resident director, or local compliance officer is mandatory for foreign entities.

- Banking & Financial Rules: A local business bank account is often required before registration is fully approved.

- Tax ID & Registrations: Applying for a VAT number, EORI (customs) registration, and local tax ID is essential even for digital businesses.

- Anti-Money Laundering (AML) & KYC: EU-wide AML rules enforce strict documentation, ownership transparency, and verification protocols.

In 2025, many EU countries have streamlined their registration processes but still enforce rigorous economic substance tests, beneficial ownership disclosures, and anti-avoidance checks. Understanding these regulations is essential before choosing your branch location.

For instance, Estonia and Ireland allow digital-first setups, but you’ll still need to comply with holding company requirements or open a compliant business bank account to activate your branch. These are not optional — they’re the legal foundation for market access, invoicing, and fiscal residency alignment across the EU.

📊 Infographic: Branch vs Subsidiary in 2025 – Compliance, Liability & Expansion Goals | Gazett.eu

Branch vs Subsidiary – Which Is Better in 2025? 🏛️

For non-EU companies looking to expand into the European Union, the decision between setting up a branch or a subsidiary in 2025 hinges on several factors: legal liability, compliance obligations, taxation, and flexibility for future growth. A branch is not a separate legal entity and exposes the parent to full liability. Meanwhile, a subsidiary is a limited liability company registered under EU law, offering insulation from legal risk and broader tax planning capabilities.

While branches are easier to set up and cost-effective for short-term operations, most strategic expansions prefer subsidiaries due to increased investor confidence, eligibility for grants, and reputational advantages. In countries like Luxembourg, Netherlands, and Ireland, subsidiaries can also access local tax incentives unavailable to branches.

🔍 Key Differences at a Glance

- 🧾 Legal Entity: Branch is not separate; Subsidiary is legally independent

- 📊 Liability: Branch = full parent liability; Subsidiary = limited liability

- 📍 Registration: Branch is faster but restricted; Subsidiary unlocks incentives

- 💼 Control: Branch must follow parent HQ; Subsidiary has local governance

- 🌐 Long-Term Expansion: Subsidiary supports scaling, fundraising & partnerships

🌍 Best Countries to Set Up a Branch Office in the EU (2025)

📷 Infographic: Top 5 EU Countries for Non-EU Companies Setting Up Branches – Gazett.eu

- 🇳🇱 Netherlands – Highly respected for its hybrid structures, tax treaties, and ease of entry via local notaries.

- 🇩🇪 Germany – Strong banking network, powerful industrial market, and stable governance for branches.

- 🇪🇸 Spain – Liberalized branch setup for foreign firms with low minimum capital and English support services.

- 🇫🇷 France – Suitable for tech, pharma, and logistics businesses targeting francophone markets.

- 🇵🇱 Poland – Eastern EU powerhouse offering low operational costs and pro-business local regulations.

Local Agents, Compliance & Reporting Rules ⚖️

Setting up a European branch office in 2025 goes beyond incorporation — regulatory compliance is jurisdiction-specific and tightly monitored. Most EU countries require resident legal representatives or agents for all foreign branches, along with country-level obligations like public registry disclosures, statutory audits, and annual filings.

While the EU’s Single Market tools standardize cross-border access, the rules still vary widely — especially for non-EU entities from India, US, and UK expanding into Europe. Below is a compliance snapshot of five key destinations for branch-level expansion.

📷 Infographic: Legal Agent, Filing & Registry Rules for EU Branch Offices – Gazett.eu 2025

- 🇳🇱 Netherlands: Legal rep mandatory, annual returns required, public registry updated yearly.

- 🇩🇪 Germany: Resident agent + monthly VAT filings + high transparency obligations.

- 🇪🇸 Spain: Spanish citizen/legal resident as rep; quarterly reports and compliance inspection risks.

- 🇨🇾 Cyprus: IFRS reporting, zero withholding tax, and detailed BO (beneficial owner) disclosure.

- 🇵🇱 Poland: Requires sworn translations, public account registry & local tax rep if no EU address.

✅ Pro Tip: If you're an entrepreneur opening a bank account and branch office together — always check for agent liabilities, tax filing thresholds, and whether a physical address is needed for legal correspondence.

Key Costs & Minimum Capital Requirements 💰

Opening a branch office in Europe involves more than just legal filings — businesses must also prepare for registration fees, notary/legalization charges, accounting obligations, and in some countries, minimum capital commitments. These costs vary based on entity type (branch vs subsidiary) and country-level rules.

For non-EU holding companies and foreign entrepreneurs setting up branches, it's crucial to evaluate both one-time incorporation costs and recurring annual compliance charges. Below is a data-driven snapshot of 2025 capital and cost structures across top EU markets.

📷 Infographic: 2025 EU Branch Setup Fees, Capital Thresholds & Annual Costs | Verified by Gazett.eu

- 🇩🇪 Germany: No minimum capital for branches; avg. €2,500–€4,000 setup + €1,200/yr compliance.

