📦 The State of E-commerce in Europe – 2025 Case Study

In 2025, Europe’s e-commerce industry stands at a critical intersection of growth, digital maturity, and regulatory evolution. With a market value nearing €1 trillion, the sector has moved far beyond simple online shopping. From cross-border logistics and digital tax harmonization to AI-driven personalization and multimodal delivery innovation, the continent is witnessing a dramatic reinvention of how goods are sold, shipped, and returned.

This case study provides a complete breakdown of Europe’s e-commerce ecosystem — designed for students, professionals, and companies seeking market insight. You’ll discover which countries are scaling fastest, what role platforms vs D2C play, how EU policy is reshaping delivery, and what technologies will define the next five years of online retail in Europe.

📷 Visual: Gazett.eu Case Study on E-commerce in Europe – 2025

📚 Table of Contents

- 📦 Market Size, Growth & Category Split

- 🏪 Marketplaces vs D2C – Who Leads in 2025?

- 🚚 Logistics, Fulfillment & Packaging Innovation

- 📜 EU Regulation: Cross-Border, VAT, Trust

- 💳 Payment Evolution: BNPL, Wallets & Fintech

- 🤖 Retail Tech: AI, Personalization & Robotics

- 🌍 Country Snapshots – Germany to Romania

- 🧾 Consumer Trust, Returns & Sustainability

- 🔮 2030 Outlook: Unified Platforms & Immersive Shopping

- 📌 Conclusion – Strategic Takeaways & Visual Matrix

- 🔗 Sources – EU E-commerce Data 2024–2025

📦 Market Size, Growth & Category Split

Europe’s e-commerce industry has entered a phase of post-pandemic maturity, with an estimated total market size of €979 billion in 2025. This represents a year-on-year growth rate of 10.2%, despite inflation, regulatory tightening, and logistics rebalancing across the continent.

Germany, France, Italy, Netherlands, and Poland now anchor the top-performing ecosystems, while fast-emerging nations like Romania, Czechia, and Portugal are benefiting from EU digital funding, improving fulfillment networks, and a mobile-first consumer base. In 2025, over 58% of online sales originate from smartphones, powered by one-click checkouts and app-driven loyalty programs.

📊 Infographic: Europe’s E-commerce Market Size and Category Share – Source: Eurostat, Statista, Ecommerce Europe

- 📈 Total Market Size (2025): €979 billion

- 📱 Mobile Commerce Share: 58%

- 👕 Top Product Segment: Fashion & Apparel (29%)

- 🔌 High-Ticket Spend Category: Consumer Electronics (21%)

- 🌍 Fastest Growth Markets: Poland, Romania, Czechia

For more data on post-pandemic growth sectors, see our breakdown of Europe’s top-performing digital industries in 2025.

🏪 Marketplaces vs D2C – Who Leads in 2025?

The European e-commerce landscape is no longer dominated by a single platform. While Amazon remains the largest player in several countries, local giants such as Allegro (Poland), Bol.com (Benelux), Zalando (Germany), and Cdiscount (France) continue to grow, driven by regional loyalty and a focus on returns, logistics, and regulatory compliance.

At the same time, Europe is experiencing a surge in Direct-to-Consumer (D2C) strategies, especially among fashion, cosmetics, health, and home product brands. Platforms like Shopify, WooCommerce, and BigCommerce are powering this transformation — allowing companies to reduce dependency on marketplaces, own their customer data, and retain control over brand experience and pricing.

📊 Visual: Platform Dominance vs Brand-Led D2C Evolution in Europe – Source: Eurostat, Shopify EU, Zalando Reports

- 🛍️ Amazon: Still leading in Germany, Italy, Spain – but under EU scrutiny.

- 📦 Allegro: Poland’s most trusted local e-commerce player.

- 🧢 Zalando: Europe’s largest vertical marketplace for fashion – now supports partner integration.

- 🚀 D2C Trend: 38% of EU consumers bought from brand websites in Q1 2025.

