Best Holding Company Locations in Europe - 2025 Rankings & Comparison

In today’s global economy, holding companies are more than just shell structures. They are strategic platforms that enable multinationals, private equity funds, and family offices to consolidate control, optimize taxes, reduce legal risk, and centralize global asset management. In 2025, the role of the European holding company is evolving rapidly — shaped by new OECD frameworks, substance requirements, and treaty shifts.

Whether you’re advising on cross-border restructuring, planning long-term dividend flows, or managing group-level IP and investments, the right jurisdiction can mean the difference between compliance risk and regulatory efficiency. This data-backed ranking explores where — and why — to structure your European holding company today.

📷 Visual: Strategic Use Cases for EU Holding Companies – Tax Planning, IP Control, Treaty Access (Gazett.eu, 2025)

📚 Article Overview

- 1. What Makes a Holding Company Attractive in 2025? 📌

- 2. Methodology: How We Ranked These Countries 🧮

- 3. Luxembourg – Europe’s SOPARFI Powerhouse 🇱🇺

- 4. Netherlands – Flexible Substance + Global Treaties 🇳🇱

- 5. Ireland – IP-Focused Holding Regime 🇮🇪

- 6. Cyprus – Treaty Access with Zero WHT 🇨🇾

- 7. Switzerland – Cantonal Leverage and Refund Relief 🇨🇭

- 8. Malta – Participation Exemption + Full Refunds 🇲🇹

- 9. Risks, Substance & 2025 Compliance Factors ⚖️

- 10. Summary Matrix + Use Cases for Investors 💼

What Makes a Holding Company Attractive in 2025 📌

📷 Infographic: Key Drivers for Choosing a European Holding Location in 2025 – Gazett.eu

🔍 What Top CFOs and Advisors Look For:

- ✔️ Participation Exemption: Are dividends and capital gains tax-exempt?

- ✔️ Withholding Tax Relief: Is there 0% or treaty-reduced outbound WHT?

- ✔️ Tax Treaty Network: Can income flow cross-border without friction?

- ✔️ Substance Flexibility: Are physical presence and staffing thresholds reasonable?

- ✔️ Legal Certainty: Are rulings, advance pricing, and transparency available?

- ✔️ Exit Strategy Compatibility: Can entities be dissolved or sold tax-efficiently?

In 2025, the global minimum tax (OECD Pillar Two), DAC7/DAC8 disclosures, and base erosion safeguards are tightening compliance. This means traditional tax haven structures no longer offer blanket safety. Instead, modern holding jurisdictions must combine regulatory acceptance with cross-border benefits. The six countries ranked in this article reflect those new priorities — providing treaty strength, legal clarity, and investor trust while adapting to evolving global standards.

In addition to tax benefits, top holding company jurisdictions in Europe today must also enable simplified compliance reporting, IP management compatibility, and alignment with the international anti-abuse standards enforced by the EU and OECD. This convergence of legal, financial, and structural advantages is what makes holding companies a strategic cornerstone in global group setups — not just for tax, but for governance, transparency, and long-term scalability.

Methodology: How We Ranked These Countries 🧮

📷 Infographic: Ranking Logic & Evaluation Criteria for 2025 – Gazett.eu Structuring Series

📊 Evaluation Criteria for Our Rankings:

- ✔️ Corporate Tax Structure: Effective tax rate, exemptions, refund mechanisms

- ✔️ Withholding Tax Profile: WHT on dividends, interest, royalties

- ✔️ Tax Treaty Access: Number and scope of double tax treaties (DTTs)

- ✔️ Holding Legal Framework: Availability of participation exemption, hybrid use-cases

- ✔️ Substance & Anti-Abuse Compliance: Requirements to access tax benefits legally

- ✔️ Setup Efficiency: Formation timeline, legal clarity, operating cost baseline

Our 2025 ranking model uses a weighted scoring matrix assigning points to each jurisdiction based on data published by PwC Tax Summaries, KPMG EU Insights, and verified government sources. Emphasis was placed on: dividend flow efficiency, treaty reach, investor accessibility, and regulatory clarity for cross-border corporate setups.

The final list includes only those EU and EFTA countries with a track record of legal transparency, compliance with OECD directives, and an active policy framework for international holding structures. This ensures both real-world usability and regulatory sustainability.

