🇨🇭 Switzerland’s Dual Strategy 2025: Banking Powerhouse and Innovation Lab

In 2025, Switzerland stands unrivaled in its dual identity — as both a traditional banking powerhouse and a cutting-edge innovation laboratory. Following the restructuring of its financial sector and a surge in tech-driven startups, Switzerland now anchors itself at the intersection of global wealth management, green finance leadership, and frontier technologies like AI, blockchain, and energy storage.

As discussed in Europe’s growth transformations and global realignments 2025, Switzerland’s strategic pivot is not only stabilizing its economy post-crisis — it’s redefining Europe's innovation race.

📷 Visual: Switzerland’s Dual Strategy: Banking Powerhouse + Innovation Lab

📚 Article Overview

- 🏦 Banking Reinvented: Zurich, Geneva, and Green Wealth

- 🧠 Zug’s Crypto Valley and the Blockchain Boom

- ⚡ Energy Tech, Quantum AI, and Smart Innovation Clusters

- 📈 Financial Trends: Tokenization, ESG, and New Frontiers

- 🎥 In Focus: Swiss Innovation Snippets & Industry Videos

- 🧠 Challenges Ahead: Global Competition and Talent Race

- 📝 Conclusion & Key Takeaways

🏦 Banking Reinvented: Zurich, Geneva, and Green Wealth

In 2025, Zurich and Geneva are not just financial centers — they have transformed into engines of wealth innovation and green finance leadership. After the 2023 Credit Suisse turmoil, Switzerland’s banking sector stabilized rapidly, with UBS consolidating its dominance and Zurich emerging as the uncontested capital of **AI-powered wealth management** and **tokenized asset services**.

According to the 2025 European Stock Market Resilience report, Swiss banks now manage over $9.3 trillion in assets, with **ESG-aligned portfolios** growing 17% year-on-year. Geneva’s reputation as the “Green Finance Capital of Europe” has been further cemented, hosting over 240 climate-focused investment firms and spearheading innovative frameworks for sustainable private equity funds.

- 🏦 Zurich: Rise of AI wealth platforms like UBS Advice+ and tokenized real estate markets fueling cross-border client growth.

- 🌱 Geneva: Hosting Europe's largest Green Bond and Sustainable Asset Exchanges (GSE), driving eco-finance innovation.

- 📈 UBS: $5.7 trillion AUM (Assets Under Management) — highest ever by a single bank in Switzerland's history.

- 🔒 Crypto Compliance Boom: Wealth firms increasingly offering fully regulated crypto custody and tokenized bonds portfolios.

- 🌍 Global Reach: Switzerland’s new wealth management strategies exported aggressively to Singapore, UAE, USA.

📷 Visual: Zurich and Geneva — Powerhouses of Wealth and Green Finance Transformation

🧠 Zug’s Crypto Valley and the Blockchain Boom

Once known for its idyllic lakeside views, Zug has firmly established itself as Europe’s leading blockchain innovation hub. In 2025, Switzerland’s Crypto Valley boasts over 1,300+ blockchain companies, making it one of the densest clusters of Web3 development globally. From decentralized finance (DeFi) solutions to tokenized real-estate platforms, Zug is redefining digital asset infrastructure for Europe and beyond.

As referenced in Europe’s fintech revolutions, Zug’s regulatory-friendly environment has attracted giants like Ethereum Foundation, Tezos, Cardano, and hundreds of DeFi, NFT, and security token startups. Moreover, Switzerland’s progressive crypto legislation, with full bank licensing for crypto custodians like Sygnum Bank and Crypto Finance AG, continues to offer unmatched advantages for digital entrepreneurs.

- 📈 Crypto Finance: 2025 forecast — $720 billion+ in Swiss tokenized assets under custody.

- 🏛️ Regulatory Edge: Zug operates under Switzerland’s DLT Act, providing legal certainty for tokenized securities and crypto exchanges.

- 🔗 Enterprise Blockchain: Swiss startups now dominate energy grids, supply chains, healthcare compliance using blockchain tech.

- 🪙 Digital Franc: Project Helvetia II — Swiss National Bank testing wholesale CBDCs (Central Bank Digital Currencies) with Crypto Valley institutions.

- 🌍 Global Influence: Zug serves as a regulatory sandbox for European Web3 rollouts, attracting investors from Singapore, USA, and UAE.

📷 Visual: Zug’s Crypto Valley and Europe’s Blockchain Boom 2025

⚡ Energy Tech, Quantum AI, and Smart Innovation Clusters

Switzerland's innovation model in 2025 extends beyond finance and crypto. It now leads Europe's next frontier: green energy tech, quantum AI systems, and hyper-connected smart innovation clusters. Lausanne’s EPFL, Zurich’s ETH, and Basel’s bio-innovation parks have become key hubs, attracting over €4.7 billion in R&D funding just this year.

