🏭 Made in Europe 2.0: Inside the Return of Strategic Manufacturing

Europe’s industrial policy is undergoing a seismic shift. After decades of outsourcing and overdependence on global supply chains, 2025 marks the emergence of a bold new strategy: Made in Europe 2.0. From clean energy to semiconductors, batteries to defense, the EU is investing in strategic manufacturing capacity — not just to compete, but to survive in a world shaped by geopolitical tension, green transitions, and economic fragmentation.

Drawing from live sources like the Green Deal Industrial Plan, EIT Manufacturing, and the European Sovereignty Fund proposals, we explore how reshoring is becoming the cornerstone of Europe’s industrial rebirth.

📷 Visual: Strategic Manufacturing Hubs and Green Industrial Recovery in the EU – 2025

📚 Article Overview

- 1. Why Reshoring Is Back – Europe's Wake-Up Call

- 2. The Green Deal Industrial Plan – Net-Zero Factories & Funding

- 3. Battery Alliances & Semiconductor Sovereignty

- 4. Critical Infrastructure, Raw Materials & Investment Zones

- 5. The Big Gaps – Inequality, Delays, and Regulatory Gridlock

- 📝 Conclusion + Key Takeaways + Funding Table

🔁 Why Reshoring Is Back – Europe’s Wake-Up Call

Europe’s overreliance on overseas manufacturing hit a critical breaking point between 2020 and 2023. COVID-era bottlenecks, China's export controls, and Russia’s war on Ukraine exposed just how fragile the continent’s industrial ecosystem had become. The result? A sharp turn toward “strategic autonomy” — and with it, the return of reshoring.

- 📦 Over 70% of EU manufacturers now cite “supply chain fragility” as a top operational risk. (Source: Eurostat Industry Pulse 2025)

- 🔄 Germany and France have launched national reshoring subsidies worth over €40B combined since 2022.

- 🛑 Europe's dependence on Chinese electronics, batteries, and semiconductors exceeded 90% in certain categories by 2023.

The EU's pivot is now driven by security, not just economics. From pharmaceuticals to microchips, the reshoring wave is being reshaped as a survival strategy. And it’s just beginning.

Internal link to context: Made in Europe – EU Manufacturing 2025

📷 Visual: Why Reshoring Returned – Strategic Manufacturing Risk Map (2025)

🌱 The Green Deal Industrial Plan – Net-Zero Factories & Funding

The EU’s Green Deal Industrial Plan is more than a climate policy — it’s now the foundation of Europe’s post-crisis manufacturing strategy. Launched in response to both energy shocks and the U.S. Inflation Reduction Act, the plan is fueling a new era of net-zero industrial development across the continent.

- 🏭 Over €270B in green industrial projects have been unlocked via relaxed state aid rules across 18 member states.

- ♻️ EU's Net-Zero Industry Act targets 40% of Europe’s clean tech demand to be met through local production by 2030.

- 🔋 Key focus sectors: batteries, solar panels, wind turbines, heat pumps, and carbon capture technologies.

Combined with the upcoming European Sovereignty Fund and streamlined permitting for factories, the Green Deal Plan is creating a regulatory fast lane for sustainable manufacturing at scale.

Internal link to context: Portugal’s Green Energy Model – Leading the Transition

📷 Visual: EU Green Industrial Plan – Projects, Funding & Fast-Track Hubs (2025)

🔋 Battery Alliances & Semiconductor Sovereignty

In the battle for economic sovereignty, the EU is betting big on two industrial bottlenecks: battery production and semiconductor supply. Through state-led alliances and joint ventures with private players, Europe is working to eliminate its most critical external dependencies by 2030.

- 🔋 The European Battery Alliance has mobilized over €127B in investments across 14 countries for local gigafactories.

- 💾 The EU Chips Act (budget: €43B) aims to double Europe’s global chip market share to 20% by 2030.

- 🇫🇷 France and 🇩🇪 Germany lead in battery output, while 🇳🇱 Netherlands and 🇮🇹 Italy are ramping up foundry capacity.

These moves are about more than industrial output—they’re about leverage. Batteries and chips power everything from cars to communications to defense. Without them, Europe stays dependent. With them, it leads.

