🧭 Strategic Hubs of Europe 2025: Why Austria, Czechia, and Slovakia Are Attracting Global Investment

In 2025, global investors are shifting their focus away from saturated Western capitals toward the heart of Central Europe. Austria, Czechia, and Slovakia are emerging as next-generation hubs for tech, manufacturing, and clean energy — driven by FDI incentives, strategic logistics access, and skilled workforces.

This exclusive analysis explores how these three nations are reshaping Europe’s investment map — with multi-billion-euro projects, battery gigafactories, R&D corridors, and world-class innovation frameworks. Backed by data from EU agencies, investor briefings, and industry reports, we uncover what’s powering Central Europe’s rise.

📷 Visual: Central Europe’s Rising Stars — Austria, Czechia & Slovakia in 2025's Global Investment Landscape

📚 Article Overview

- 📈 Central Europe's FDI Surge in 2025

- 🚗 Slovakia: The Automotive and Battery Boom

- 🔬 Austria: Innovation, Grants, and Scalable Stability

- 🤖 Czechia: R&D Zones, Talent, and High-Value Investment

- 🧭 How Central Europe Compares to Western Hubs

- 💬 What Experts and Leaders Say

- 🎥 Real Snippets & Industry Videos

- 📝 Conclusion & Key Takeaways

📈 Central Europe's FDI Surge in 2025 – Why the World Is Betting on Austria, Czechia & Slovakia

📊 Visual: 2024–2025 FDI Growth (% Increase) – Austria, Czechia, Slovakia vs EU Average

- 🇸🇰 Slovakia: +37% FDI Growth in 2024 – Driven by EVs, batteries, and Korean investment

- 🇦🇹 Austria: €2.1B FDI in 2023 – 460+ foreign companies established, 5,200+ new jobs

- 🇨🇿 Czechia: +29% FDI Surge – Focus on semiconductors, R&D, and green logistics zones

- 📊 EU Comparison: Western Europe averaged just +11% growth in same period

- 🚀 Top Sectors: Clean Energy, Automotive Tech, Advanced Manufacturing, AI Zones

- 🛡️ Strategic Push: Backed by EU Green Deal, Industrial Autonomy & Supply Chain Resilience policy

Foreign direct investment in Europe is shifting eastward — and fast. In 2025, Austria, Czechia, and Slovakia are no longer considered fringe players. These Central European nations are becoming top choices for clean energy factories, advanced automotive plants, and digital infrastructure — attracting billions in funding from Asia, the U.S., and within the EU itself.

According to the European Commission and IMF data, Austria recorded a 21% FDI rise, Slovakia surged by 37%, and Czechia posted a 29% increase in 2024 alone — outperforming Western peers like France, Germany, and Italy. These trends are expected to continue through 2025, especially as the EU pivots toward resilient, nearshored supply chains and net-zero industrial strategies.

This shift isn’t just about cost. It's about access to talent, stable governments, green corridors, and smarter grants. As global investors reprioritize security and scalability over prestige, Central Europe is becoming the new core. Related reading: Foreign Investment in Europe 2025 and Eastern Europe’s Rise.

🚗 Slovakia: The Automotive and Battery Boom Powering Europe’s EV Future

📷 Visual: Slovakia’s Major EV and Battery Projects – Kosice, Nováky, Bratislava (2025)

- 🏭 Volvo Cars: €1.2B EV plant in Kosice – 250,000 cars/year, 3,300 jobs created

- ⚙️ Hyundai Mobis: €170M EV parts facility in Nováky – €26M state aid, coal region revival

- 🔋 Gotion-InoBat Gigafactory: €1.2B investment, 20 GWh capacity by 2027

- 📈 Slovakia = #1 car producer per capita globally (VW, Kia, Stellantis, JLR)

- 🚚 Strategic location with EU access to Germany, Hungary, Poland, Austria

- 🎯 Backed by SARIO + EU Green Industrial Policy for energy and battery supply chains

"Slovakia’s east provides the perfect mix of talent, logistics access, and state support." — Jim Rowan, CEO, Volvo Cars (2024)

Slovakia has become the EU’s most capital-efficient EV manufacturing hotspot. From east to west, the country now hosts multiple giga-projects that blend cutting-edge innovation with strategic funding from the state and the EU.

