🦄 Nordic Startups 2025: The Sustainability Unicorns Driving Europe’s Tech Edge

In 2025, the Nordic region—Sweden, Denmark, Norway, Finland, and Iceland—has emerged as Europe’s strongest cluster of sustainable innovation. A rare mix of progressive policy, green funding, and deep-rooted environmental ethics has positioned the Nordics at the frontier of sustainability-driven tech entrepreneurship. With over 35 unicorns and scaleups focused on climate, food, energy, and logistics, the region is setting the benchmark for what modern growth looks like.

From Sweden’s Northvolt powering EV batteries to Finland’s Wolt redefining food logistics, these startups aren’t just scaling fast — they’re scaling responsibly. Backed by reports from Nordic Innovation and global deal trackers like PitchBook, the Nordic tech scene is now recognized as a global ESG investment hotspot.

📷 Visual: Nordic Sustainability Unicorns Map (Image to be uploaded)

📚 Article Overview

- 🇸🇪 Sweden: Pioneering Green Tech Giants

- 🇩🇰 Denmark: Innovating for a Sustainable Future

- 🇫🇮 Finland: Merging Technology with Sustainability

- 🇳🇴 Norway: Harnessing Natural Resources Responsibly

- 🇮🇸 Iceland: Small Nation, Big Impact

- 📈 Investment Trends and Government Initiatives

- 🧭 Challenges and the Road Ahead

- 📝 Conclusion & Key Takeaways

🇸🇪 Sweden: Pioneering Green Tech Giants

Sweden continues to lead Europe in climate-forward entrepreneurship with unicorns like Northvolt, Climeon, and Einride pushing the frontiers of energy storage, carbon capture, and electric freight. Stockholm alone has produced more unicorns per capita than any city outside Silicon Valley. Backed by the Swedish Energy Agency and Vinnova, the country’s climate tech ecosystem thrives on green financing, export subsidies, and university spinouts.

A growing number of startups are aligning with Sweden’s ambitious 2045 net-zero goals. In particular, the fusion of deeptech and cleantech is making waves in global markets. As previously highlighted in EU manufacturing trends and global trade outlooks, Sweden’s green industrial exports are becoming a serious force across Europe and Asia.

- 🔋 Northvolt raised $1.2 billion in 2023, Europe’s largest clean battery round.

- 🚛 Einride’s electric freight corridors now operate in Sweden, Germany & the U.S.

- 🌬️ Climeon’s carbon capture units are now deployed on over 65 vessels and power sites.

- 💼 Over 60% of Sweden’s VC funding in 2024 went to sustainability-linked startups.

- 🌍 Sweden contributes nearly 20% of Europe’s ESG startup unicorns.

📷 Visual: Sweden’s Climate Unicorns – Energy, Freight & Cleantech (Image to be uploaded)

🇩🇰 Denmark: Innovating for a Sustainable Future

Denmark continues to punch far above its weight in sustainability-driven innovation. With Copenhagen as its launchpad, the country has become home to some of Europe’s most creative startups tackling climate, food waste, fintech, and clean energy. Backed by strong public-private cooperation and a deeply embedded green culture, Danish founders are building scalable solutions that fit both the market and the planet.

From Too Good To Go (now valued at over $1.1B) fighting global food waste to Pleo reinventing expense management with ESG transparency built-in, Danish unicorns are redefining what Nordic capitalism looks like. Emerging cleantech players like Seaborg Technologies are developing compact molten salt reactors, while wind energy firms expand export footprints. As covered in Europe’s green transition playbook, Denmark is often seen as the proof-of-concept lab for sustainable entrepreneurship.

- ♻️ Too Good To Go has helped save over 200 million meals globally since launch.

- 💳 Pleo crossed $150M ARR in 2024, with built-in ESG reporting modules for SMEs.

- ⚛️ Seaborg Technologies raised €91M for safe, compact nuclear innovation (2023).

- 🌬️ Denmark exports over €10B/year in wind turbine tech and green energy infrastructure.

