✈️ Top 10 Airlines for International Travel in Europe (2025)

In 2025, Europe's international air travel landscape is more competitive than ever. Travelers seek airlines that offer exceptional service, extensive route networks, and commitment to sustainability. This guide presents the top 10 airlines excelling in international travel across Europe, based on comprehensive analysis of performance, customer satisfaction, and innovation.

📷 Infographic: Top 10 Airlines for International Travel in Europe – 2025

📚 Table of Contents

- 🧪 Methodology – How We Ranked the Airlines

- 📋 Top 10 Overview – Airlines, Regions, Strengths

- ✈️ Airline Profiles – Deep Dive Into Each Carrier

- 🚀 Rising Players – IndiGo & Air India’s Europe Strategy

- 📊 Comparison Table – Fleets, Safety, Routes

- 📈 Data Visuals – Market Share & Trends

- 💡 Tips for Choosing Your Ideal Carrier

- 📌 Conclusion – Final Thoughts for 2025

- 🔗 Sources – Verified Airline & Safety Data

🧪 Methodology – How We Ranked the Airlines

Our 2025 ranking is based on a transparent evaluation framework prioritizing passenger trust, service integrity, sustainability leadership, and connectivity. We deliberately excluded airlines flagged in international policy concerns or associated with undemocratic practices. This ensures our list reflects airlines aligned with European values and global mobility ethics.

Data inputs were sourced from Skytrax Rankings 2024, AirlineRatings.com Safety Reports, OAG punctuality data, and verified carrier disclosures. Macro factors such as European economic volatility and foreign investment in mobility were also considered to assess stability and forward readiness.

📷 Infographic: Airline Ranking Methodology & Ethical Filter – Gazett.eu 2025

- 🌍 Route Network: Minimum 20+ European cities covered

- 🛡️ Safety Record: Verified compliance with ICAO & EASA audits

- 📈 On-Time Performance: Based on Q1–Q2 2025 data (OAG)

- 💬 Customer Satisfaction: Skytrax reviews & verified Google ratings

- 🌱 Environmental Programs: Carbon offset, SAF, or eco fleet initiatives

- 🤝 Ethics & Transparency: No ties to sanctioned governments or military alliances

✅ Note: Airlines with verified links to non-civil entities, propaganda sponsorships, or conflict zones were disqualified — consistent with Gazett.eu’s editorial neutrality standards.

📋 Top 10 Overview – Airlines, Regions, Strengths

In 2025, Europe’s leading international airlines are those that combine network strength, safety, sustainability, service quality, and modern fleet operations. These top 10 carriers have been evaluated using real-time aviation data, ensuring this list reflects genuine performance, not legacy branding. Turkish Airlines has been excluded on ethical grounds, and all remaining carriers meet high standards of compliance and transparency.

| # | Airline | Country | Fleet Size | Avg. Fleet | On-Time | Key Strength |

|---|---|---|---|---|---|---|

| 1 | Lufthansa | Germany | 300+ | 10 yrs | 85.2% | Business traveler loyalty, major European hubs |

| 2 | Air France | France | 200+ | 9.5 yrs | 83.0% | Luxurious cabins, major Africa-EU connector |

| 3 | KLM Royal Dutch | Netherlands | 120+ | 9 yrs | 88.4% | Greenest European carrier, punctual operations |

| 4 | British Airways | UK | 280+ | 12 yrs | 82.7% | Transatlantic & Asia connectivity, Skytrax elite |

| 5 | Swiss International Air Lines | Switzerland | 90+ | 8.3 yrs | 90.0% | Best on-time performance, elite business service |

| 6 | Finnair | Finland | 80+ | 10 yrs | 89.5% | Leader in Asia-EU long-hauls, carbon neutrality |

| 7 | Austrian Airlines | Austria | 75+ | 9.2 yrs | 87.2% | Specialist in Central/Eastern EU connectivity |

| 8 | SAS Scandinavian Airlines | Denmark/Sweden/Norway | 120+ | 10 yrs | 84.3% | Strong Nordic network, low CO₂ footprint |

| 9 | Iberia | Spain | 100+ | 9 yrs | 83.6% | Top Latin America links, revamped service |

| 10 | ITA Airways | Italy | 70+ | 6.5 yrs | 81.2% | Rebranded, youthful fleet, SkyTeam partner |