- 🧠 Why D2C Wins: Better margins, customer data, personalized UX.

Curious how D2C brands are reshaping fulfillment and warehousing? Explore our logistics breakdown in Europe’s New Freight Ecosystem.

🚚 Logistics, Fulfillment & Packaging Innovation

In 2025, the e-commerce logistics chain in Europe is undergoing a strategic overhaul. From hyper-local delivery hubs to AI-powered routing engines, both traditional carriers and digital-first platforms are racing to offer speed, sustainability, and convenience — all under the lens of evolving EU green transport legislation.

Companies like DHL, GLS, InPost, and DPD are deploying electric fleets, automating last-mile lockers, and partnering with local brands to shorten fulfillment cycles. Meanwhile, packaging reform laws across the EU are pushing for eco-friendly designs and returns-ready parcels. Over 60% of companies now use minimalist packaging or reusable systems to align with the bloc’s 2030 climate agenda.

🚛 Infographic: Logistics, Packaging & Fulfillment Trends – Europe 2025 | Source: Eurostat, DHL, InPost Reports

- 🏬 Micro-Fulfillment Centers: Up 37% YoY – key to fast local delivery

- 📦 Packaging Laws: 2024 EU directive bans multi-layered plastics

- ⚡ Electric Fleets: 25% of DHL's EU fleet now zero-emission

- 🤖 Smart Lockers: InPost & Amazon rolling out automated pickup points

- 🚁 Drones: Early trials in Italy (Amazon), CEE (Zalando)

To understand how infrastructure is enabling this shift, check out our article on EU’s mega logistics investments in 2025.

📜 EU Regulation – Cross-Border, VAT, Trust

The regulatory landscape for e-commerce in Europe has matured rapidly. The implementation of the VAT One-Stop Shop (OSS) allows businesses to report sales tax centrally, reducing bureaucracy but also increasing scrutiny. Marketplaces must now verify seller VAT IDs and ensure compliance across all shipping zones.

The Digital Services Act (DSA) places significant responsibility on large online platforms, requiring them to monitor illegal listings, ensure content transparency, and display clear seller information. Meanwhile, the EU has banned geoblocking practices, enabling consumers to purchase from any EU country without being redirected or charged discriminatory prices.

📜 Infographic: EU VAT, OSS & Platform Rules in 2025 | Source: European Commission, Ecommerce Europe

- 💶 VAT OSS: Centralized portal for EU-wide tax declarations

- ⚖️ DSA Obligations: Seller identity, fake review monitoring, product safety

- 🚫 Geoblocking Ban: Full cross-border accessibility for consumers

- 🛡️ GDPR & Trust Labels: Standardized consent + new “e-label” programs

- 📬 Returns & Transparency: Return rights extended to all cross-border sellers

For deeper legal analysis, explore our coverage of EU tax reform and compliance zones for digital sellers.

💳 Payment Evolution – BNPL, Wallets & Fintech

Europe’s e-commerce payments in 2025 are defined by flexibility and speed. While Buy Now, Pay Later (BNPL) services like Klarna, Scalapay, and Alma are leading in consumer convenience, the region is also seeing a surge in the use of digital wallets for mobile-based, frictionless checkout — especially in countries like France, the Netherlands, and Germany.

In Central and Eastern Europe, Open Banking protocols have become more widespread, with platforms such as Trustly and Sofort providing fast, low-cost alternatives to credit card rails. The rise of embedded finance means consumers can now access flexible payments, refund automation, and checkout protection tools natively on most European online stores.

💳 Infographic: Payment Evolution in European E-commerce – 2025 | Source: ECB, Klarna, Statista

- 🛒 BNPL Usage: 28% of all e-commerce checkouts in Europe (Q1 2025)

- 📲 Top Wallets: PayPal, Apple Pay, Google Pay – 64% of mobile transactions

- 🔗 Open Banking Tools: Trustly, Sofort growing fast in Central/Eastern Europe

- ⚙️ Embedded Finance: Pay insurance, refunds, tax in one checkout

- 💼 B2B Payments: Invoice-based multi-currency systems rising across EU platforms

For deeper financial innovation trends in commerce, read our insight into Europe’s most disruptive fintech startups this year.