- 🏙️ Copenhagen named the “#1 test city” for urban green pilots in 2024 (Nordic Cities Index).

📷 Visual: Denmark’s Green Tech Ecosystem – Food, Fintech & Clean Energy (Image to be uploaded)

🇫🇮 Finland: Merging Technology with Sustainability

Finland is emerging as the Nordics' quiet powerhouse in deeptech-led sustainability. With a strong emphasis on research and a thriving support network of state-backed accelerators, Finnish startups are fusing advanced space, biotech, and food innovation with climate resilience. The Helsinki–Espoo corridor is now home to scaleups that are not only profitable — but planet-positive by design.

Startups like Solar Foods are pioneering protein production from CO₂ and air, while space-tech firm ICEYE is building climate intelligence from satellite radar. Meanwhile, Wolt — now part of DoorDash — continues to expand its ESG-first delivery model across Europe. As shown in smart urban innovation hubs and global economic pivots, Finland is blending tech, trust, and transparency like few others.

- 🚀 ICEYE raised $136M for its flood-risk satellite monitoring tech (2023).

- 🥬 Solar Foods produces “Solein” — a protein made from CO₂, air, and electricity.

- 🍽️ Wolt now operates in 25 countries with a carbon-accountable delivery model.

- 🎓 Finland invests 3.2% of GDP in R&D — highest in the EU (Eurostat 2024).

- 🧪 52% of Finnish startup funding in 2024 went to science-based climate ventures.

📷 Visual: Finland’s Deeptech & Climate Unicorns (Image to be uploaded)

🇳🇴 Norway: Harnessing Natural Resources Responsibly

Norway has long balanced fossil fuel wealth with a progressive sustainability agenda. Now, in 2025, it’s doubling down on hydropower, smart grids, and cleantech exports — while supporting startups that use natural resources responsibly. As fossil divestment accelerates, innovation is rising in sectors like energy management, EV integration, and consumer-facing green platforms.

Companies like Tibber (smart electricity retail) and Otovo (home solar systems) are scaling across Europe with data-driven pricing models and carbon-cutting outcomes. Oslo-based Desert Control is exporting nanoclay tech to regenerate arid land. As covered in Europe’s factory resilience strategies, Norway is also fueling clean infrastructure in energy-intensive regions.

- 💡 Tibber helps 500,000+ households optimize energy use in real-time.

- ☀️ Otovo has installed 50,000+ rooftop solar units across 13 countries.

- 🌱 Desert Control has active pilots in UAE, India, and southern Spain.

- ⚡ Norway generates over 92% of its power from hydropower (Statkraft, 2024).

- 📦 State-owned fund Investinor deployed €280M in climate-focused startups (2023–24).

📷 Visual: Norway’s Energy-Tech Scaleups & Resource Innovation (Image to be uploaded)

🇮🇸 Iceland: Small Nation, Big Impact

Iceland may be small in population, but it’s become a massive innovator in climate resilience and circular economy models. With access to abundant geothermal energy, low-carbon electricity, and carbon-negative storage solutions, Icelandic startups are building technologies that serve as global climate prototypes. Reykjavik has emerged as a hotbed for ventures in clean fuels, ocean tech, and carbon capture.

Key players like Carbfix and Climeworks are scaling carbon storage in basalt rock, while food-tech pioneers like ORF Genetics use geothermal-powered labs for sustainable biotech. Iceland’s unique energy mix and funding programs have also attracted cleantech pilots from larger EU markets. As explored in renewables outlooks and Europe’s green infrastructure race, Iceland is an outlier that’s becoming a leader.

- 🌋 Over 85% of Iceland’s energy comes from geothermal and hydropower (IEA, 2024).

- 🌍 Carbfix stores CO₂ underground by turning it into stone — with 70k+ tons captured.

- 🧬 ORF Genetics produces growth factors using barley grown with geothermal steam.