Luxembourg: Europe’s SOPARFI Powerhouse 🇱🇺

📷 Infographic: Luxembourg’s SOPARFI Model for EU Holding Companies – 2025 | Gazett.eu

Why Luxembourg stands out:

✔️ 0% tax on qualifying dividends and capital gains under participation exemption

✔️ Extensive treaty access (80+ countries)

✔️ Stable, EU-aligned compliance regime via SOPARFI structures

✔️ No WHT under EU directives and many DTAs

The SOPARFI (Société de Participations Financières) regime in Luxembourg is the cornerstone of its reputation as Europe’s most reliable holding jurisdiction. Companies benefit from full participation exemption on dividends and capital gains, provided they meet ownership thresholds (≥10%) and minimum holding period (12 months). This has made Luxembourg a trusted home for private equity, IP holding, and cross-border investment platforms.

Luxembourg’s political neutrality, multilingual financial sector, and predictable legal environment make it a top-tier destination for structuring EU and global operations. The country is also quick to align with OECD rules — including Pillar Two compliance and CBCR disclosures — while preserving core tax advantages for compliant firms.

Sources: Deloitte Luxembourg Tax Highlights, PwC Tax GuideNetherlands: Flexible Substance + Global Treaties 🇳🇱

📷 Infographic: Netherlands Holding Structure & Treaty Matrix – 2025 | Gazett.eu

Why the Netherlands remains a global hub:

✔️ Participation exemption applies to ≥5% shareholdings with business substance

✔️ Over 90 double tax treaties worldwide

✔️ Favorable treatment for holding & conduit entities

✔️ Transparent legal structure (B.V.) with flexible setup rules

The Netherlands is globally respected for its powerful tax treaty network and clearly defined participation exemption rules. Holding companies are exempt from tax on qualifying dividends and capital gains from participations of at least 5%, provided they pass a motive test (business purpose) and avoid passive portfolio criteria.

The preferred legal structure is the B.V. (Besloten Vennootschap), which is simple to register and cost-effective to maintain. While substance requirements have increased in recent years, the Dutch system remains highly cooperative, with access to advance rulings and compliance certainty for properly structured holding setups.

Sources: PwC Netherlands Tax Guide, CMS Holding Company ReportIreland: IP-Focused Holding Regime 🇮🇪

📷 Infographic: Ireland’s Participation Exemption & IP Holding Advantages – 2025 | Gazett.eu

Why Ireland is a modern holding hotspot:

✔️ New participation exemption (2025) for foreign dividends

✔️ Alignment with U.S. firms via tax treaty and IP holding structures

✔️ 12.5% corporate rate with robust R&D tax credits

✔️ EU-compliant + tech/startup friendly legal ecosystem

Ireland’s 2025 tax reforms introduced a long-awaited participation exemption on foreign dividends, aligning it more closely with other EU holding jurisdictions. Combined with a flat 12.5% corporate tax, strong IP protection, and a cooperative tax authority, Ireland is now ideal for IP-rich and U.S.-linked companies.

The Private Company Limited by Shares (LTD) remains the standard legal entity for Irish holding firms. Ireland also maintains over 70 bilateral tax treaties and is favored for setups involving U.S. profit repatriation, thanks to its flexible treatment of controlled foreign corporations (CFC) and effective enforcement of BEPS standards.

Sources: Azets Ireland – Participation Exemption 2025, PwC Ireland Tax GuideCyprus: Treaty Access with Zero WHT 🇨🇾

📷 Infographic: Cyprus Holding Benefits – Zero WHT, Treaty Access, and EU Compliance (2025) | Gazett.eu

Why Cyprus is structurally efficient:

✔️ No withholding tax on outbound dividends, interest, or royalties to non-residents

✔️ Participation exemption on dividends and capital gains

✔️ Over 65 double tax treaties

✔️ Cost-efficient, EU-aligned company setup with English-speaking environment

Cyprus offers a globally respected holding regime thanks to its zero withholding tax framework, participation exemptions, and simplified compliance. It remains particularly attractive for structuring around emerging markets, Middle East, and Eastern Europe.