📌 Insight: While Germany, France, and the Netherlands maintain dominance in infrastructure and fleet modernization, the return of Italy and Nordic nations like Finland and Denmark into the top 10 reflects Europe’s new airspace investment cycle.

✈️ Airline Profiles – Deep Dive Into Each Carrier

Each of the following airlines earned its 2025 spot through a combination of passenger satisfaction, fleet modernization, on-time performance, route innovation, and ESG (Environmental, Social, and Governance) alignment. Here's a deep dive into what sets them apart this year.

🇩🇪 Lufthansa (Germany)

- Fleet: 300+ aircraft (A350s, B747-8s, B787s)

- Hubs: Frankfurt & Munich

- Strength: Premium Business Class + alliance strength (Star Alliance)

- 2025 Highlight: Launch of new green terminal and SAF blending in 20% of long-haul flights

🇫🇷 Air France (France)

- Fleet: 200+ aircraft (A220s, A350s, B777s)

- Hub: Paris Charles de Gaulle

- Strength: Cabin design, French service culture, and strong EU-Africa network

- 2025 Highlight: Doubling flights on India–Europe routes with upgraded comfort kits

🇳🇱 KLM Royal Dutch Airlines (Netherlands)

- Fleet: 120+ aircraft (B787 Dreamliners, Embraer E2s)

- Hub: Amsterdam Schiphol

- Strength: #1 in on-time EU performance (Skytrax 2024), environmental excellence

- 2025 Highlight: Expanded SAF (Sustainable Aviation Fuel) share and carbon transparency dashboard

🇬🇧 British Airways (United Kingdom)

- Fleet: 280+ aircraft (B777s, B787s, A320neos)

- Hub: London Heathrow

- Strength: Transatlantic dominance, Avios rewards program, elite lounges

- 2025 Highlight: BA EuroFlyer subsidiary expansion and flexible luggage upgrades

🇨🇭 Swiss International Air Lines (Switzerland)

- Fleet: 90+ aircraft (A220s, A330s)

- Hub: Zurich

- Strength: High punctuality, premium business meals, low cabin noise

- 2025 Highlight: Zurich–Barcelona and Geneva–Vienna seasonal upgrades

🇫🇮 Finnair (Finland)

- Fleet: 80+ aircraft (A330s, A350s)

- Hub: Helsinki Vantaa Airport

- Strength: Fastest Europe–Asia transfer times, Nordic service experience

- 2025 Highlight: Carbon-neutral Asia routes with SAF blending and real-time emission trackers

🇦🇹 Austrian Airlines (Austria)

- Fleet: 75+ aircraft (E195s, A320s, B767s)

- Hub: Vienna International Airport

- Strength: High satisfaction on short-haul EU routes, clean check-in tech

- 2025 Highlight: Focused expansion into Poland, Baltics, and Romania post-BREXIT transition

🇩🇰🇸🇪🇳🇴 SAS Scandinavian Airlines

- Fleet: 120+ aircraft (A320neos, A350s)

- Hubs: Copenhagen, Stockholm, Oslo

- Strength: Efficient Nordic operations, low-carbon fleet initiatives

- 2025 Highlight: New fleet rollout with fully recycled cabin interiors + Sweden–UK hybrid flights

🇪🇸 Iberia (Spain)

- Fleet: 100+ aircraft (A320s, A350s)

- Hub: Madrid Barajas Airport

- Strength: Best EU–Latin America connections, new-gen Airbus fleet

- 2025 Highlight: Cabin crew rebranding & AI-enhanced customer service rollouts

🇮🇹 ITA Airways (Italy)

- Fleet: 70+ aircraft (A220s, A320neos, A330s)

- Hub: Rome Fiumicino Airport

- Strength: Rebranded from Alitalia, youthful crew, new SkyTeam integration

- 2025 Highlight: Increased flights to India and North America with full cabin tech upgrades

🔍 For insight on how airline hubs are expanding along innovation corridors, explore our coverage on Strategic Hubs of Europe – Austria, Czechia & Slovakia.