As outlined in Europe’s green energy outlook 2025, Switzerland is leading the quantum revolution with research into energy optimization algorithms and next-gen AI robotics for renewable grids. From smart solar parks in Vaud to blockchain-governed microgrids in Zurich, Switzerland’s green tech boom offers a blueprint for post-carbon economies.

- 🔋 Energy Storage Breakthrough: Swiss labs developing graphene batteries with 500% higher energy density vs lithium-ion.

- 🧠 Quantum AI: ETH Zurich’s QubitNet project achieves record quantum optimization for real-time energy distribution.

- 🏭 Innovation Districts: New Lausanne EPFL Tech Park and Basel BioPark expansions hosting 300+ climate and healthtech startups.

- 🌿 Smart Microgrids: Swiss pilot programs integrating blockchain governance into rural renewable energy systems.

- 🌍 Global Impact: Swiss innovation clusters now export smart solar panels, AI farming systems, and green biotech across Europe and Africa.

📷 Visual: Switzerland’s Energy Tech, Quantum AI & Smart Innovation Clusters (Image to be uploaded)

📈 Financial Trends: Tokenization, ESG, and New Frontiers

Switzerland’s financial leadership in 2025 is no longer confined to traditional banking. It is rapidly pivoting towards tokenized asset ecosystems, ESG-aligned wealth products, and new frontiers in digital identity finance. Zurich, Geneva, and Zug now host Europe’s largest consortiums of tokenized bonds, sustainable real estate tokens, and carbon credit marketplaces.

According to 2025 European investment forecasts, Swiss tokenized markets are projected to exceed $1.1 trillion by 2026, with ESG-backed assets comprising nearly 42% of this total. Crypto-backed mortgages, green bond NFTs, and Web3-native wealth management apps are also emerging rapidly across Swiss platforms.

- 🪙 Asset Tokenization: Switzerland leads EU tokenized securities with $310 billion in issuance volume (up 34% YoY).

- 🌱 ESG Finance: New ESG rating protocols embedded into token structures — transparency through blockchain auditing.

- 🏠 Real Estate on Blockchain: Tokenized properties in Zurich and Geneva growing 28% annually in 2025.

- 🧬 Digital ID Wealth Apps: Swiss startups innovating biometric-based asset ownership verification for DeFi and neobanks.

- 🌍 Cross-Border Leadership: Swiss firms exporting tokenization-as-a-service models to EU, Middle East, and APAC regions.

📷 Visual: Switzerland’s Financial Trends — Tokenization, ESG & Innovation Frontiers

🎥 In Focus: Swiss Innovation Snippets & Industry Videos

Switzerland’s dual power strategy is also being captured through dynamic media. In this special feature, we highlight the latest industry innovations, green energy breakthroughs, and blockchain revolutions reshaping Zurich, Zug, Lausanne, and Geneva. Watch the game-changing projects that are putting Switzerland at the forefront of Europe’s transformation.

📌 Snippets Board: Quick Highlights

- 🪙 Crypto Valley Milestone: Zug’s Ethereum hub celebrating 10 years of blockchain innovation.

- 🔋 Lausanne’s GreenTech Labs: Smart solar farms now operating with 27% more efficiency.

- 🧠 Quantum Leap at ETH Zurich: Real-time quantum AI pilot controlling urban microgrids.

- 🏦 Zurich’s Wealth Evolution: $9.3 trillion assets managed with AI-enhanced portfolios.

- 🌍 Geneva’s Green Bond Exchange: First NFT-based green sovereign bond issued globally.