The preferred vehicle is a Private Company Limited by Shares, which is affordable and quick to incorporate. Cyprus ensures substance standards are met through regulatory guidance and continues to align with BEPS and EU anti-abuse rules while retaining investor appeal through low administration overhead.

Sources: Cyprus Holding Companies Update – Mondaq, Deloitte Cyprus Tax HighlightsSwitzerland: Cantonal Leverage and Refund Relief 🇨🇭

📷 Infographic: Switzerland’s Cantonal Holding Tax Strategy – 2025 | Gazett.eu

Why Switzerland is still elite:

✔️ Participation relief for 10%+ holdings (≥1 year)

✔️ Refund system for qualifying foreign taxes

✔️ Tax-efficient cantonal options (11.9%–20.5%)

✔️ Over 100 DTTs + non-EU independence for strategic neutrality

Switzerland remains a premium jurisdiction for holding companies, especially where asset protection and precision tax planning are critical. While not part of the EU, Switzerland offers access to over 100 double tax treaties, favorable refund structures, and flexible cantonal rates — making it ideal for multinational wealth management and fund holdings.

The standard holding vehicle is an Aktiengesellschaft (AG). Swiss tax law allows federal and cantonal relief on qualifying holdings, and companies benefit from advance tax rulings and consistent post-BEPS adaptation without harsh anti-holding bias.

Sources: Goldblum – Swiss Holding Company Guide, PwC Switzerland Tax OverviewMalta: Participation Exemption + Full Refunds 🇲🇹

📷 Infographic: Malta’s Full Refund Holding Structure & Participation Exemption – 2025 | Gazett.eu

Why Malta remains highly competitive:

✔️ Participation exemption on dividends and capital gains from qualifying holdings

✔️ Unique tax refund mechanism (up to 6/7ths corporate tax)

✔️ No WHT on outbound dividends, interest, royalties

✔️ 70+ tax treaties + EU alignment and English legal system

Malta offers a powerful combination of participation exemption and tax refunds, making it an attractive base for holding and group structuring. The effective tax rate can drop as low as 5% for non-resident shareholders via the refund system, while outbound payments remain exempt from WHT — streamlining global profit repatriation.

The preferred entity is a Private Limited Company, commonly used for holding and IP structures. Malta adheres to OECD and EU standards while providing administrative simplicity, ruling clarity, and operational cost benefits that are especially attractive to private investors and SME holding models.

