🇩🇪Germany’s Sector-Wise Business Market Size | Top Growth Categories

As we enter 2025, Germany stands firm as Europe’s largest and most diversified economy, with a projected GDP nearing $4.5 trillion. Long synonymous with industrial excellence, the country is now driving transformation across energy, mobility, digital finance, and AI-driven sectors.

Recent moves — such as its €500 billion defense acceleration strategy and large-scale industrial reforms under the industrial revival plan — position Germany at the core of European resilience and realignment. These steps echo broader EU shifts toward energy independence, reshoring, and sovereignty as detailed in Europe’s Economic Engines 2025.

This report explores Germany’s top 10 business sectors by market size in 2025, tracks emerging growth engines, and connects sectoral performance to strategic themes such as the Green Deal, AI competition, and FDI trends.

📊 Visual: Germany’s Sectoral Landscape in 2025 – Energy • Tech • Manufacturing • AI | Designed by Gazett.eu

📑 Table of Contents

- 🇩🇪 Introduction – Germany’s Economic Engine in 2025

- 📊 Top 10 Sectors by Market Size

- 🚀 Fastest-Growing Industries – 2023–25 CAGR

- 🖥️ Tech, AI & Infrastructure: The New Economic Backbone

- 🏭 Advanced Manufacturing & Mittelstand Dominance

- 🌱 Energy, Climate & Green Transformation

- 🌍 Export Champions – Sectoral Trade Value

- 📌 Sector Matrix + Regional Highlights

- 🔗 Sources + CTA

📊 Top 10 Sectors by Market Size – Germany 2025

Germany’s diversified economy continues to be led by its automotive, engineering, and chemical sectors — but digital industries, healthcare, and green energy are catching up fast. The chart and table below summarize the top 10 sectors by estimated market size in 2025.

📊 Visual: Germany’s Sector-Wise Market Size in 2025 – Source: Destatis, GTAI, McKinsey | Designed by Gazett.eu

| # | Sector | Market Size (2025) | Highlights |

|---|---|---|---|

| 1 | Automotive & Mobility | $500B+ | Germany’s global flagship sector, led by EV exports |

| 2 | Mechanical Engineering | $350B | Machinery, tools, robotics – major export strength |

| 3 | Chemicals & Pharmaceuticals | $300B | Germany is Europe’s leader in pharma & chemicals |

| 4 | Information Technology | $250B | Cloud, cybersecurity, data infrastructure |

| 5 | Financial Services | $200B | Frankfurt-based banking & fintech ecosystem |

| 6 | Healthcare & Life Sciences | $180B | Medical devices, hospital systems, biotech |

| 7 | Green Energy & Utilities | $150B | Hydrogen, wind, solar under EU Green Deal |

| 8 | Logistics & Supply Chain | $120B | Rail, inland ports, freight corridors |

| 9 | Construction & Infrastructure | $100B | Public housing, EU recovery projects |

| 10 | Retail & E-commerce | $90B | Marketplace platforms & B2C brands scaling |

For cross-border context, compare with our reports on EU manufacturing priorities and the fastest-growing European economies in 2025.

🚀 Fastest-Growing Industries – 2023–2025 CAGR

Germany’s transformation from an industrial economy to a digital and green powerhouse is reflected in its fastest-growing sectors. From fintech to AI, these high-CAGR industries reveal where investment, policy, and innovation are converging in 2025.

📈 Visual: Germany’s Top 6 High-Growth Industries by CAGR – Source: Statista, McKinsey, BMWK | Designed by Gazett.eu

| # | Sector | CAGR (2023–25) | Growth Drivers |

|---|---|---|---|

| 1 | Fintech & Digital Banking | 11.5% | Neo-banks, embedded finance, PSD3 integration |

| 2 | Renewable Energy | 10.2% | Green Deal targets, hydrogen R&D, wind projects |

| 3 | Artificial Intelligence | 9.8% | Enterprise tools, SaaS automation, B2B intelligence |

| 4 | E-commerce | 9.0% | D2C brands, mobile shopping, logistics tech |

| 5 | Healthtech | 8.5% | Telehealth, wearables, senior-care platforms |

| 6 | Logistics Tech | 8.2% | Smart warehousing, cold chains, last-mile AI |

These industries also represent Europe’s strategic shift, as explored in our analysis of Europe’s AI race,

renewable energy plans, and

foreign investment surges in Germany’s tech infrastructure.