Internal link to context: Top EU Tech Startups Driving Semiconductor Innovation

📷 Visual: Battery Clusters & Semiconductor Sovereignty Hubs – EU 2025

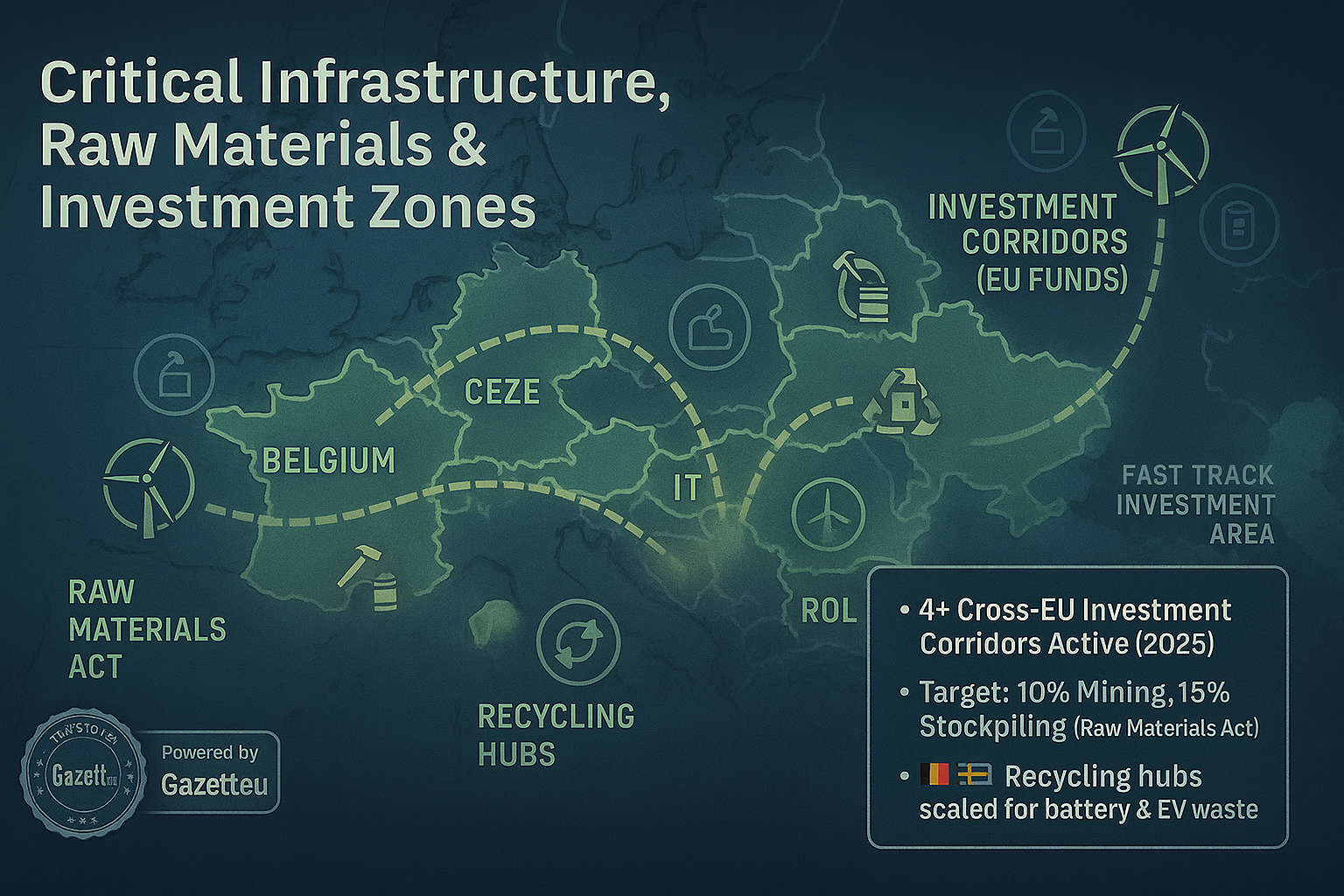

🧱 Critical Infrastructure, Raw Materials & Investment Zones

Strategic manufacturing can’t function without secure infrastructure. That’s why the EU is building new industrial corridors, funding mining and recycling hubs, and redesigning permitting laws to fast-track factory zones. The shift toward “industrial readiness” is being backed by regulation and billions in cohesion funds.

- 🛤️ EU Investment Zones launched in 🇨🇿 Czechia, 🇵🇱 Poland, 🇸🇰 Slovakia, and 🇷🇴 Romania as part of cross-border industrial corridor plan.

- 🧲 The Critical Raw Materials Act targets 10% domestic mining + 15% strategic stockpiling of key inputs like lithium, cobalt, and rare earths.

- 🔁 Recycling and refining hubs are being prioritized for battery metals and e-waste in 🇧🇪 Belgium and 🇸🇪 Sweden.

The EU’s strategy isn’t just about production. It’s about control. Whoever owns the materials and the logistics owns the future. In 2025, that means reshaping Europe's ground game—from mines to megaplants.

Internal link to context: Top 10 Infrastructure Projects Reshaping the EU in 2025