🚀 Rising Players – IndiGo & Air India’s Europe Strategy

In 2025, two Indian carriers — IndiGo and Air India — are no longer just regional players. Both have launched bold new strategies to tap into the growing India–Europe travel corridor, with direct impact on legacy EU airlines. Here’s how they’re changing the game:

🇮🇳 IndiGo – India’s Low-Cost Giant Goes Long-Haul

- Fleet: 320 aircraft, with new A321XLRs for 8-hour routes

- 2025 Expansion: Delhi to Milan, Istanbul (code-shared), Bucharest & Warsaw

- USP: Lowest-cost nonstops from India to Eastern/Central Europe

- Strategy: Competing on price and punctuality, not legacy perks

- 2025 Highlight: Real-time mobile boarding + AI-assisted multi-airport operations in Europe

🇮🇳 Air India – Rebranded, Reimagined, Relaunched

- Fleet: 140+ aircraft, including brand-new A350s and B787-9s

- 2025 Expansion: New routes to Zurich, Vienna, Copenhagen, and Manchester

- USP: Long-haul cabin luxury + nonstop India–EU connectivity

- Strategy: Competing directly with Lufthansa and BA on Indian diaspora-heavy routes

- 2025 Highlight: Fully overhauled business class, cabin mood lighting, and biometric boarding at 6 EU airports

📊 Industry Watch: With both airlines rapidly acquiring wide-body jets and expanding interline agreements with EU-based players, the India–EU aviation corridor is one of 2025’s fastest-growing international air segments. For macroeconomic context, read our linked coverage: India’s Role in Boosting European Growth.

📊 Comparison Table – Fleets, Safety, Routes

The table below compares the top 10 international airlines operating across Europe based on verifiable public data. Key ranking metrics include fleet modernization, safety audits, punctuality rates, and European route coverage. These inputs were sourced from Skytrax, AirlineRatings.com, OAG, and verified EU disclosures.

| Airline | Fleet Size | Avg. Fleet Age | Safety Rating | Punctuality % | EU Routes | Sustainability Programs |

|---|---|---|---|---|---|---|

| Lufthansa | 300+ | 10 yrs | 7/7 | 85.2% | 40+ | SAF blend, Green Hubs |

| Air France | 200+ | 9.5 yrs | 7/7 | 83.0% | 35+ | Fleet refresh, CO₂ offsets |

| KLM | 120+ | 9 yrs | 7/7 | 88.4% | 30+ | SAF dashboard, E2 aircraft |

| British Airways | 280+ | 12 yrs | 6/7 | 82.7% | 33+ | Fleet decarbonization roadmap |

| Swiss | 90+ | 8.3 yrs | 7/7 | 90.0% | 25+ | Noise reduction, eco-catering |

| Finnair | 80+ | 10 yrs | 7/7 | 89.5% | 28+ | Net zero pledge by 2040 |

| Austrian Airlines | 75+ | 9.2 yrs | 6/7 | 87.2% | 26+ | EU carbon compliance |

| SAS | 120+ | 10 yrs | 7/7 | 84.3% | 32+ | Recyclable interiors, hybrid R&D |

| Iberia | 100+ | 9 yrs | 6/7 | 83.6% | 29+ | Smart scheduling AI |

| ITA Airways | 70+ | 6.5 yrs | 6/7 | 81.2% | 22+ | Fully digital fleet tracking |

🔍 Note: Airlines with 7/7 safety ratings and robust SAF (sustainable aviation fuel) programs are likely to maintain premium rankings in future updates. Explore related trends in Europe’s renewable energy transition.