🖥️ Tech, AI & Infrastructure – The New Economic Backbone

Germany’s future economic leadership hinges on the integration of cutting-edge infrastructure and digital capability. By 2025, the country is channeling over €50 billion into national AI programs, accelerating 5G coverage, and rolling out advanced cloud and quantum computing hubs — primarily in Berlin, Frankfurt, and Munich.

These upgrades are part of Germany’s transition toward digital sovereignty — with strong government and EU support via the AI Race Strategy and strategic innovation clusters.

- 🧠 €50B+ AI Investment: National roadmap focused on applied enterprise AI.

- 📡 5G Expansion: Reaching over 89% of the population by Q3 2025.

- 💽 Cloud + Quantum Infrastructure: Key hubs in Frankfurt, Jülich, and Munich.

- 🚗 Smart Mobility Corridors: Connected highways, freight tech pilots underway.

- 🏙️ Urban Innovation Labs: Launched in Berlin, Hamburg, Karlsruhe.

🖥️ Visual: Germany’s Digital & Infrastructure Growth Engines | AI, Cloud, Mobility – Designed by Gazett.eu

Germany’s tech backbone also powers the rise of AI-based logistics, advanced finance platforms, and energy-efficient data centers — as detailed in our spotlight on EU fintech disruptors and FDI in future infrastructure.

🏭 Advanced Manufacturing & Mittelstand Dominance

Germany’s global leadership in engineering and precision manufacturing continues in 2025, with over €1.3 trillion in industrial output driven by its world-class Mittelstand ecosystem. These small and mid-sized firms are the heart of Germany’s smart factory revolution, robotics innovation, and export resilience.

- 🔧 58% of total manufacturing GVA comes from Mittelstand firms

- 🏗️ 40% of industrial machinery now includes robotics or AI layers

- 📈 +12% YoY growth in advanced components & automation exports

- 🏭 Clusters: Saxony (automated tools), Baden-Württemberg (precision parts), Bavaria (high-tech factories)

🏭 Visual: Germany’s Industrial Heart – Smart Tools, Clusters & Mittelstand Innovation | Designed by Gazett.eu

The manufacturing revival is part of a wider European push for sovereignty — as discussed in Made in Europe 2.0,

Eastern Europe’s factory hubs, and

Germany’s new industrial strategy.

🌱 Energy, Climate & Green Transformation

Germany is at the center of Europe’s energy and climate shift — leading on green infrastructure, hydrogen development, and sustainable industrial practices. In 2025, more than 52% of the country’s electricity is produced from renewables, with national efforts targeting net-zero emissions through smart regulation, green finance, and technology transitions.

- 💧 €9B Hydrogen Roadmap: 60+ electrolysis projects by 2025.

- 🔋 Renewables: Wind, solar, and biomass now power 52% of national electricity.

- 🏭 Industrial retrofits: Steel and chemical plants shifting to green heat and materials.

- 📦 Carbon Reporting: Mandatory ESG audits under EU taxonomy.

- 🌍 GHG Targets: On course for 65% reduction from 1990 levels by 2030.

🌱 Visual: Germany’s Climate Transformation | ESG, Renewables, Hydrogen – Designed by Gazett.eu

Explore deeper green policy shifts in Europe’s climate blueprint,

Portugal’s renewable success, and

Germany’s industrial adaptation strategy.