🤖 Retail Tech – AI, Personalization & Robotics

As competition intensifies, European e-commerce leaders are investing heavily in smart technology. From personalized recommendations to robotic fulfillment, the new digital experience is both invisible and intelligent. Platforms like Zalando, About You, and Fnac now use machine learning for pricing, search, and supply chain efficiency.

Augmented Reality (AR) try-ons have become mainstream in beauty, eyewear, and furniture shopping, helping customers visualize products instantly. On the backend, EU warehouses are increasingly equipped with autonomous picking bots, AI vision systems, and voice command inventory tech. Personalized UX isn’t just about the front-end — it’s a full-stack transformation.

🤖 Infographic: Retail Tech, AI, and Robotics in European E-commerce – Source: Statista, EU RetailTech Alliance

- 🧠 AI Recommendation Engines: 70% of major platforms use ML for personalization

- 🪞 AR Try-Ons: France and Nordics lead adoption in fashion and beauty

- 🤖 Warehouse Robotics: Germany, Poland, and Netherlands see rapid automation

- 🗣️ Chatbots & Voice UX: Now resolve >55% of first-level e-commerce queries

- 🔍 Smart Search: NLP + image-based suggestions boosting conversions by 2x

Interested in deep tech trends in the region? Check our editorial on Europe’s AI Race in 2025.

🌍 Country Snapshots – Germany to Romania

While Europe’s e-commerce market is unified by policy, consumer behavior and platform dominance vary significantly from country to country. From Germany’s sustainability-first ecosystem to Poland’s domestic platform boom, this snapshot reveals key traits shaping the local e-commerce battlefield.

🌍 Infographic: Country-by-Country Trends in European E-commerce – Source: Eurostat, Local Platform Data

- 🇩🇪 Germany: Mature market, eco-packaging norms, Amazon & Zalando lead.

- 🇫🇷 France: Omnichannel + D2C push, high AR adoption, Cdiscount growing.

- 🇮🇹 Italy: Mobile-first surge, BNPL exploding, logistics investment rising.

- 🇳🇱 Netherlands: Bol.com dominant, top smart-locker penetration in EU.

- 🇵🇱 Poland: Allegro drives local loyalty, low returns, price-driven shoppers.

- 🇷🇴 Romania: Rising mobile checkout, young consumer base, regional platforms scaling.

For deeper national economic context, explore our feature on Eastern Europe’s Tech & Trade Boom in 2025.

