Fintech Innovation Race: 🇨🇭🇸🇬 Switzerland vs Singapore

In 2025, two of the world’s smartest financial hubs are locked in an innovation rivalry that could reshape global finance. Switzerland’s Crypto Valley and Singapore’s Tokenization Sandbox are battling not just for blockchain supremacy but also leadership in ESG finance, tokenized wealth ecosystems, and AI-driven financial services. Zurich, Zug, Geneva — once seen as bastions of traditional banking — are now rapidly evolving into Web3 powerhouses. Meanwhile, Singapore’s proactive Monetary Authority (MAS) is launching green fintech initiatives, digital identity programs, and world-first tokenization pilots.

This article explores the battle between Europe’s innovation fortress and Asia’s digital finance gateway across blockchain adoption, venture capital, ESG leadership, and fintech regulation models. Prepare for a deep dive into data, deals, and the future of money itself.

📚 Article Overview

- 🏦 Switzerland’s Crypto Valley and Fintech Boom

- 🌏 Singapore’s Fintech Acceleration and ESG Tech

- 🔥 Key Battles: Talent, VC, Innovation Policies

- 📊 Tokenization, Blockchain, and ESG Wealth Race

- 🌍 Global Expansion Strategies: Europe vs Asia

- 🎥 Real Snippets & Industry Videos

- 🧠 Challenges Ahead: Regulation, Talent, Competition

- 📝 Conclusion & Key Takeaways

🏦 Switzerland’s Crypto Valley and Fintech Boom

Nestled between Zurich and Zug, Switzerland’s Crypto Valley continues to be one of the world's most vibrant blockchain ecosystems in 2025. Hosting more than 1,300 blockchain companies, Zug has become the epicenter for tokenized finance platforms, decentralized asset management, and Web3 infrastructure builders. According to the CV VC Report 2025, Crypto Valley startups now manage a combined valuation of over $400 billion.

Zug’s regulatory landscape is highly favorable, with early acceptance of crypto custody services and tokenized real estate markets. Wealth management giants in Zurich, such as UBS and Julius Baer, are actively launching digital asset divisions. Moreover, innovations around blockchain-based identity verification and green finance tokenization are placing Switzerland at the frontier of the future digital economy.

- 🚀 Crypto Valley hosts 1,300+ blockchain companies (2025 CV VC Report)

- 💼 Zurich banks manage $1.2 trillion in tokenized assets

- 🌱 70+ green fintech startups based in Zug (GreenToken, CarbonX)

Read more about Switzerland’s Dual Strategy in Banking and Innovation.

📷 Visual: Switzerland's Crypto Valley and Fintech Boom (Image to be uploaded)

🌏 Singapore’s Fintech Acceleration and ESG Tech

As Europe deepens its banking and blockchain excellence, Singapore is racing ahead as a global fintech powerhouse in 2025. With over 1,500 fintech firms and a strong ESG finance ecosystem supported by the Monetary Authority of Singapore (MAS), the city-state is setting new benchmarks in decentralized finance (DeFi), regtech compliance, and sustainable asset tokenization.

ESG innovation is central to Singapore’s fintech boom, with leading institutions offering green digital bonds, carbon credits tokenization, and AI-powered ESG analytics platforms. The government-backed Green Finance Action Plan 3.0 expects to mobilize over $100 billion in sustainable investments by 2030, positioning Singapore as a critical hub for future-ready financial innovation.

- 💳 Over 1,500 active fintech firms operating in Singapore (2025 Fintech Report)

- 🌿 $100 billion ESG green finance target by 2030

- 🚀 Launch of 50+ decentralized asset marketplaces on Singaporean platforms

Explore related trends on Global Trade and Fintech Expansion in 2025.