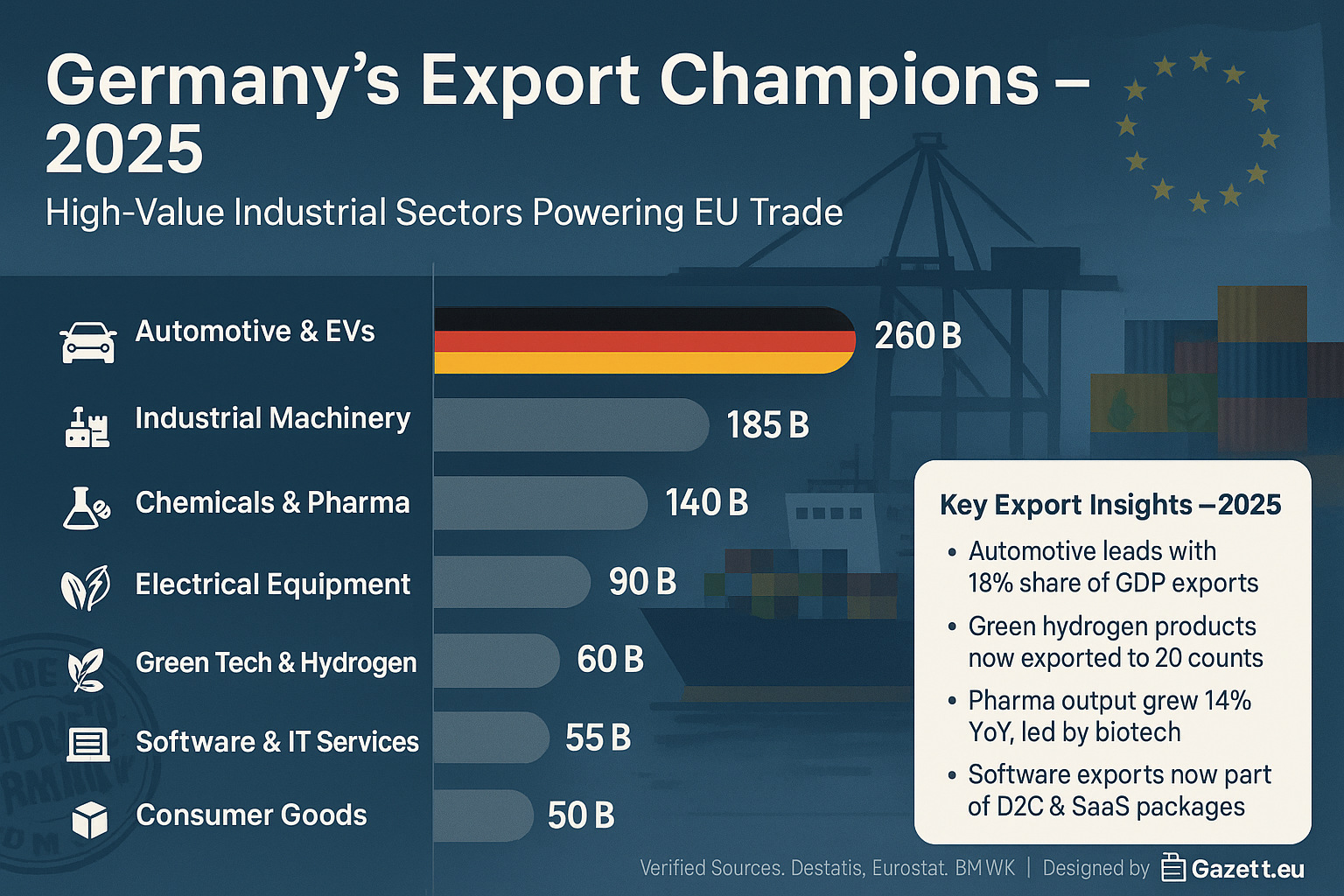

🌍 Export Champions – Sectoral Trade Value

Germany leads the EU in goods exports in 2025, with a diverse and resilient industrial trade base. From automotive excellence to smart machinery, chemicals, and green tech, its exports not only power the European economy but also reflect strategic shifts toward sustainability and innovation.