- 🧪 Iceland has one of the lowest carbon footprints per startup in Europe.

- 🌊 Ocean tech pilots include marine heat pumps and kelp-based biofuels.

📷 Visual: Iceland’s Climate Tech & Geothermal Ventures (Image to be uploaded)

📈 Investment Trends and Government Initiatives

Nordic governments have become quiet champions of startup ecosystems—strategically blending R&D investment, equity co-funding, and green public procurement to accelerate climate innovation. Agencies like Sweden’s Vinnova, Denmark’s Innovation Fund, and Finland’s Business Finland are pushing out millions in grants, early-stage capital, and export support. Meanwhile, sovereign wealth funds and pension capital are increasingly flowing into impact-driven unicorns from the region.

Nordic nations are also coordinating regionally via the Nordic Innovation alliance and the European Innovation Council. Their startup-friendly tax regimes, transparent governance, and digital-first infrastructure are pushing them up the global rankings. As explored in foreign investment analysis and EU policy shifts, this alignment is helping Nordic countries attract global VCs and tech giants.

- 💰 In 2024, Nordic startups raised over €11.8 billion in VC and private equity (Dealroom).

- 🌍 Government innovation funds issued more than €2.3B in grants across climate tech & ESG.

- 📊 Sweden and Denmark lead Europe in public-private co-investment frameworks.

- 🏦 Norway’s sovereign wealth fund now allocates 2.5% to impact VC and sustainability-linked startups.

- 🧭 Finland ranks #1 in the EU for ease of starting a green-tech business (OECD, 2025).

📷 Visual: Nordic Government & VC Investment in ESG Innovation (Image to be uploaded)

