🛡️ How Europe’s Defense Giants Are Redrawing Global Security Lines in 2025

In 2025, Europe's defense industry is no longer just a supplier — it’s becoming a sovereign strategic actor. With players like Airbus Defense, Rheinmetall, Leonardo, and Thales leading the charge, the European Union is reshaping global security balances across aerospace, cyber, naval, and AI-driven warfare sectors. From Berlin to Rome, Paris to Madrid, a powerful new industrial-military complex is emerging that could define Europe's geopolitical destiny for decades.

As explored in Germany’s security revival and France’s cyber defense vision, Europe’s leading states are investing heavily in indigenous defense innovation. No longer reliant on external powers, Europe's defense renaissance is powered by satellites, AI swarms, quantum radars — and a clear drive for strategic autonomy.

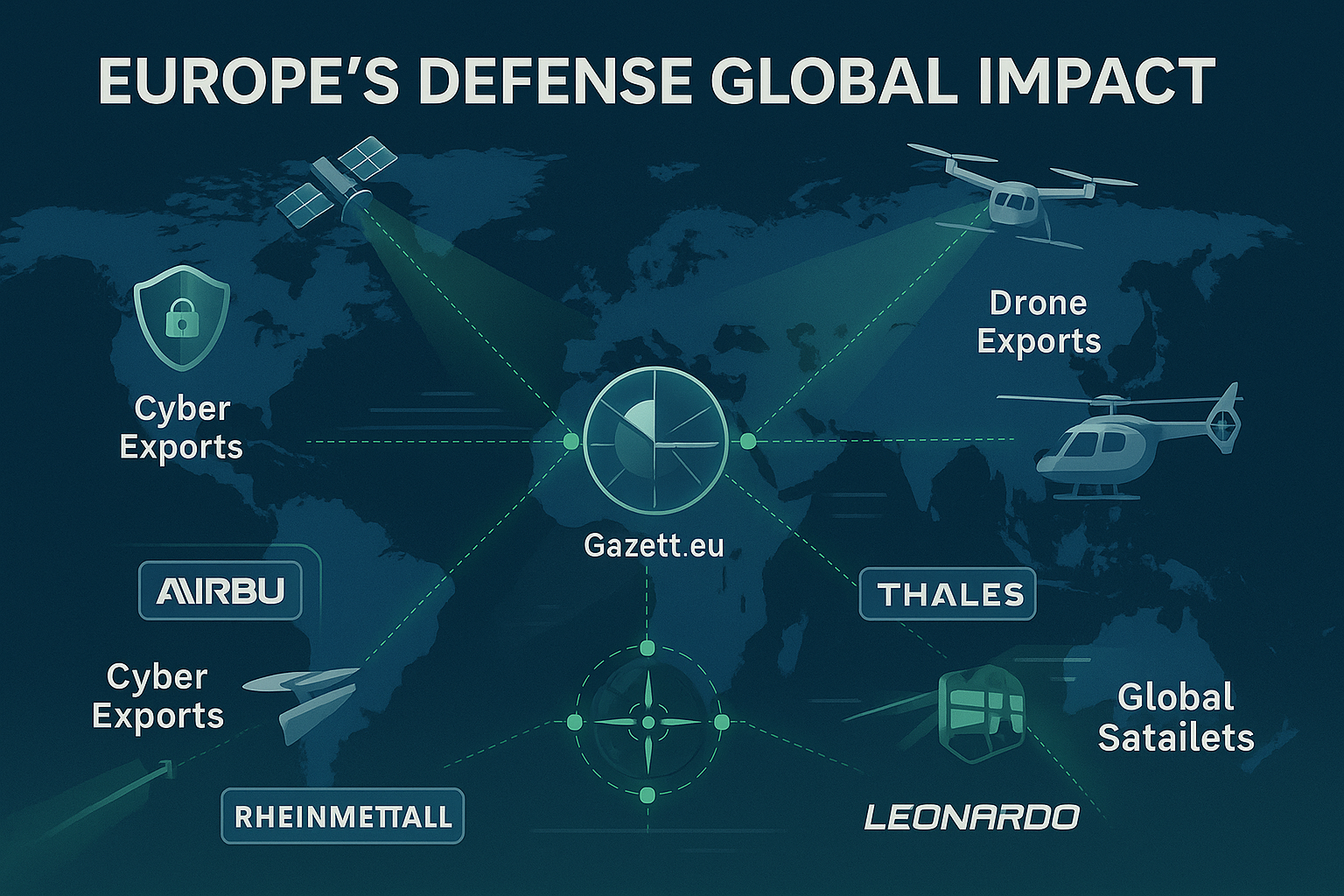

📷 Visual: How Europe’s Defense Giants Are Redrawing Security Lines

📚 Article Overview

- 🛡️ Europe's Defense Titans: Airbus, Rheinmetall, Leonardo, Thales

- 🚀 Major Projects: Drones, Satellites, Tanks, and AI Systems

- 🔗 EU Strategic Compass and Industrial Sovereignty Goals

- 🌍 Global Impact: Redefining Security Beyond Europe

- 📈 Financial Boom: Revenues, Investments, and Orders Surge

- 🎥 In Focus: Industry Snippets & Defense Innovation Videos

- 🧠 Challenges Ahead: Talent, Competition, and Regulation

- 📝 Conclusion & Key Takeaways

🛡️ Europe's Defense Titans: Airbus, Rheinmetall, Leonardo, Thales

In 2025, four European defense giants — Airbus Defense and Space, Rheinmetall AG, Leonardo S.p.A., and Thales Group — have emerged as strategic heavyweights reshaping the continent’s security architecture. These companies are not only dominating the military supply chains of Europe but are also increasingly influential in global defense exports, innovation ecosystems, and cyber-physical resilience networks.

As seen in Germany’s continental defense investment and France’s cyber shield strategy, national governments are boosting their industrial champions through megaprojects, sovereign funding, and regulatory autonomy drives under the EU’s Strategic Compass.

- 🛰️ Airbus is Europe’s leader in military satellites, drones, and Eurofighter Typhoon upgrades.

- 🚛 Rheinmetall dominates next-generation tanks, autonomous vehicles, and battlefield AI platforms.

- 🚁 Leonardo pioneers advanced helicopters, maritime surveillance, and aerospace cyber defense.

- 🔒 Thales advances in quantum communication systems, AI cybersecurity, and secure military IoT.

📷 Visual: Europe's Defense Titans Leading Global Security Redraw

🚀 Major Projects: Drones, Satellites, Tanks, and AI Systems

Europe’s defense renaissance in 2025 is not just financial — it is technological. From autonomous drones to cyber-enhanced tanks, Europe’s defense giants are delivering cutting-edge projects that are redrawing global battlefield doctrines. New flagship initiatives showcase Europe's ambition to lead in next-generation warfare platforms while securing technological sovereignty against rising global threats.