📷 Visual: Singapore’s Fintech Acceleration and ESG Tech (Image to be uploaded)

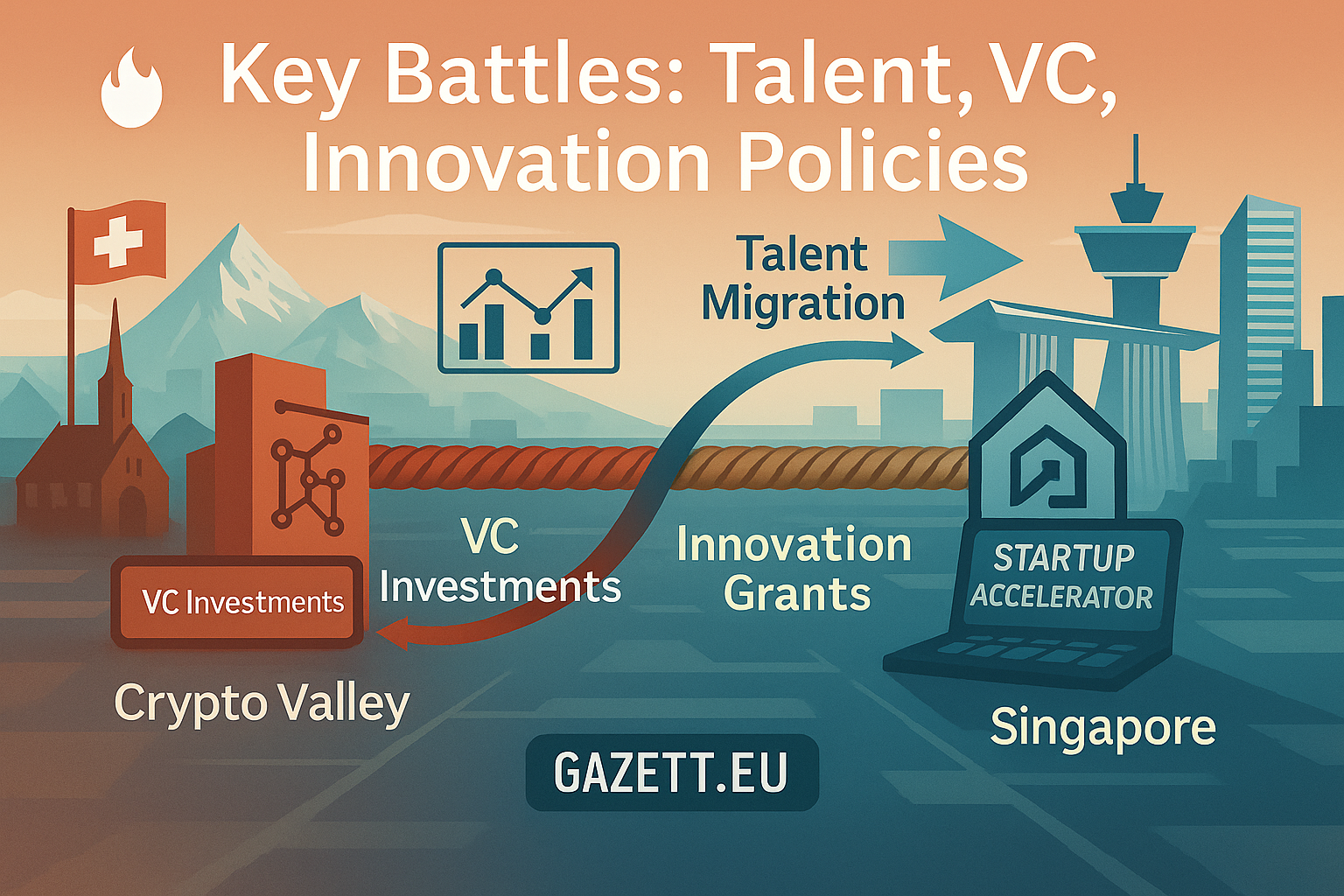

🔥 Key Battles: Talent, VC, Innovation Policies

In 2025, the real fintech innovation rivalry between Switzerland and Singapore boils down to three fronts: talent acquisition, venture capital deployment, and regulatory innovation policies. Zug’s Crypto Valley is still luring blockchain developers with tokenization ecosystems and strong legal clarity, but Singapore’s government is countering with major startup grants and a 100% tax deduction for qualifying tech projects.

Talent attraction remains critical — with Switzerland banking on its high-quality education hubs like ETH Zurich and Lausanne’s EPFL, while Singapore accelerates with programs like the Tech.Pass initiative targeting foreign AI, crypto, and ESG experts. Meanwhile, both countries fiercely compete for VC investments, with Zug raising over $2.5 billion in Web3 deals in 2024 and Singapore-backed funds targeting $3 billion+ in sustainable fintech investments.