With the Volvo EV plant in Kosice alone bringing over €1.2B in investment and 3,300 jobs to the underdeveloped east, Slovakia is rapidly transforming into a core part of Europe’s mobility future. Backed by powerful logistics access and coal-to-clean zone transitions like Nováky, this small country is making a big mark on Europe’s map.

Related read: Made in Europe 2.0 and Eastern Europe’s Rise.

🔬 Austria: Innovation, Grants, and Scalable Stability for Global Investors

📷 Visual: Austria’s Scalable Innovation Funnel – Funding, R&D, Jobs and Economic Output

- 💸 aws: €1B innovation support annually – grants, loans, and guarantees

- 🏢 ABA: 460+ foreign firms established in 2023 → €2.1B FDI → 5,200+ jobs

- 🧬 COMET Clusters: 25+ R&D excellence centers in AI, biotech, energy, mechatronics

- 🌍 Vienna: Named EU’s #2 city for cross-border R&D partnerships (2024)

- ⚖️ Ranked Top 3 in Europe for “Stability & Business Scale-up Environment”

"Austria isn’t just stable — it’s scalable for innovation. Investors come for reliability, and stay for results." — Rene Tritscher, Managing Director, ABA

Austria has quietly built one of the EU’s most powerful public-private funding ecosystems. With over €1 billion per year in direct innovation support through the federal aws platform, the country accelerates hundreds of high-impact ventures across biotech, AI, energy storage, and automation.

Meanwhile, Austria’s ABA recorded a record year in 2023 — helping over 460 international firms enter or expand across the country, generating more than €2.1 billion in investment. Its combination of reliability, fast setup, and government trust makes it a magnet for serious global players.

Related read: Top EU Countries for FDI and Europe’s Economic Engines.

🤖 Czechia: R&D Zones, Talent, and High-Value Investment Are Redefining Its Economy