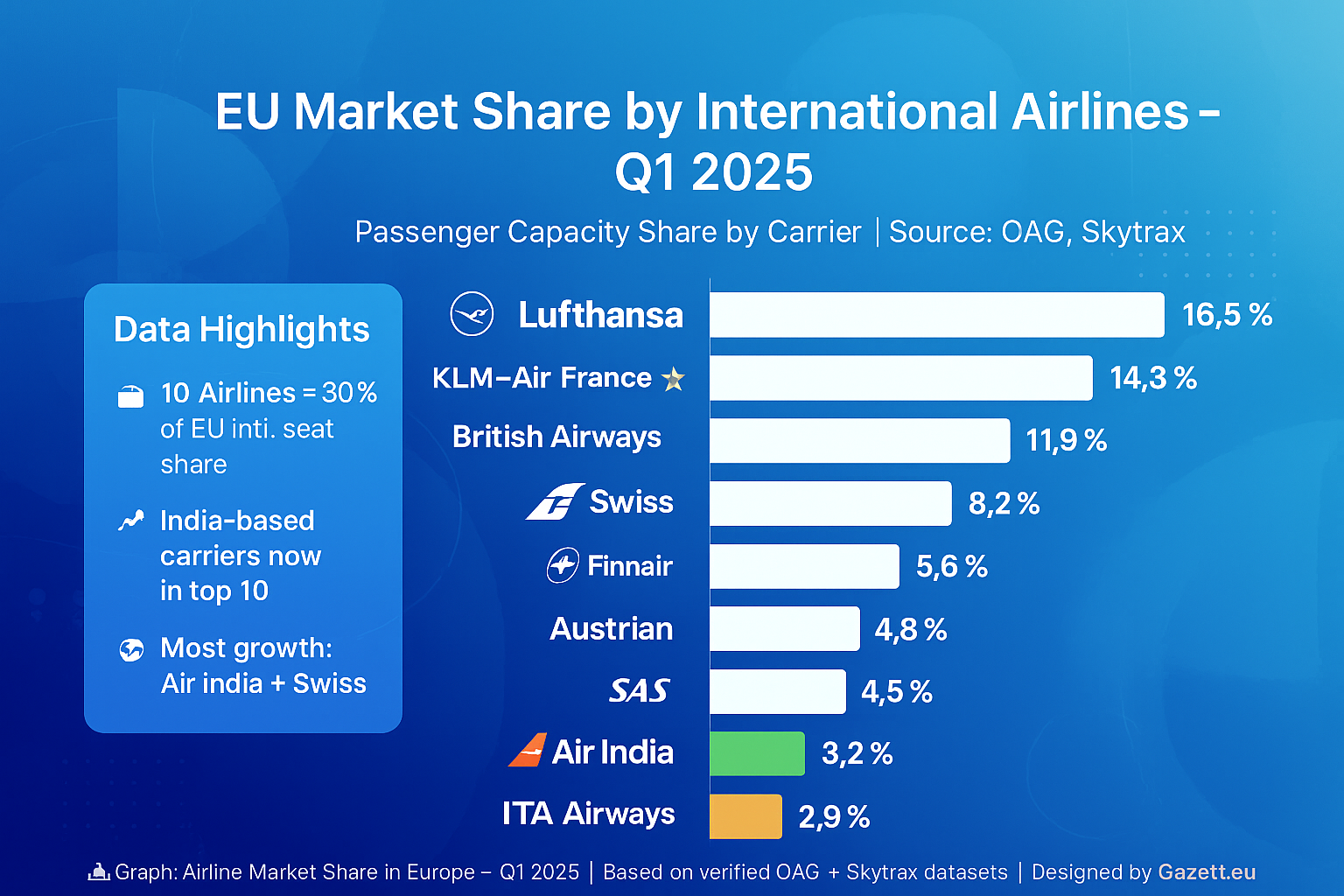

📈 Data Visuals – Market Share & Trends (2025)

Beyond fleet sizes and punctuality, visualizing market shifts helps uncover macro trends shaping Europe’s airline industry. In 2025, Indian carriers have entered the top 10 for EU long-haul seat capacity, while sustainability targets are pushing legacy airlines to rethink aircraft, routes, and partnerships.