According to latest reports covered in Europe’s Military Tech Revolution and Global Trade Realignments 2025, these projects reflect a decisive pivot toward AI-driven command, space-based resilience, green energy deployment, and cross-domain interoperability.

- 🛰️ IRIS² Satellite Network: Airbus leads Europe’s secure military communications satellite constellation to rival U.S. Starlink projects.

- 🚀 Eurodrone Program: Airbus and Leonardo collaborating to field high-endurance, AI-integrated surveillance and strike drones.

- 🚛 Rheinmetall Panther KF51 Tank: Unveiled in 2025 with autonomous targeting, hybrid propulsion, and drone-launch modules.

- 🤖 Thales AI-Command Systems: Real-time multi-domain command interfaces, integrating battlefield AI decision support and cybersecurity shields.

- 🔋 Green Military Bases: Leonardo and Airbus collaborating on energy-positive, zero-carbon smart bases for EU Rapid Deployment Forces.

📷 Visual: Europe’s Megaprojects in Drones, Satellites, AI-Defense Systems 2025

🔗 EU Strategic Compass and Industrial Sovereignty Goals

Launched in 2022 and now fully operationalized by 2025, the EU Strategic Compass serves as the blueprint for Europe’s sovereign security ambitions. It mandates greater industrial defense independence, integrated crisis response capabilities, and coordinated cyber, space, and maritime resilience frameworks.

According to Gazett’s geopolitical realignment analysis and recent European Council reports, Europe's goal is clear: by 2030, at least 50% of defense acquisitions must be intra-European, and cross-border defense industrial partnerships should power a resilient and sustainable security architecture.

- 🛡️ Strategic Autonomy: Reducing dependency on external suppliers by fostering EU-native defense R&D and manufacturing hubs.

- 🌍 Cross-Border Procurement: EU-wide defense procurements and industrial clustering incentives to boost interoperability.

- 🛰️ Space Sovereignty: Launch of IRIS² satellite constellation to secure European military communications independently.

- ⚡ Rapid Deployment Readiness: EU's first permanent 5,000-troop Rapid Reaction Force operational by mid-2025.

- 🔒 Cyber Command Networks: Establishment of EU Cyber Command Centers in Brussels, Madrid, and Tallinn.

📷 Visual: EU Strategic Compass & Sovereignty Goals in 2025

🌍 Global Impact: Redefining Security Beyond Europe

Europe’s defense renaissance is not confined to its own borders. In 2025, major EU players are increasingly exporting European security standards, cyber norms, green military tech, and defense interoperability solutions worldwide. From Indo-Pacific deterrence alliances to African counterterrorism assistance, Europe’s defense footprint is growing across multiple continents.