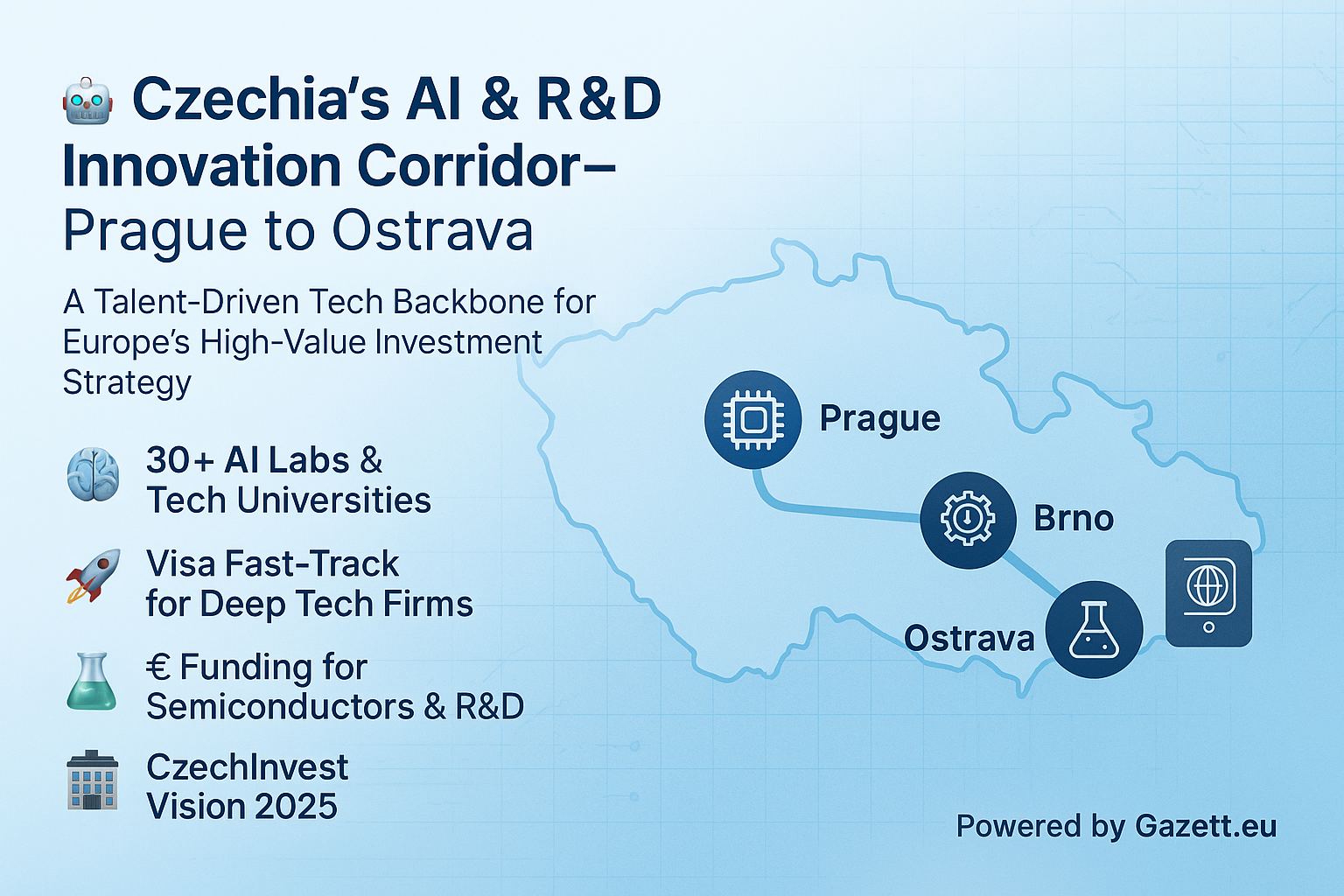

📷 Visual: Czechia’s AI and R&D Corridor Map – Prague, Brno, Ostrava

- 🏙️ Prague–Brno–Ostrava: AI corridor with 30+ labs, startups, tech universities

- 🧠 CzechInvest Vision 2025: Fast-track foreign investment in semiconductors, automation, and AI

- 🛰️ Strategic partnerships in aerospace, EV supply chains, and high-value logistics

- 🧪 R&D expenditure = 1.99% of GDP – among the highest in Central Europe

- 🧳 New investor visa framework launched for deep tech companies (2024)

- 🌍 Major FDI sources: Germany, Netherlands, Taiwan, South Korea

"We are not chasing volume. We’re chasing value — in R&D, resilience, and future-proof sectors." — Petr Očko, Deputy Industry Minister, Czechia

Czechia is no longer just a low-cost manufacturing destination. In 2025, it’s a growing powerhouse in high-tech R&D, backed by smart government support, a skilled STEM workforce, and geographic access to both Germany and Austria’s industrial bases.

The launch of its fast-track visa system for tech investors, along with growing Taiwanese cooperation on semiconductor R&D, is solidifying Czechia’s place in the EU’s high-value future. Learn more: Startup Cities of Europe 2025.