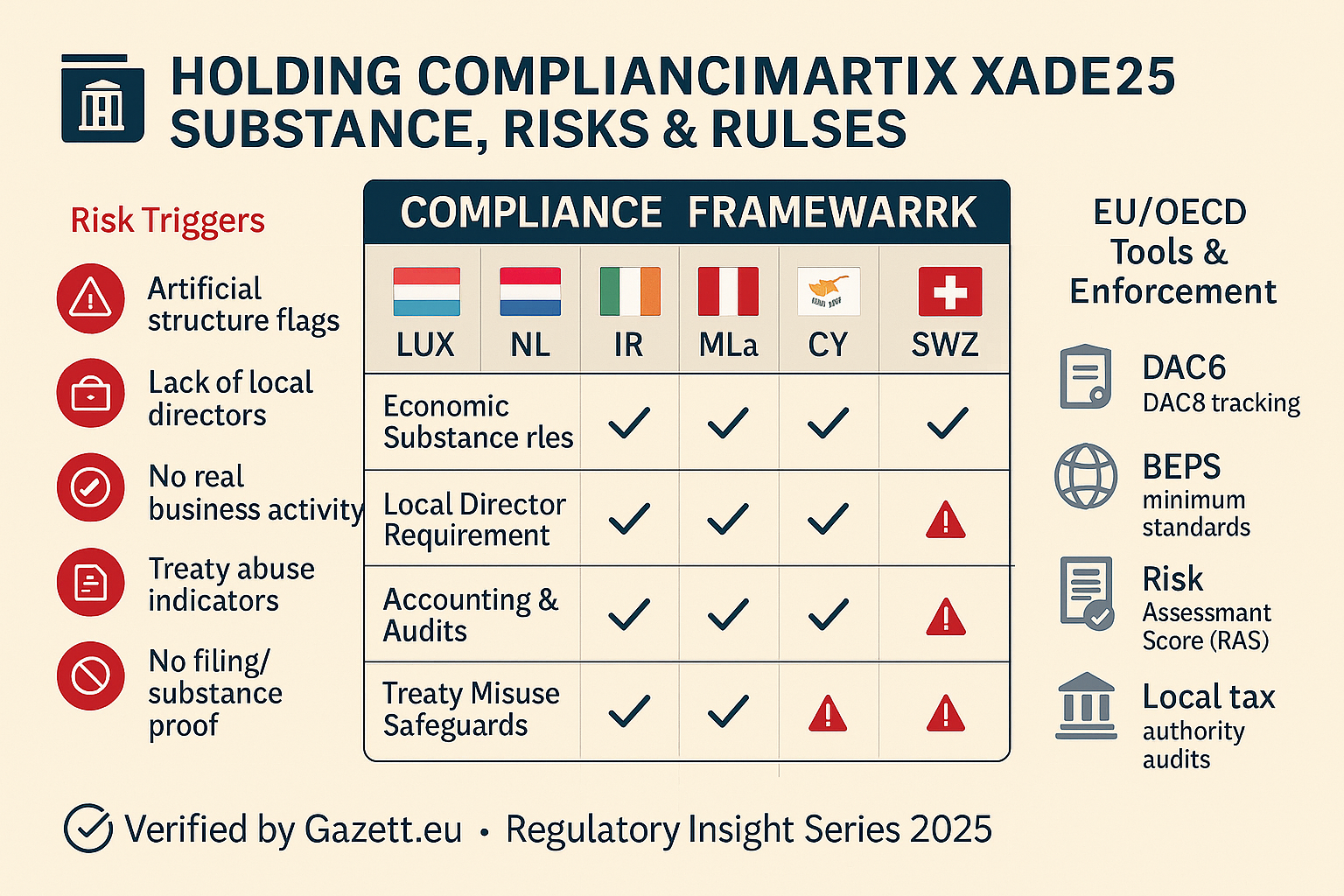

Sources: Malta Holding Company Guide – Contact, PwC Malta Corporate Tax OverviewRisks, Substance & 2025 Compliance Factors ⚖️

📷 Infographic: Holding Company Risk Landscape & Substance Requirements – 2025 | Gazett.eu

What to monitor in 2025:

✔️ Substance rules under OECD BEPS Action 5 and EU ATAD

✔️ Mandatory disclosure regimes: DAC6, DAC7, DAC8

✔️ Risk of hybrid mismatches, GAAR (general anti-abuse rules)

✔️ Increased scrutiny on passive conduits & low-function entities

While holding companies remain structurally beneficial, regulators are demanding stronger evidence of economic substance. This includes maintaining active directors, documented decision-making, physical presence, and demonstrable business activity — especially in jurisdictions where holding activity is the main revenue stream.

In 2025, holding companies must also align with global reporting regimes such as Country-by-Country Reporting (CbCR) and tax transparency standards enforced under the OECD’s Inclusive Framework. Entities without strategic function or with aggressive treaty exploitation are at risk of reclassification or denied treaty benefits.