- 🇳🇱 Netherlands: Branch setup: €1,000–€2,000; no capital needed unless converting to BV entity.

- 🇪🇪 Estonia: Virtual-friendly; €190 e-Residency fee; €0 minimum for branches.

- 🇨🇾 Cyprus: ~€1,800 incorporation cost + €350/yr annual levy; no capital needed for branches.

- 🇮🇪 Ireland: €2,500–€3,000 setup; €0 minimum capital; branch must report to CRO annually.

✅ Pro Tip: Capital thresholds apply mainly to subsidiaries. For branches, operational costs and liability insurance are more relevant — especially in jurisdictions like Germany or Ireland where banks require local proof-of-address for compliance onboarding.

📂 Step-by-Step Timeline & Documents to Set Up a Branch Office in the EU – 2025

Setting up a branch office in the European Union as a non-EU company requires detailed planning and document submission, which varies slightly between member states. However, the core process across most business-friendly nations follows a predictable legal and administrative path.

📷 Visual: Process Timeline and Documentation Checklist for EU Branch Offices in 2025 – Gazett.eu

| Week | Milestone | Notes |

|---|---|---|

| Week 1 | Select Country, Legal Structure & Name Check | Must comply with local naming/branding rules |

| Week 2 | Hire Local Agent or Authorized Rep | Needed for tax/legal filings and public registry |

| Week 2–3 | Prepare Docs + Translate/Legalize | May need notary, apostille, or certified copies |

| Week 3–4 | Register at Business Register | Chamber of Commerce or CRO equivalent |

| Week 4 | Apply for VAT & Tax ID | May take longer in countries like Germany |

| Week 5–6 | Open Business Bank Account | May require local resident director |

📋 Documents Required (2025)

- Certificate of Incorporation (Parent Company)

- Board Resolution approving EU branch

- Power of Attorney for legal representative

- Proof of Registered Office (EU jurisdiction)

- Director & UBO IDs (passports)

- Bank reference letter (some countries)

- Articles of Association (translated + certified)

✅ Documents must usually be translated and legalized (apostille or consular attestation) in the official language of the destination country.

🔗 Also read: Where to Open a Business Bank Account in Europe (2025) and Best Holding Company Countries in Europe (2025)