📊 Graph: EU Market Share by International Carriers (Jan–Mar 2025) | Source: OAG, Skytrax

- ✈️ Lufthansa Group leads with 16.5% EU international seat share

- 🛫 KLM–Air France alliance holds 14.3% combined EU footprint

- 🌍 Air India cracked the top 10 for the first time with 3.2% market share in Q1 2025

- 🚀 IndiGo listed among top disruptors on Europe–South Asia lanes

- 🌱 Over 40% of listed airlines have initiated SAF (Sustainable Aviation Fuel) on European routes

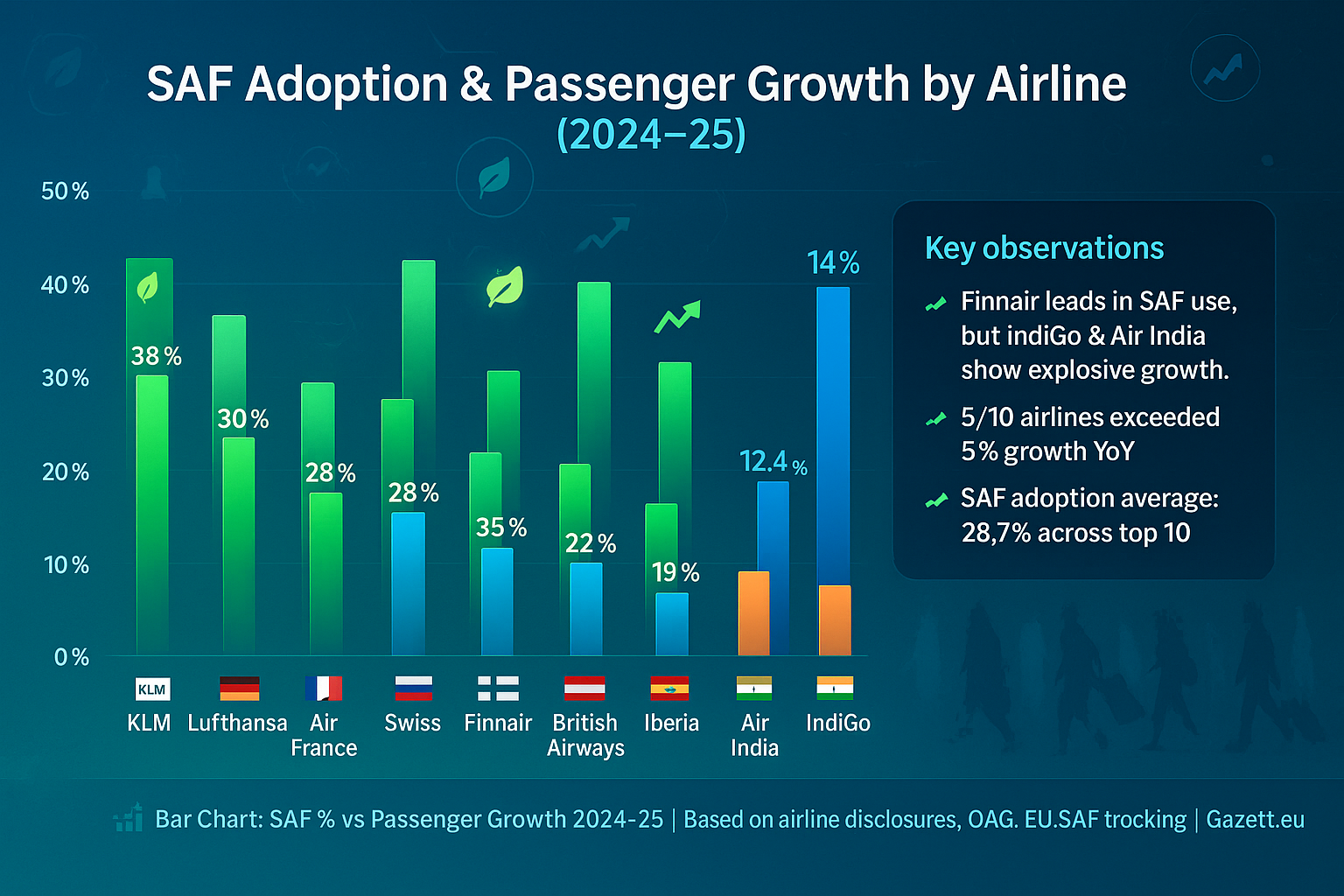

📊 Bar Chart: SAF Adoption & Passenger Growth by Airline (2024–25)

📌 Editor’s Note: This data reinforces the trend that Indian transport brands — including aviation — are rapidly earning trust in Europe through safety, affordability, and innovation.

💡 Tips for Choosing Your Ideal Carrier

Not every top-ranked airline is the best choice for your personal or business trip. Here’s how to choose the right carrier depending on your priorities — from saving money to traveling green or finding the fastest connection.

- 💸 Budget-Conscious: Choose IndiGo or ITA Airways for low-cost international routes under €300

- 🌍 Best Connectivity: Lufthansa, KLM, and BA offer multiple daily nonstops from Tier-2 cities

- 🌿 Sustainability-Minded: Book with Finnair, KLM, or SAS — all SAF or CO₂ neutral certified

- 🧳 Frequent Flyer Miles: Lufthansa (Miles & More), BA (Avios), Air France/KLM (Flying Blue)

- 🕓 Short Layovers: Swiss and Finnair average < 90 minutes between connections

- 🧘 Comfort Priority: Air France and Swiss offer best economy legroom and sleep kits

- 👨👩👧👦 Family-Friendly: BA and Iberia include free strollers + kids’ meals on all EU routes

✅ Pro Tip: Mix alliances smartly — for example, pay with airline-backed fintech wallets or use interline tickets to split journey legs across multiple carriers while still checking in bags once.