As highlighted in Gazett’s Global Trade Outlook and in NATO-EU joint frameworks, Europe's export of security is now driven as much by innovation leadership as by strategic necessity. Satellites, cyber shields, AI battlefield systems — all serve as vectors of influence beyond traditional military deployments.

- 🌐 Indo-Pacific Defense Ties: Airbus and Thales secure major drone surveillance and maritime defense contracts with Japan, Australia, and India.

- 🌍 Africa Cyber Resilience: Rheinmetall and Leonardo deliver mobile cyber-defense command centers to West African coalitions.

- 🛰️ Global Satellite Network: IRIS² expands secure satellite coverage to Africa, the Middle East, and parts of Latin America.

- 🤖 AI & Cyber Export: European AI-command platforms and cyber-coordination hubs sold to NATO partners and Indo-Pacific democracies.

- 🔋 Green Defense Diplomacy: Export of eco-friendly logistics systems, smart bases, and green fleets as soft power vectors.

📷 Visual: Europe’s Expanding Global Security Influence 2025

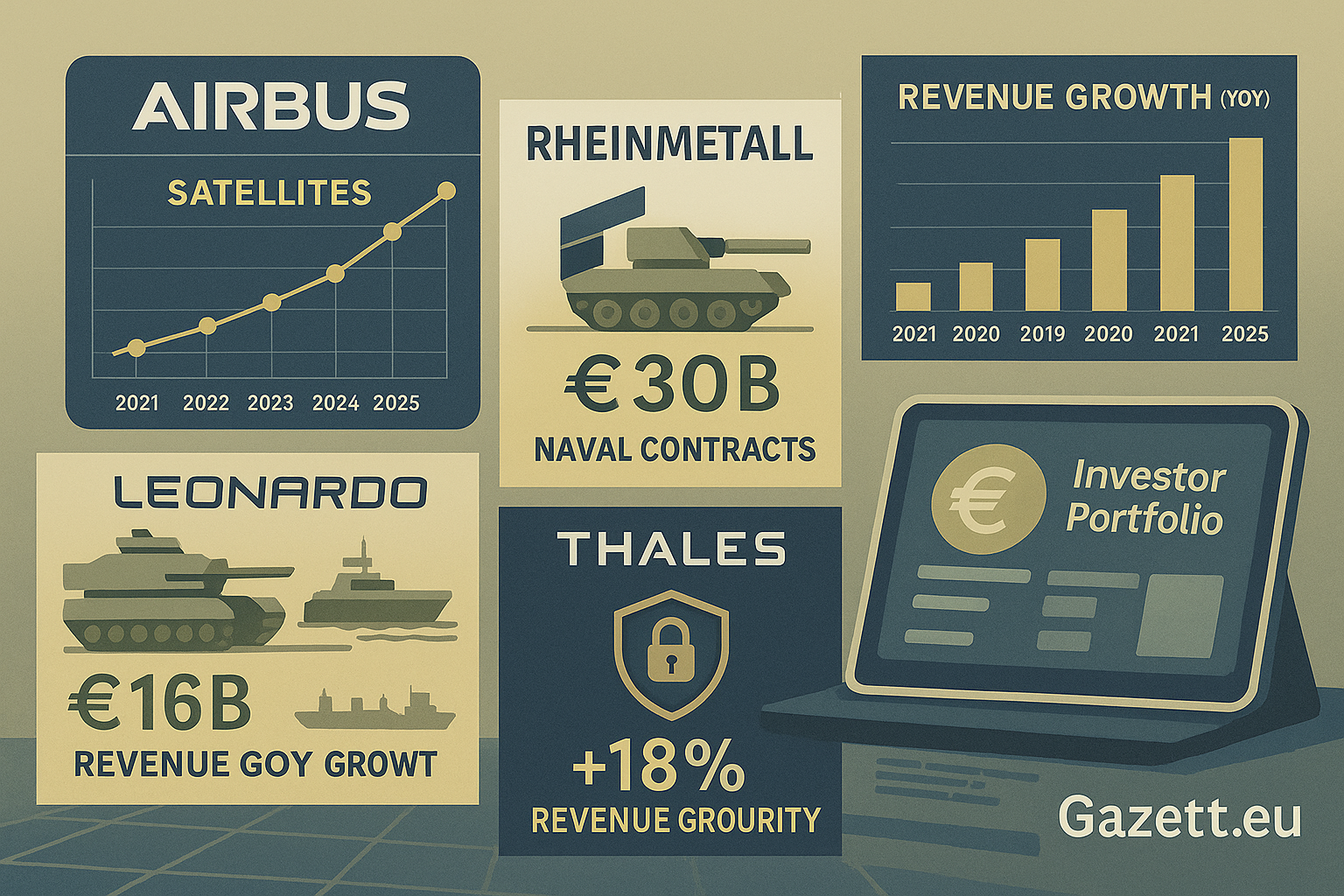

📈 Financial Boom: Revenues, Investments, and Orders Surge

Europe's defense giants are not just winning battles in innovation — they are setting new financial benchmarks. In 2025, companies like Airbus Defense, Rheinmetall, Leonardo, and Thales are reporting record-breaking revenues, bumper order books, and double-digit investment inflows across aerospace, land, cyber, and maritime domains.