- 🧠 Switzerland’s ETH Zurich ranks top 10 globally for blockchain and AI research (QS Rankings 2025)

- 💰 Singapore’s fintech sector attracted $3.1 billion in funding in 2024 (MAS Annual Report)

- ⚖️ Both countries pushing next-gen tokenization regulations by end of 2025

Also explore related developments in Europe’s Research and Innovation Hubs 2025.

📷 Visual: Key Battles in Talent, VC, and Innovation Policies (Image to be uploaded)

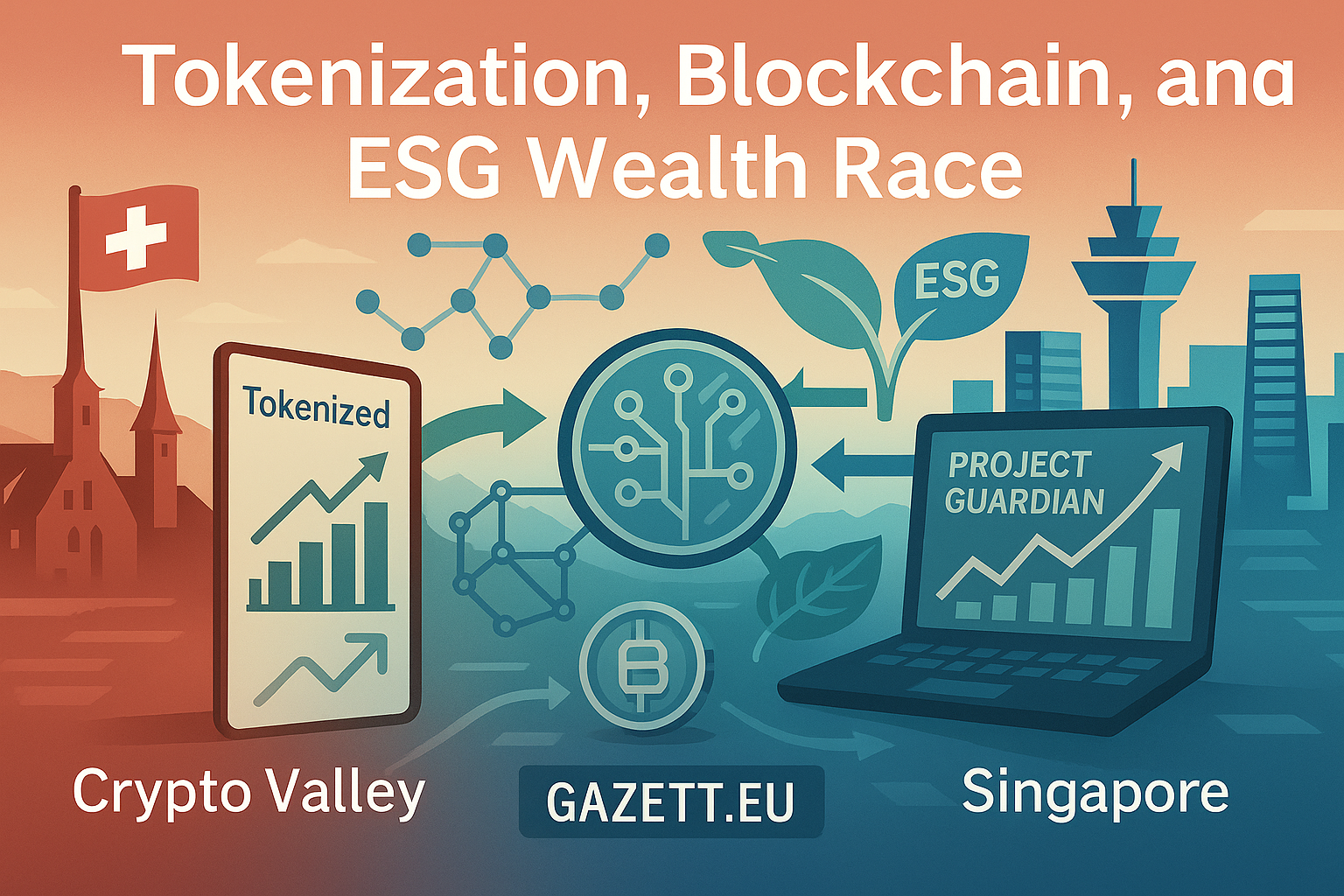

📊 Tokenization, Blockchain, and ESG Wealth Race

In 2025, the tokenization of assets is reshaping financial ecosystems across Switzerland and Singapore. From real estate to fine art, the movement toward blockchain-backed securities is gaining momentum. According to a report by Boston Consulting Group, the global tokenized asset market could reach $16 trillion by 2030 (source).

Switzerland’s Crypto Valley is expanding beyond Zug, focusing heavily on compliance-ready platforms aligned with evolving ESG investing standards. Meanwhile, Singapore has launched its Project Guardian — a central bank-driven initiative for asset tokenization trials with JPMorgan and DBS Bank (source).

Interestingly, tokenization is increasingly linked with green finance innovations in both hubs. ESG compliance integrated into tokenized offerings is becoming a new norm, especially for sustainability-linked bonds and carbon credit markets. Switzerland’s Green Tokenization Initiative aims to capture 15% of the future ESG asset tokenization market by 2030.

Related reads: Switzerland’s Dual Strategy 2025, Global Trade & Innovation 2025.

🌍 Global Expansion Strategies: Europe vs Asia

As Switzerland’s Crypto Valley fintech startups seek new growth avenues, Southeast Asia has emerged as a top destination. Firms are expanding into Singapore, Hong Kong, and Dubai, driven by regulatory clarity and fintech-friendly hubs.

Meanwhile, Singapore’s fintech giants — fueled by initiatives like MAS FinTech Innovation Hub — are aggressively setting up presences in Zurich and Zug. The **Europe-Asia fintech corridor** is expected to grow by 18% CAGR between 2024-2028, creating cross-border tokenized finance markets and green investment platforms.