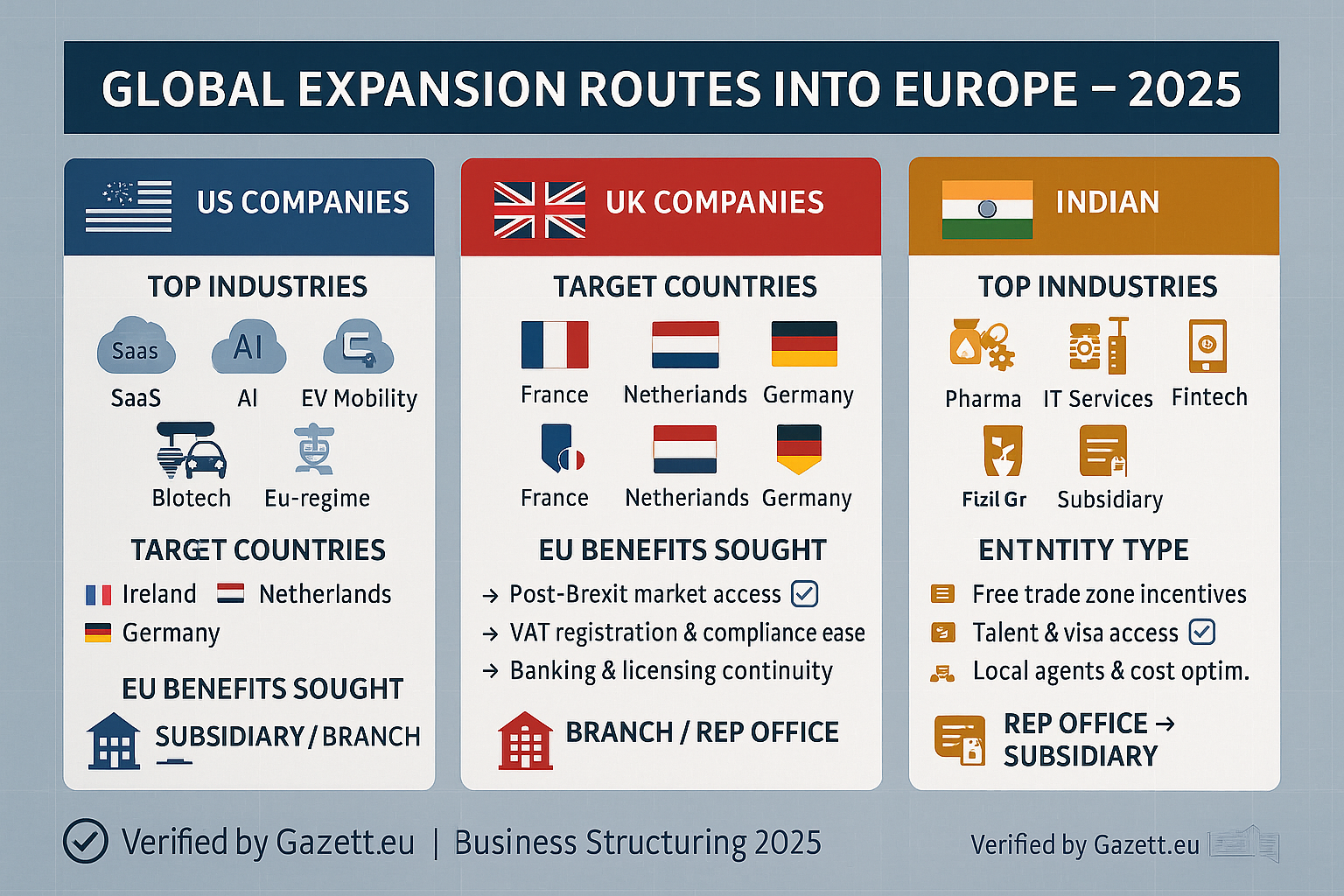

🔍 Use Cases: US, UK, and Indian Firms Expanding in 2025

📷 Infographic: Strategic Use Cases – How Global Firms Are Setting Up European Branch Offices in 2025

- 🇺🇸 US Companies: Tech startups and enterprise software firms are establishing EU branches to access data-compliant markets and unlock R&D incentives in countries like Ireland and Germany.

- 🇬🇧 UK Companies: Post-Brexit, UK exporters and financial firms are using Netherlands and France to regain seamless EU access while preserving UK operations.

- 🇮🇳 Indian Firms: Pharmaceutical, IT, and fintech companies are prioritizing Cyprus and Germany for ease of compliance, business banking, and trade zone benefits.

Related reads on Gazett.eu: Best Holding Company Countries in Europe 2025, Where to Open a Business Bank Account in Europe.

📊 Country Comparison Matrix + Decision Guide for Founders

Choosing the right country to open a branch office in Europe as a non-EU company depends on regulatory comfort, speed of setup, cost sensitivity, tax treaties, and sectoral fit. Here's a matrix to help Indian, UK, and US founders make informed expansion decisions in 2025.

📷 Infographic: EU Countries Compared – Branch Setup Costs, Timelines & Startup-Friendliness | Gazett.eu

| Country | Setup Time | Avg. Cost (EUR) | Local Agent Needed? | Banking Access | Best For |

|---|---|---|---|---|---|

| 🇳🇱 Netherlands | 5–8 days | €1,500 – €2,000 | Yes | High | Tech, Trade, B2B Services |

| 🇪🇪 Estonia | 48–72 hours | €500 – €800 | No (E-Residency) | Medium | Remote, SaaS, Freelance Hubs |

| 🇩🇪 Germany | 10–14 days | €2,000 – €3,000 | Yes | Very High | Industrial, Fintech, MedTech |

| 🇨🇾 Cyprus | 3–5 days | €1,000 – €1,400 | Yes | Medium | Holding, E-Commerce |

| 🇮🇪 Ireland | 6–10 days | €1,200 – €1,800 | Yes | High | IP-Based, Tech Firms |

✅ Founder Tip: If holding structures or banking access are your top priorities, pair this setup with the right country’s incentives. The right match can save thousands and improve compliance.

🧭 Conclusion + Key Takeaways for Global Entrepreneurs

As foreign companies look to Europe for expansion in 2025, the branch office model offers flexibility, lower upfront capital, and a faster route to market compared to full subsidiaries. That said, founders must navigate a nuanced landscape of compliance rules, local agent mandates, and post-Brexit frameworks.

From Estonia’s digital-first system to Germany’s stability or Cyprus’ treaty access model — the best destination depends on your industry type, compliance capacity, and market entry goals. Structuring your expansion with proper legal support can make or break your operational success.

📷 Infographic: Final Takeaways – Where, Why & How to Set Up a Branch Office in the EU | Gazett.eu

- 📌 Fastest Setup: Estonia (under 3 days with e-Residency)

- 📌 Most Compliant: Germany and Ireland (for robust banking + legal structures)

- 📌 Best for IP/Tech: Ireland and Netherlands (due to tax treaties + R&D credits)

- 📌 Low-Cost Options: Cyprus and Poland (minimal agent + registry fees)

- 📌 Investor Tip: Always align your branch location with business banking & future EU licensing pathways.

🔗 Related Reads: Top Holding Company Destinations | Europe’s Tax Haven Rankings | Business Banking in Europe 2025

Sources: European Commission SME Portal | Invest in EU | OECD Country Compliance Database | Enterprise Ireland | German Trade & Invest (GTAI)