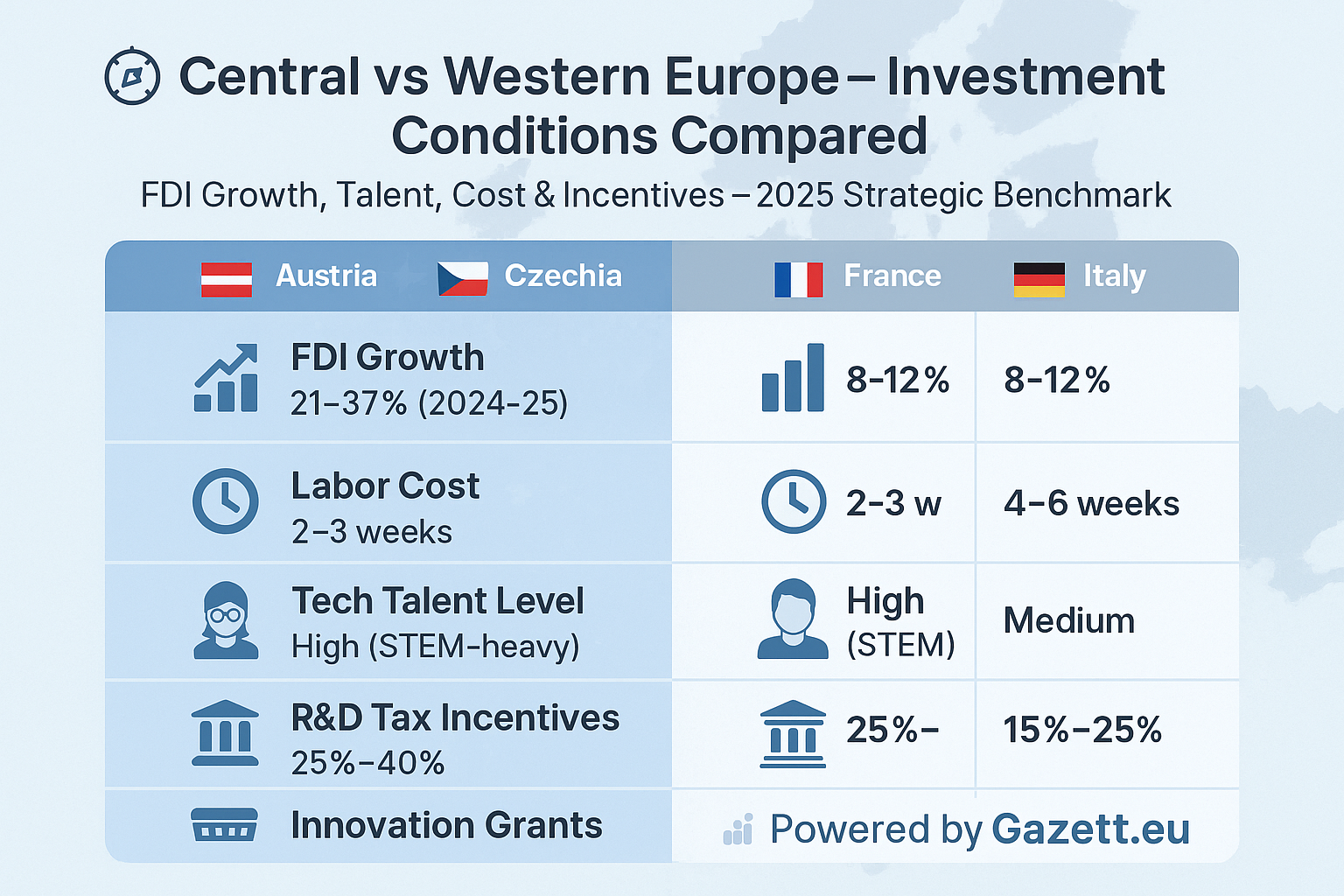

🧭 How Central Europe Compares to Western Hubs – Cost, Talent, Incentives & Output

📊 Visual: Central Europe vs Western Europe – 2025 FDI Drivers Compared

| 📌 Metric | 🇦🇹🇨🇿🇸🇰 Austria / Czechia / Slovakia | 🇫🇷🇩🇪🇮🇹 France / Germany / Italy |

|---|---|---|

| Avg FDI Growth (2024) | 21%–37% | 8%–12% |

| Labor Cost (€/hr, avg) | €11–€18 | €25–€35 |

| Setup Time (Company Reg.) | 2–3 weeks | 4–6 weeks |

| Tech Talent Availability | High (STEM-driven) | Medium |

| R&D Tax Incentives | 25%–40% | 15%–25% |

| Gov. Innovation Grants | Strong – e.g., Austria aws €1B/yr | Moderate |

| Energy Transition Support | Green Deal-aligned | Fragmented |

📌 Data Source: Eurostat, CzechInvest, ABA, SARIO, EIB 2024–25 Reports

As the numbers show, **Central Europe now outperforms Western Europe on cost-efficiency, setup speed, and sector focus**. The FDI surge toward Austria, Czechia, and Slovakia isn’t just temporary — it’s structural, built on a deep foundation of innovation incentives and regional alignment with EU strategic goals.