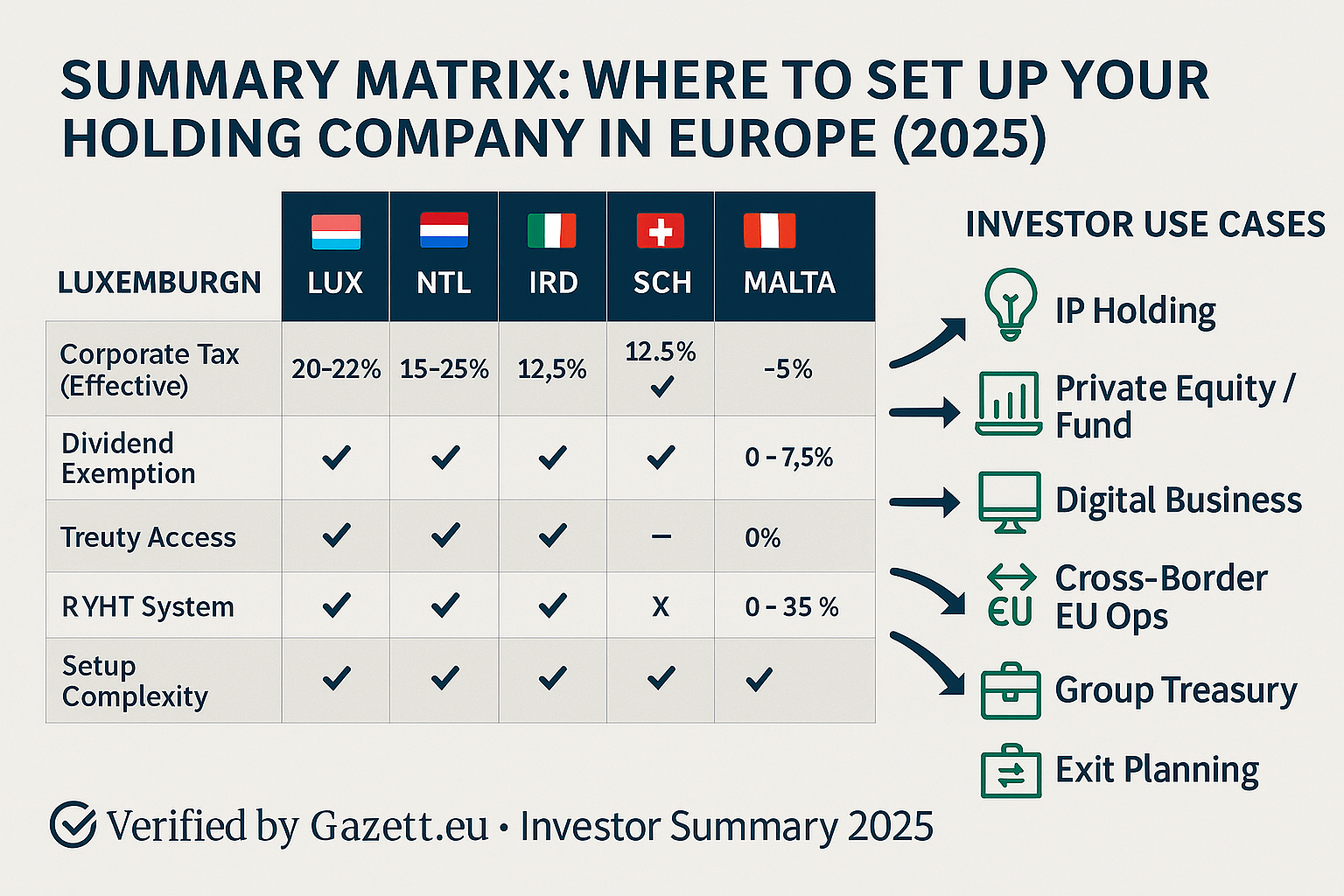

Sources: OECD BEPS Action 5 – Harmful Tax Practices, EU DAC6–DAC8 Compliance HubSummary Matrix + Use Cases for Investors 💼

📷 Infographic: 2025 Comparison Matrix – Europe’s Top Holding Company Locations | Gazett.eu

| Country | Corporate Tax | WHT on Dividends | Treaties | Unique Benefit |

|---|---|---|---|---|

| 🇱🇺 Luxembourg | 24.94% | 0% (with exemption) | 80+ | SOPARFI regime with dividend/capital gain exemption |

| 🇳🇱 Netherlands | 25.8% | Reduced via DTT/EU | 90+ | Substance-friendly exemption & treaty leadership |

| 🇮🇪 Ireland | 12.5% | 25% (treaty reduced) | 70+ | New participation exemption + strong IP base |

| 🇨🇾 Cyprus | 12.5% | 0% | 65+ | No WHT on outbound flows |

| 🇨🇭 Switzerland | 11.9–20.5% | 35% (treaty reduced) | 100+ | Cantonal optimization & refund relief |

| 🇲🇹 Malta | 35% (refundable) | 0% | 70+ | Refund-based system for foreign investors |

✅ Investor Tip: These countries don’t just offer tax breaks — they offer legal frameworks that are treaty-validated, OECD-compliant, and scalable for long-term international structures. Align your holding jurisdiction with your business model: IP-heavy? High-dividend yield? Treaty-focused? Pick the right match, not just the lowest rate.