📷 Visual: Investment Corridors, Mining Zones & Material Security Areas – EU 2025

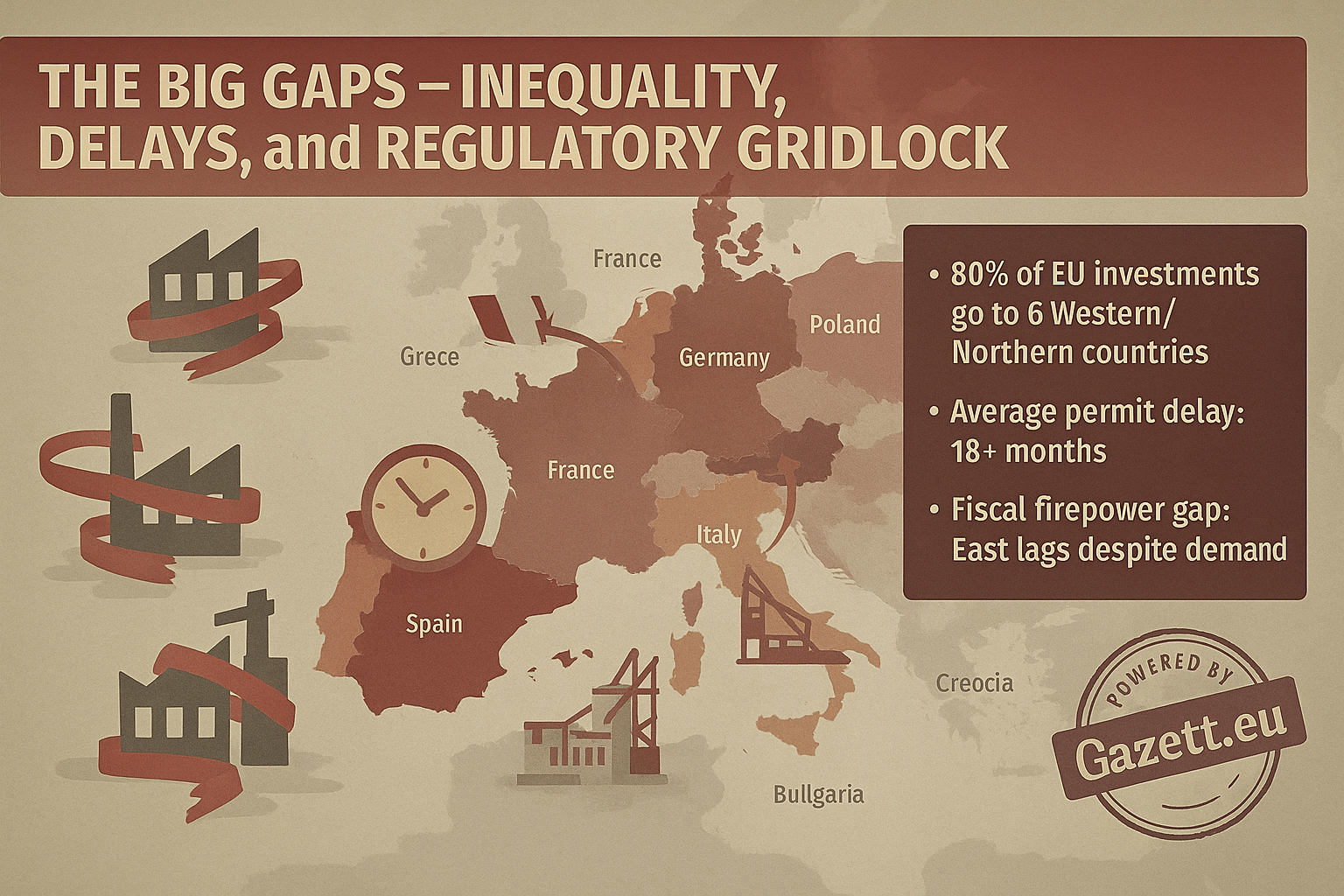

⚖️ The Big Gaps – Inequality, Delays, and Regulatory Gridlock

Despite the policy momentum, “Made in Europe 2.0” is still uneven. Bigger countries have more firepower. Smaller ones wait longer. And across the board, factories face the same historic EU bottleneck: permits, permissions, and paperwork.

- 📊 80% of new industrial investments in 2024 went to just 6 countries: 🇩🇪 Germany, 🇫🇷 France, 🇮🇹 Italy, 🇪🇸 Spain, 🇳🇱 Netherlands, and 🇸🇪 Sweden.

- ⏳ Average approval time for a net-zero factory exceeds 18 months in many EU countries — 3x slower than U.S. or South Korea.

- 🧾 State aid limits still create unfair funding gaps, despite recent reforms — Eastern and Southern member states lag behind.

Without deeper fiscal solidarity and serious deregulation, the Green Industrial push could deepen the divide within the Union — turning strategic autonomy into strategic fragmentation.

Internal link to context: The European Growth Gap – Why Some Countries Are Falling Behind

📷 Visual: EU Industrial Inequality & Permitting Delays by Region – 2025

📝 Conclusion & Strategic Takeaways

“Made in Europe 2.0” isn’t just a slogan — it’s a necessity. In a world of fractured trade, energy insecurity, and rising tech rivalry, the EU’s survival hinges on rebuilding what it lost: manufacturing muscle, material access, and policy autonomy. The path ahead demands balance — between green and industrial, fast and fair, national and Union-level. The good news? Europe is already building it.

| Pillar | Action / Status |

|---|---|

| ⚙️ Industrial Sovereignty | €270B+ unlocked for strategic sectors (chips, batteries, renewables) |

| ♻️ Green Readiness | Net-Zero Industry Act + fast-track permitting zones expanding |

| 🧲 Material Access | Raw Materials Act + stockpiles + domestic mining underway |

| 🏗️ Cross-EU Coordination | Investment corridors in Central & Eastern Europe expanding |

Sources: EIT Manufacturing, European Commission, Reuters, ELIAMEP, Financial Times