💬 What Experts and Leaders Say About Central Europe’s Strategic Rise

📷 Visual: Verified Strategic Quotes – From CEOs, Ministers, and EU Leadership

"Slovakia’s east provides the perfect mix of talent, logistics access, and state support." — Jim Rowan, CEO, Volvo Cars

"Austria isn’t just stable — it’s scalable for innovation. Investors come for reliability, and stay for results." — Rene Tritscher, Managing Director, ABA

"We are not chasing volume. We’re chasing value — in R&D, resilience, and future-proof sectors." — Petr Očko, Deputy Industry Minister, Czechia

"Europe’s core supply chains will depend on Central resilience hubs like Austria and Slovakia — not just Paris and Berlin." — Thierry Breton, EU Commissioner for Internal Market

🎥 Real Snippets & Industry Videos

Here’s a quick look at real-world moments shaping Austria, Czechia, and Slovakia’s rise as strategic hubs. These highlights are taken from public announcements, press events, and industry briefings that reflect the energy on the ground across Central Europe.

🔧 Volvo’s Groundbreaking Ceremony in Kosice (2024)

Slovakia’s Prime Minister and Volvo executives jointly announced the €1.2B EV plant in Kosice. The clip shows the ceremonial first dig, press speeches, and drone shots of the planned site expected to deliver 3,300 jobs.

💡 Austria’s AI & Clean Energy Funding Panel

From Vienna’s innovation summit: aws leaders and Austrian ministers discuss €1B annual innovation support and highlight COMET clusters focused on quantum tech, mechatronics, and AI-powered energy platforms.

📦 Czechia’s Industrial Innovation Showcase

A behind-the-scenes look at CzechInvest's new R&D corridor programs in Brno and Ostrava. Engineers demonstrate real AI chip prototyping, robotics testing, and Czechia’s clean logistics zones.

📊 EU Briefing: FDI Strategy & Strategic Autonomy

A Brussels panel with Commissioner Thierry Breton highlights the EU’s support for shifting investment corridors toward Central Europe. Includes policy visualizations and funding roadmap timelines through 2026.

📝 Conclusion & Key Takeaways from Central Europe’s Strategic Investment Wave

The transformation of Austria, Czechia, and Slovakia from secondary markets to strategic investment hubs is now undeniable. Backed by cutting-edge industries, high-performing public agencies, and EU alignment, these three countries are capturing a rising share of global FDI — and reshaping Europe’s growth map.

Whether you’re a policymaker, investor, or founder, this Central European triangle now offers cost-effective scale, advanced sector ecosystems, and long-term geopolitical value. As EU policy shifts toward autonomy and resilience, Austria, Czechia, and Slovakia are already delivering.

| 🏳️ Country | 🎯 Key Sector Focus | 📊 FDI Highlights (2024–25) | 🚀 Edge for Investors |

|---|---|---|---|

| 🇸🇰 Slovakia | EVs, Batteries, Auto Parts | €2.5B+ projects, 6,000+ jobs | Fast growth, low cost, strong state aid |

| 🇦🇹 Austria | AI, Clean Energy, Biotech | €2.1B FDI via ABA, €1B/year aws | Scalable, stable, grant-rich |

| 🇨🇿 Czechia | Semiconductors, R&D, AI | 29% FDI growth, visa reforms | Talent density, German border access |

Want to explore more about Europe’s evolving growth map? Check out our related reports on regional FDI, startup ecosystems, and green manufacturing:

Sources: European Commission, Austrian Business Agency (ABA), CzechInvest, SARIO Slovakia, IMF, Eurostat, EU Innovation Reports