| # | Export Sector | 2025 Value (€B) | EU Ranking |

|---|---|---|---|

| 1 | Automotive & EVs | €260B | 🇩🇪 #1 in EU |

| 2 | Industrial Machinery | €185B | 🇩🇪 #1 in EU |

| 3 | Chemicals & Pharma | €140B | 🇩🇪 #1 in EU |

| 4 | Electrical Equipment | €90B | 🇩🇪 #2 in EU |

| 5 | Green Tech & Hydrogen | €60B | 🇩🇪 #1 in EU |

| 6 | Software & IT Services | €55B | 🇩🇪 #3 in EU |

| 7 | Consumer Goods | €50B | 🇩🇪 #2 in EU |

🌍 Visual: Germany’s Sector-Wise Export Leaders in 2025 – Designed by Gazett.eu

For more on Europe’s shifting industrial base, read Made in Europe,

FDI Trends, and

Germany’s Revival Strategy.

📌 Sector Matrix + Regional Highlights

Germany’s economic growth in 2025 is not just sectoral, but regional. This sector-region matrix reveals where the most strategic combinations of industry and geography are emerging — from Bavaria’s EV dominance to Saxony’s green tech rise and Berlin’s leadership in software and policy. This smart economic layering is crucial to Germany’s long-term industrial balance.

| Sector | Bavaria | NRW | Baden-W. | Saxony | Berlin |

|---|---|---|---|---|---|

| 🚗 Automotive & EVs | ✅ | ✅ | ✅ | 🔄 | ❌ |

| 🏭 Industrial Machinery | ✅ | 🔄 | ✅ | ✅ | ❌ |

| 🧪 Chemicals & Pharma | 🔄 | ✅ | ✅ | ❌ | ❌ |

| 💻 Software & IT Services | 🔄 | ✅ | ✅ | ❌ | ✅ |

| 🌿 Green Tech & Hydrogen | ✅ | ✅ | 🔄 | ✅ | 🔄 |

| 📦 Consumer Goods | ✅ | ✅ | ✅ | ❌ | 🔄 |

| 🔋 Electronics & Chips | ✅ | 🔄 | ✅ | ✅ | ❌ |

| 🧠 AI & Deep Tech | 🔄 | 🔄 | ✅ | ❌ | ✅ |

- 🟡 Bavaria: Automotive, electronics, and hydrogen innovation zones

- 🔵 North Rhine-Westphalia: Logistics, chemicals, and software corridors

- 🟢 Baden-Württemberg: Precision tools, robotics, and smart factories

- 🟣 Saxony: Green manufacturing, battery assembly, and chip pilots

- 🔴 Berlin: AI, SaaS, policy, and D2C labs

Explore deeper insights in Germany’s Industrial Revival,

Top Startup Cities, and

EU Infrastructure Index.

🔗 Sources & Verified Data – Germany Business 2025

This article is based on publicly available economic data, verified sectoral reports, and cross-referenced European policy disclosures. All numbers have been rounded for consistency and formatted per Gazett.eu editorial standards. Export figures, investment flows, and industrial allocations use official sources with live or last-available 2025 projections.

External references: Destatis, Eurostat, BMWK, IMF WEO 2025, EU Green Deal Tracker, EPRS Market Insights, McKinsey Digital Germany 2025, Roland Berger Mittelstand Reports, Agora Energiewende. For further policy guidance, see:

Destatis |

Eurostat |

BMWK Germany |

IMF WEO |

EPRS Think Tank |

Agora Energiewende |

Read the full Europe-wide sector report here

Are you a researcher, founder, policymaker, or investor exploring Germany’s strategic sectors? Our editorial team at Gazett.eu can help you navigate verified industry insights, EU regulations, and expansion opportunities across Europe.