According to recent data from the Swiss Finance Institute, over 60% of Swiss fintechs now have an active partnership or client base in Asian markets. Singapore leads Asia with strong ESG integration, blockchain regulation, and talent attraction strategies.

To dive deeper into Europe’s innovation race, check our coverage on Europe’s Tech Unicorn Boom.

🎥 Real Snippets & Industry Videos

Explore handpicked real-world videos showcasing Switzerland’s Crypto Valley evolution and Singapore’s fintech & ESG boom. These exclusive industry snippets highlight ground-level innovation, tokenization success, blockchain adoption, and how fintech hubs are shaping global financial trends.

🇨🇭 Inside Zug’s Crypto Valley 2025

A look at how Zug became the world's first Crypto Valley and how Swiss blockchain innovations are scaling globally.

🇸🇬 Singapore’s Project Guardian: Tokenized Finance Future

Discover how Singapore is racing ahead with Project Guardian, tokenizing real-world assets and leading Asia’s ESG finance frontier.

🧠 Challenges Ahead: Regulation, Talent, Competition

Despite their successes, both Switzerland and Singapore face rising challenges in sustaining their fintech leadership. In Switzerland, the evolving European regulatory frameworks — including updates around MiCA (Markets in Crypto Assets Regulation) — could slow cross-border blockchain initiatives unless harmonized with Swiss laws.

Meanwhile, Singapore’s fintech sector is experiencing fierce competition from emerging hubs like Dubai, Hong Kong, and Seoul. Talent scarcity in AI, cybersecurity, and green finance is a growing concern, despite initiatives like the Tech.Pass program. Regulatory crackdowns on certain DeFi services also threaten to bottleneck innovation if not addressed via balanced policy frameworks.

- ⚖️ Switzerland must align Crypto Valley regulations with upcoming EU crypto frameworks.

- 🧠 Singapore facing an urgent need for more AI, blockchain, and ESG tech specialists.

- 🌐 Talent competition rising from UAE, Hong Kong, and Australia fintech ecosystems.

Dive deeper into Europe's rising tech and finance hubs in our report: Eastern Europe's Emerging Hubs 2025.

📷 Visual: Challenges Ahead for Switzerland and Singapore (Image to be uploaded)