As outlined in Europe’s Stock Market Resilience 2025 and recent SIPRI data releases, defense is now one of Europe's highest-growth sectors — fueled by security concerns, industrial funding accelerators, and a green military transformation agenda.

- 💶 Airbus Defense: €15 billion+ revenue in 2025, driven by satellites, drones, and Eurofighter upgrades (+23% YoY).

- 🚛 Rheinmetall: Record €30 billion order backlog, fueled by Panther tank exports and NATO vehicle modernization projects.

- 🚁 Leonardo: €16 billion in defense and security revenues; green logistics and smart naval contracts boosting margins.

- 🔒 Thales: 18% YoY growth in cyber-defense, aerospace security, and smart battlefield systems.

- 🛰️ EU-Wide: European Defense Fund-backed projects reach €8.7 billion active funding across cross-border megaprojects.

📷 Visual: Financial Surge of Europe's Defense Leaders in 2025

🎥 In Focus: Industry Snippets & Defense Innovation Videos

Behind Europe’s defense boom lies a wave of innovation, R&D breakthroughs, and game-changing programs. Let’s take a closer look at some real-world industry updates and visual showcases fueling the new European security architecture.

📰 Latest Industry Snippets

- ✅ Airbus leads launch of Europe’s new IRIS² secure satellite megaconstellation.

- ✅ Rheinmetall unveils next-gen AI battlefield operating system for EU Rapid Forces.

- ✅ Leonardo signs €6 billion contracts for green logistics military bases across Southern Europe.

- ✅ Thales develops quantum-secure defense cloud networks connecting battlefield units in real-time.

🎬 Recommended Industry Videos

📷 Visual: Snippets & Defense Innovation Highlights 2025

🧠 Challenges Ahead: Talent, Competition, and Regulation

Despite its impressive gains in 2025, Europe’s defense industry still faces structural hurdles. From talent shortages in AI, cybersecurity, and aerospace to regulatory bottlenecks slowing joint procurement, achieving full strategic autonomy demands navigating fierce internal and external pressures.

As covered in Europe’s NATO Autonomy Dilemma and strategic foresight reports, maintaining innovation leadership while scaling cross-border cooperation remains Europe’s defining defense challenge heading into the 2030s.

- 🧑💻 Talent Deficit: Urgent shortage of cybersecurity engineers, AI battlefield specialists, and quantum cryptography experts across EU defense firms.

- ⚖️ Regulatory Fragmentation: Varying national procurement laws delay joint mega-project rollouts (e.g., Eurodrone, FCAS fighter jet).

- 🌍 Global Competition: U.S. and Asian defense giants racing ahead in space militarization, AI cyberwarfare, and drone autonomy technologies.

- 💶 Funding Volatility: Defense funding fluctuations tied to national elections and inflationary fiscal pressures in Europe’s major economies.

- 📜 Legal Grey Zones: Emerging cyber-physical hybrid threats outpacing current international law frameworks, raising sovereignty risks.

📷 Visual: Key Challenges Facing Europe’s Defense Industry 2025

📝 Conclusion & Key Takeaways

Europe's defense giants — Airbus, Rheinmetall, Leonardo, and Thales — are not just adapting to a changing security landscape; they are redrawing the very lines of global power. Through cutting-edge satellites, autonomous platforms, cyber resilience, and green military innovations, Europe is asserting its role as a sovereign security actor.

As competition intensifies and hybrid threats evolve, Europe's path forward hinges on balancing innovation, cooperation, and strategic autonomy while addressing structural challenges. 2025 marks not an endpoint, but a bold beginning for Europe’s new security age.

| Key Domains | Highlights |

|---|---|

| Strategic Projects | Eurodrone, IRIS² satellites, AI command platforms |

| Global Impact | Defense exports to Indo-Pacific, Africa, Latin America |

| Financial Growth | Record revenues and order surges across majors |

| Challenges | Talent shortage, fragmented procurement, global rivalry |

Sources: SIPRI Defense Reports, EU Strategic Compass, NATO-EU Briefings, Airbus Defense, Rheinmetall Group.