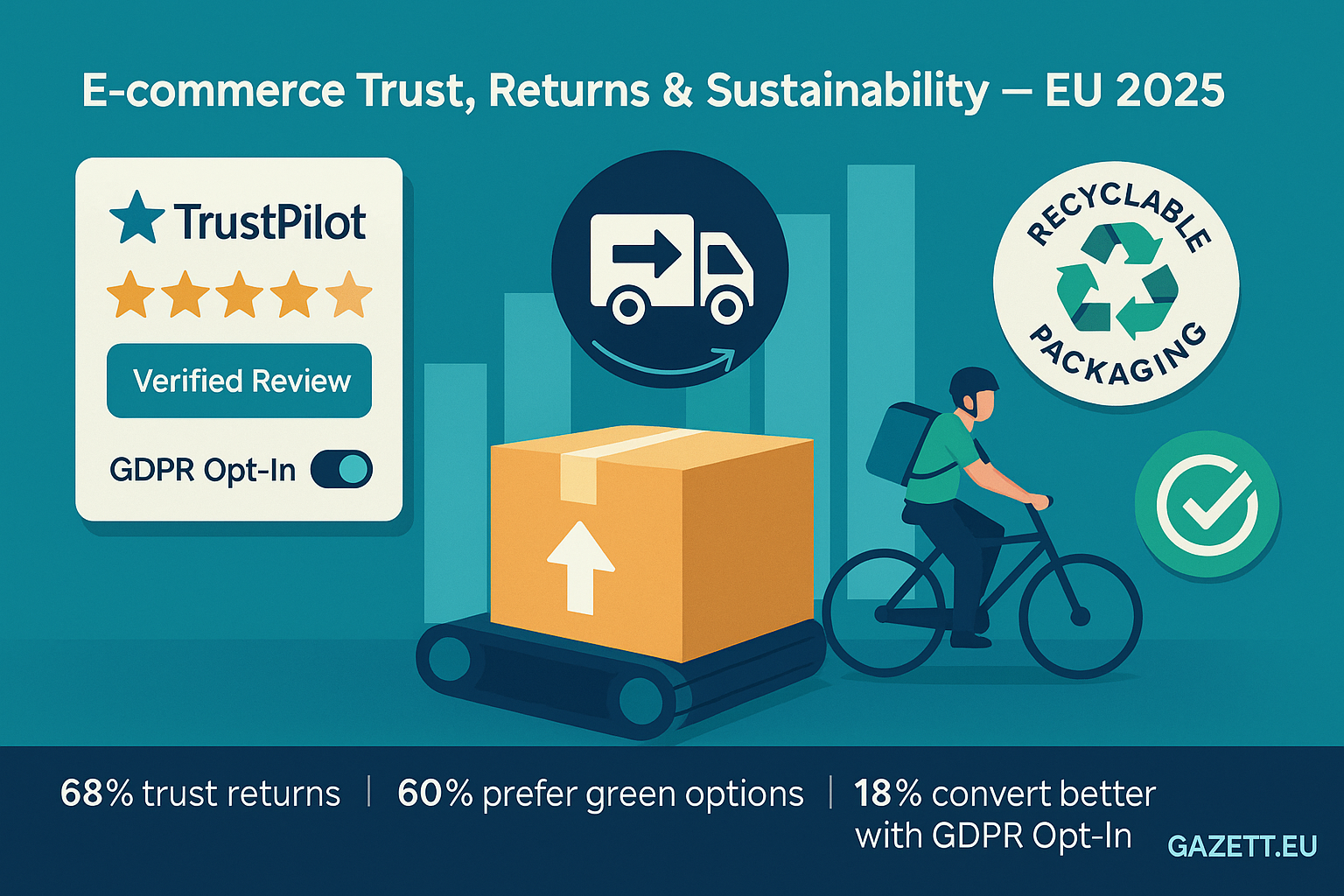

🧾 Consumer Trust, Returns & Sustainability

In a maturing e-commerce landscape, trust is currency. As cross-border transactions increase, EU consumers expect clear return policies, eco-friendly delivery options, and transparent data practices. Companies that align their logistics and UX around these values are seeing significantly higher retention and NPS scores.

In 2025, brands are evaluated not just on price and speed — but on their sustainability footprint, support transparency, and refund automation. The EU’s Right to Repair and Green Deal-driven product traceability initiatives are nudging retailers toward more responsible commerce.

🧾 Infographic: Key Consumer Expectations in EU E-commerce – Source: EU Green Deal Reports, Statista, Sendcloud 2025

- ✅ Top Concern: 68% prioritize “return simplicity” when buying

- ♻️ Sustainability: 3 in 5 users prefer low-emission or green packaging

- 🔄 Reverse Logistics: Free home pickup drives loyalty among urban buyers

- 🛡️ Data Trust: GDPR-aligned loyalty programs increase conversion by 18%

- 🔋 Green Incentives: Points for net-zero delivery or recycled packaging

For deeper insights, explore our report on how sustainability is shaping European commerce in 2025.

🔮 2030 Outlook – Unified Platforms & Immersive Shopping

As 2030 approaches, Europe’s e-commerce infrastructure is expected to shift toward a converged digital experience. Rather than operating as discrete websites or apps, tomorrow’s platforms will offer an ecosystem where users can explore, pay, share, and personalize in one continuous flow — integrating social, marketplace, payment, and identity systems.