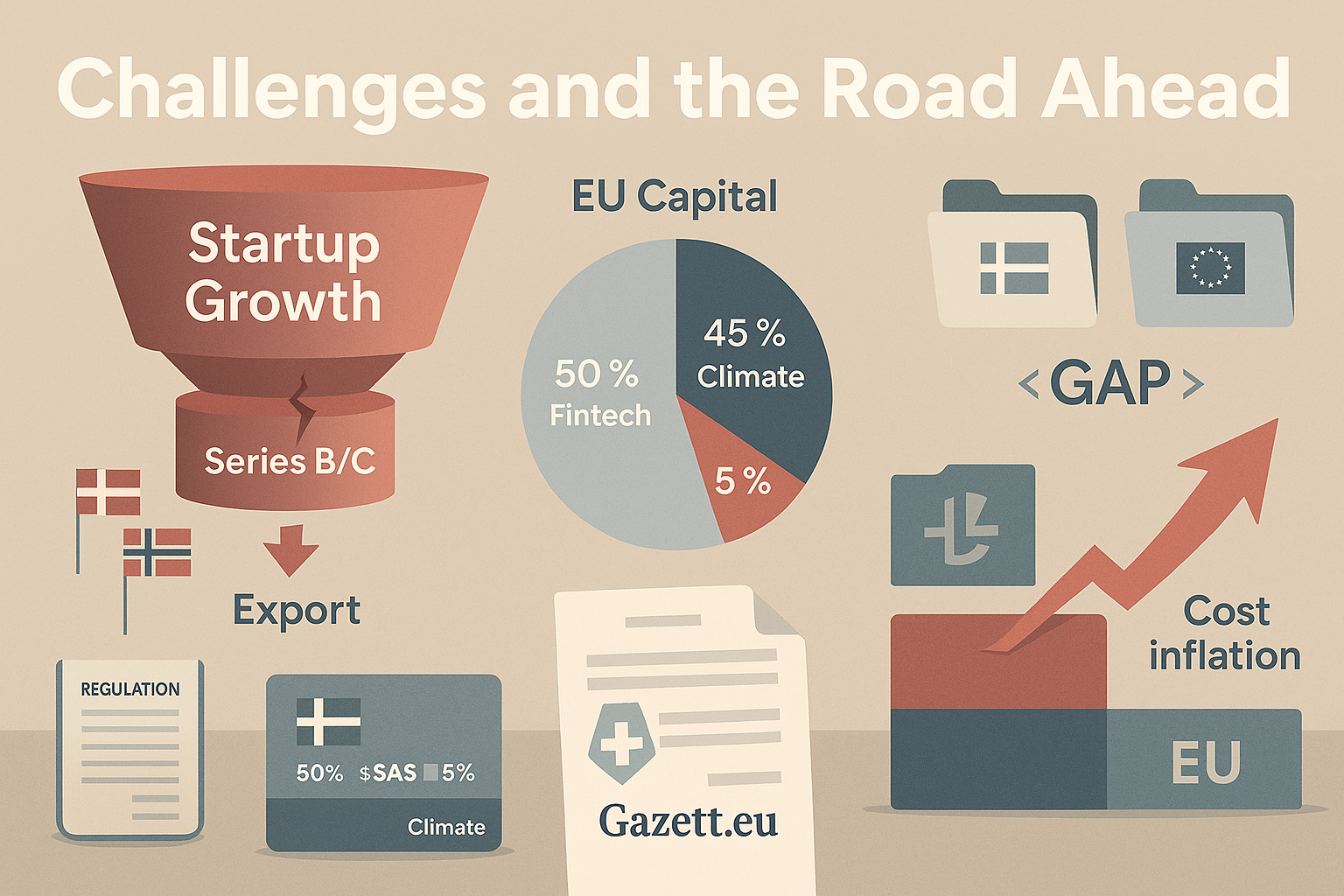

🧭 Challenges and the Road Ahead

While Nordic startups have carved out a global niche, they still face challenges scaling and competing in a fragmented regulatory and investment landscape. Supply chain dependency, rising operational costs, and limited late-stage capital remain persistent bottlenecks. Furthermore, many startups rely on public funding and soft loans—raising questions about long-term private-market resilience.

There’s also growing pressure to expand product-market fit beyond the eco-conscious Nordic consumer. Startups now need to win over institutional buyers, foreign markets, and industrial partners without compromising on ESG values. As detailed in strategic autonomy debates and regional resilience outlooks, Europe’s security and inflationary pressures may soon test even its most sustainable models.

- ⚠️ Nordic founders cite difficulty scaling beyond Series B/C rounds due to investor caution (EU Startup Monitor).

- 💹 Energy & material costs rose 18% YoY in 2024 for sustainable hardware startups.

- 🌐 Only 1 in 4 Nordic unicorns has significant market presence outside the EU (McKinsey Nordic Outlook 2025).

- 📉 Climate startups receive just 5% of late-stage capital in Europe compared to SaaS/Fintech peers.

- 🧭 Regulatory gaps persist between Nordic/EU frameworks on digital identity, procurement & reporting.

📷 Visual: Barriers to Growth for Nordic ESG Startups (Image to be uploaded)

📝 Conclusion & Key Takeaways

The Nordic startup ecosystem is no longer just a regional success story — it's becoming Europe’s blueprint for sustainable, tech-enabled innovation. From deep science in Finland to climate consumerism in Denmark, and from Iceland’s geothermal breakthroughs to Sweden’s green exports, these unicorns are defining a new benchmark: one where valuation and values can scale together. As public funds, private capital, and policy support align, the next wave of climate-positive unicorns may well emerge from the north.

| 📌 Highlight | 📈 2025 Insight |

|---|---|

| Top ESG Unicorns | Northvolt, Einride, Too Good To Go, Wolt, Tibber, Otovo |

| VC Funding Raised | €11.8B across Nordic startups in 2024 |

| Government Support | €2.3B in public grants, export credit & green innovation |

| Sectors in Focus | Climate Tech, Green Energy, Smart Freight, Food Waste |

| Biggest Bottlenecks | Late-stage funding gaps, export friction, regulatory scaling |

Sources: Nordic Innovation, Dealroom 2025, IEA Energy Reports, Startup Europe Club