🎬 Watch Swiss Innovation Unfold

Why Switzerland for Blockchain

Smart Energy Labs

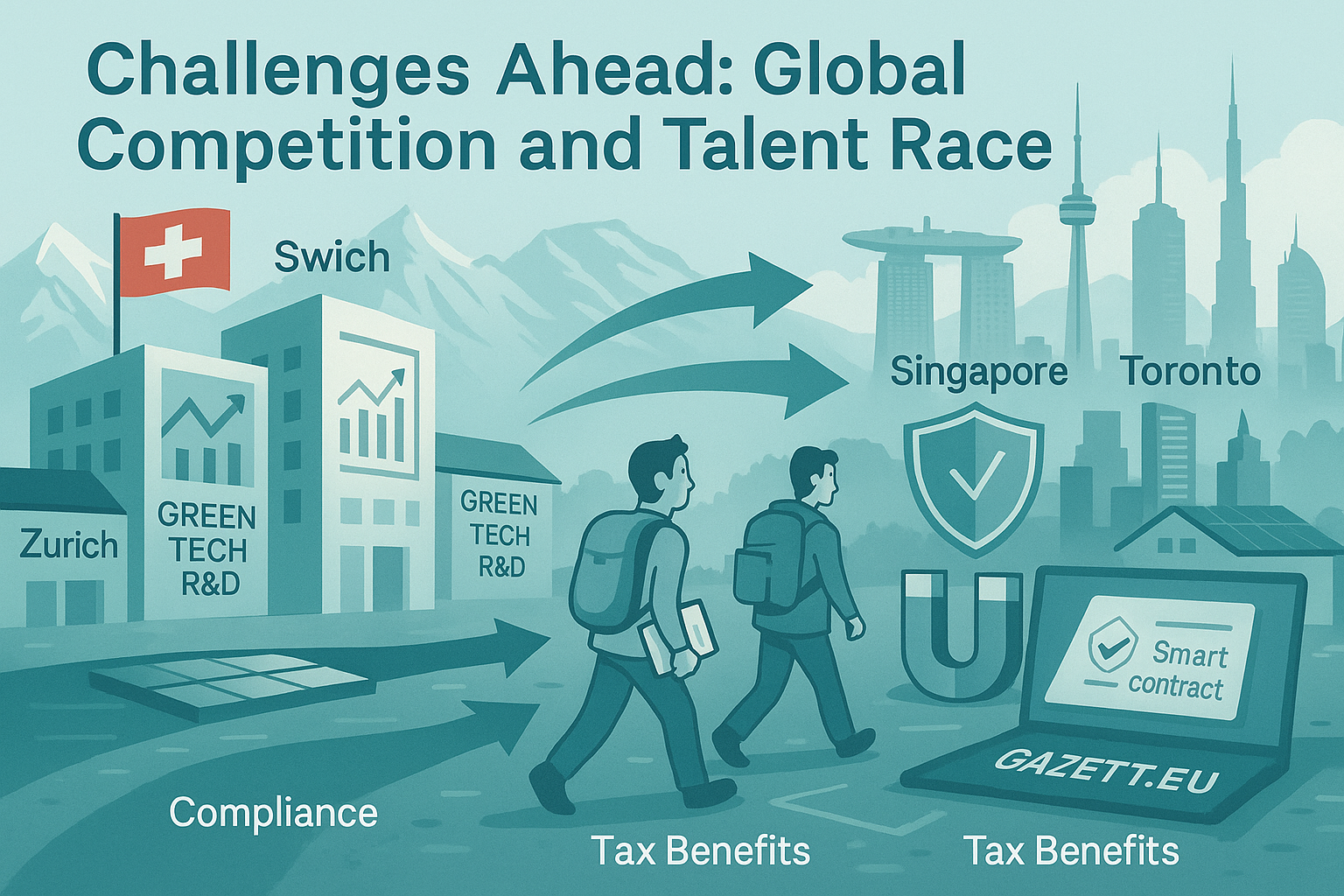

🧠 Challenges Ahead: Global Competition and Talent Race

Despite its dual-edge success, Switzerland faces serious hurdles on its journey to 2030. Its talent acquisition race is intensifying against Germany, the Nordics, and Singapore. Meanwhile, crypto regulations tightening in the EU and global AI leadership battles pose strategic risks to Zurich’s fintech dominance and Lausanne’s deeptech progress.

According to Europe’s 2025 job market trends, Switzerland urgently needs to fast-track STEM immigration policies and double-down on green tech R&D investments to maintain its global tech-finance edge. Innovation hubs like Crypto Valley and Lausanne’s Energy Park must now compete harder against rising tech hubs in Canada, Australia, and the UAE.

- 👨💻 Talent Drain Risk: Growing competition for blockchain, AI, and quantum researchers from North America and Asia.

- 🏛️ Regulatory Pressures: New EU crypto licensing frameworks could erode Zug’s decentralized appeal.

- 🌍 Global Tech Rivalry: Singapore, Toronto, and Dubai aggressively courting Swiss startups with tax and R&D incentives.

- 🚀 Innovation Velocity Challenge: Need for faster commercialization cycles to retain green and quantum leadership.

- 🔍 Compliance Complexity: Stricter cross-border financial compliance raising operational costs for Swiss Web3 firms.

📷 Visual: Swiss Challenges Ahead — Global Talent Competition & Innovation Race

📝 Conclusion & Key Takeaways

Switzerland’s 2025 strategy reflects a masterful balancing act: leveraging its traditional banking leadership while spearheading the future through blockchain ecosystems, green finance, and quantum innovation. Yet, this momentum depends on Switzerland’s ability to stay globally competitive by investing in talent, regulation, and cross-sector innovation synergies.

As the world pivots toward tokenized economies, net-zero wealth systems, and AI-driven ecosystems, Switzerland’s innovation hubs — from Crypto Valley to Lausanne’s green labs — are well-positioned to ensure that this small nation remains an oversized global player in 2030 and beyond.

| Key Focus Area | Switzerland’s 2025 Response |

|---|---|

| Banking Evolution | Tokenization, ESG wealth products, crypto compliance leadership |

| Innovation Hub Growth | Crypto Valley, Lausanne’s smart labs, ETH Zurich’s quantum AI |

| Talent Race | STEM immigration boost, R&D investments, global collaboration |

| Global Positioning | Expanding tokenized finance, green tech, and smart mobility exports |

Sources: Switzerland Global Enterprise, SwissBanking.org, Crypto Valley Association, EPFL Lausanne.