Key pilots across the EU already hint at this future. Virtual stores with 3D product viewing, AI-powered avatars, holographic mirrors, and voice-guided checkouts are emerging in categories like beauty, fashion, furniture, and automotive. Alongside, the EU’s work on digital identity wallets and seamless SEPA checkout layers promises instant, borderless commerce by 2028.

🔮 Infographic: The Future of EU E-commerce – Immersive, Unified & AI-Driven by 2030

- 🕹️ Immersive Commerce: AR/VR try-ons, virtual store walkthroughs

- 💬 Voice UX: Smart speaker checkouts & reorder prompts rising across Gen Alpha homes

- 🔗 Unified IDs: EU Wallet pilot expanding to B2C checkouts by 2028

- 📱 Content-Driven Shops: TikTok Shop, Instagram Commerce going mainstream

- 🧠 AI Avatars: Personalized shopping assistants using preference memory

Want a preview of how Europe’s AI-first commerce world is unfolding? Dive into our report on Europe’s AI transformation.

📌 Conclusion – Strategic Takeaways & Visual Matrix

The European e-commerce landscape in 2025 is marked by intelligent integration — where consumer experience, fulfillment, regulation, and tech innovation meet. It’s no longer about just price or speed. The most resilient platforms are those that offer trust, flexibility, sustainability and can adapt to real-time customer needs with AI and automation.

With global competition and regulatory pressure increasing, Europe’s digital retailers must look beyond checkout and think ecosystem: logistics, data privacy, returns, ESG, and seamless cross-border compliance. The road to 2030 will reward those who simplify, unify, and personalize.

📊 Strategic Matrix: Key EU E-commerce Growth Factors – Gazett.eu 2025

- 📦 Fulfillment: MFCs, green packaging, AI delivery routing

- 💳 Payments: BNPL, Open Banking, embedded finance UX

- 🤖 Retail Tech: Personalization, AR/VR, NLP search

- 📜 Regulation: DSA, VAT OSS, GDPR, PEF, Right to Repair

- 🔮 Future: Immersive commerce, unified IDs, Gen Z/Alpha UX

💡 For more analysis and future-forward reports, check our editorials on smart cities, fintech disruption, and AI competitiveness in Europe.

🔗 Sources – EU E-commerce Data 2024–2025

All data, forecasts, and graphics in this report are based on publicly available reports and live metrics from the most credible European institutions, logistics providers, fintech platforms, and sustainability indexes.

- 📊 European Commission – E-commerce VAT OSS & DSA Implementation Report

- 📦 DHL, GLS, InPost – Sustainability & Fulfillment Innovation Whitepapers 2025

- 📱 Klarna, Alma, PayPal, Sofort – Payment Experience Benchmarks Q1–Q2 2025

- 📈 Statista – EU E-commerce Revenue & Segmentation Forecasts (2024–2025)

- 🛍️ Eurostat – Retail Tech, Mobile Device Checkout, and B2B Platform Growth

- 🌱 EU Green Deal – Right to Repair, Product Traceability & Packaging Law Status

- 🔍 Ecommerce Europe – National Reports (Germany, France, Italy, Poland)

- 🧠 RetailTech Alliance – Smart Store Adoption Metrics & Consumer Trust Indicators

📣 Editor's Note – Build the Future of E-commerce with Digital Taantra

If you're an EU-based brand, tech startup, or logistics company ready to create a future-ready, conversion-optimized, and AI-integrated website or platform, we strongly recommend Digital Taantra. Their team specializes in building advanced business websites, platform UI/UX, and integrated marketing systems — all tailored for the European digital commerce ecosystem.

➤ Visit digitaltaantra.com to explore services, view real project samples, and get a free consultation for your brand.

🔍 External data sources are cited for transparency only. We recommend visiting the primary websites for real-time updates and formal citations.