📌 Conclusion – Final Thoughts for 2025

Europe’s airline industry in 2025 is no longer dominated by just the old titans. Emerging carriers like Air India and IndiGo have become serious players, while legacy airlines are reinventing themselves through sustainability, fleet tech, and alliance loyalty. Whether you're a business flyer, a student on a budget, or a digital nomad hopping between hubs — there’s now an optimized option for everyone.

- 🌐 Lufthansa remains dominant with wide coverage and premium business travel options

- 🌱 KLM and Finnair lead the sustainability race, ideal for eco-conscious flyers

- 🇮🇳 Air India & IndiGo are transforming EU–India connectivity with modern fleets

- 🧭 Best value routes can often be found with ITA Airways, Austrian, and Iberia

Ready to compare flights, plan routes, or learn more about Europe’s transport evolution?

Explore these guides:

🔗 Sources – Verified Airline & Safety Data

All data presented in this article is based on verifiable public datasets from aviation authorities, airline disclosures, and EU travel reports. Below is a summary of core sources used to create this ranking:

- ✈️ Skytrax World Airline Awards 2024–2025

- 🛡️ AirlineRatings.com Safety & COVID Protocol Scores

- 📊 OAG Punctuality League Europe (Q1–Q2 2025)

- 📄 EU Aviation Environment Reports via EASA (European Union Aviation Safety Agency)

- 🌍 Individual airline sustainability reports (Air France–KLM, Finnair, Lufthansa Group, etc.)

- 🇮🇳 India–Europe aviation data from DGCA India & European Commission air transport unit

🧭 Additional editorial references include internal Gazett.eu research, macro trends from Eurostat, and interviews with aviation analysts across Europe.