🏭 Made in Europe: The Return of Continental Manufacturing

From France to Poland, a quiet revolution is reshaping Europe's industrial base. Driven by reshoring momentum, green policy incentives, and energy autonomy, 2025 marks a decisive shift back to “Made in Europe.” Global supply chain disruptions, geopolitical risk, and new EU-wide industrial strategies are accelerating the trend toward local, cleaner, and more resilient manufacturing.

In this article, we explore how Europe’s industrial comeback is unfolding — with a focus on policy tools, national strategies, energy sourcing, and the sectors leading this transformation.

📚 Table of Contents

- 1. Reshoring Surge: What’s Driving the Shift?

- 2. Green Industrial Policy Across Europe

- 3. Energy as a Competitive Advantage

- 4. Smart & Sustainable Factories

- 5. Regional Spotlights: Germany, France, Eastern Europe

- 6. By the Numbers: EU Manufacturing in 2025

- 7. Future Outlook: Europe’s Industrial Sovereignty

- ✅ Conclusion

🔁 Reshoring Surge: What’s Driving the Shift?

In 2025, Europe is witnessing its largest reshoring wave in decades. From automotive parts to solar panel components, manufacturers are moving production back to the continent. This isn’t just reactionary — it’s strategic. After pandemic-era supply shocks, geopolitical instability, and growing trade frictions, governments and companies alike are choosing proximity over price.

The EU's industrial base is being rebalanced as countries prioritize resilience, sustainability, and security of supply. A 2024 Eurostat report revealed that 38% of manufacturers surveyed in Germany, Italy, and France had either moved or were planning to move production from Asia or North Africa back to Europe. This realignment is driving fresh investment into regional manufacturing hubs.

- 📦 Supply Chain Risk: Reducing dependency on global shipping and external disruptions

- 🏛️ Policy Push: EU reshoring funds, tax credits, and national reindustrialization schemes

- 🌍 Carbon Footprint: Lower emissions via local production and nearshoring logistics

- 💶 Cost Shift: Rising wages in Asia and energy price volatility closing cost gaps

- ⚙️ Automation: High-tech European plants offset labor cost differences

This reshoring push echoes trends tracked in our deep dive on European industrial sovereignty, highlighting a shift from globalized fragility to local resilience.

Internal source: Gazett.eu | Related: European Industrial Sovereignty 2025

🌱 Green Industrial Policy Across Europe

Europe’s industrial revival in 2025 isn’t just about reshoring — it’s about redefining how things are made. Green industrial policy is at the center of this shift, driven by the EU Green Deal, the Net-Zero Industry Act, and national stimulus packages. These frameworks are helping industries decarbonize while making the EU more competitive in green tech.

Countries like Germany, France, and the Netherlands are channeling billions into green subsidies, clean manufacturing zones, and circular economy projects. Meanwhile, Brussels is standardizing carbon border taxes and clean energy incentives to level the playing field across member states.

- 🔋 EU Green Deal: €600B in climate-aligned funding through 2027

- 🏭 Net-Zero Industry Act: Fast-tracking permits for clean tech factories

- 🔄 Circular Economy: Boost in material reuse, repair, and recycling in industrial zones

- 🌍 Carbon Border Adjustment: Making imports match EU environmental standards

- 🌞 Green Grants: Localized incentives for solar steel, hydrogen, and battery projects

As detailed in our recent explainer on the EU Net-Zero Industry Act, this policy toolkit is positioning Europe as both a climate leader and a green manufacturing powerhouse.

Internal source: Gazett.eu | Related: EU Net-Zero Industry Act Impact 2025

⚡ Energy as a Competitive Advantage

After years of being seen as a vulnerability, energy is emerging as a strategic edge for Europe’s manufacturing revival. Countries are rethinking industrial planning through the lens of energy independence and green sourcing. The shift is being driven by falling costs of renewables, electrification of processes, and energy efficiency mandates under the EU’s Fit for 55 strategy.

Nations with abundant clean energy — like Sweden, Spain, and Portugal — are becoming magnets for new industrial projects, especially in batteries, green steel, and low-emission chemicals. Meanwhile, France is doubling down on nuclear energy to power its industrial heartland with stable, low-carbon output.

- 🔋 Clean Energy Access: Renewable hotspots like Iberia and Nordics attracting new factories

- ⚛️ Nuclear Backbone: France and Eastern Europe expanding low-carbon energy for industry

- 🏭 Energy-Intensive Manufacturing: Green steel, electrolysis, and battery cells in focus

- 📉 Cost Factor: Cheaper electricity via wind, solar, and hydro stabilizing long-term margins

- 📦 Onsite Generation: Factories co-locating with wind/solar farms for resilience & savings

This shift is helping Europe future-proof its industrial growth. Learn more in our spotlight on energy-based industrial planning across the EU.

Internal source: Gazett.eu | Related: Europe's Energy-Industrial Hotspots 2025

🗺️ Regional Spotlights: Germany, France, Eastern Europe

Europe’s manufacturing revival is being driven not just by policy — but by regional champions. Germany remains the industrial engine of the continent, but the momentum is spreading to newer growth zones in Eastern Europe, as well as strategic hubs in France.

France is emerging as a leader in green chemistry and smart mobility, supported by mega-sites in Lyon and Normandy. Germany is doubling down on battery clusters, clean steel, and precision tools. Meanwhile, Eastern Europe — particularly Poland, Slovakia, and Romania — is booming thanks to lower operating costs and EU-backed infrastructure upgrades.

- 🇩🇪 Germany: Green steel (NRW), EV batteries (Bavaria), robotics (Saxony)

- 🇫🇷 France: Hydrogen & mobility (Normandy), pharma & clean tech (Lyon)

- 🇵🇱 Poland: Automotive, defense, and home appliances near Katowice & Łódź

- 🇸🇰 Slovakia: EV component manufacturing and battery assembly exports

- 🇷🇴 Romania: Logistics and light manufacturing boom in Bucharest–Cluj corridor

These regional shifts show how EU reshoring is not one-size-fits-all — it’s about leveraging local strengths within a continental framework. See our full report on Europe’s manufacturing map 2025 for data-driven regional trends.

Internal source: Gazett.eu | Related: European Industrial Hubs 2025

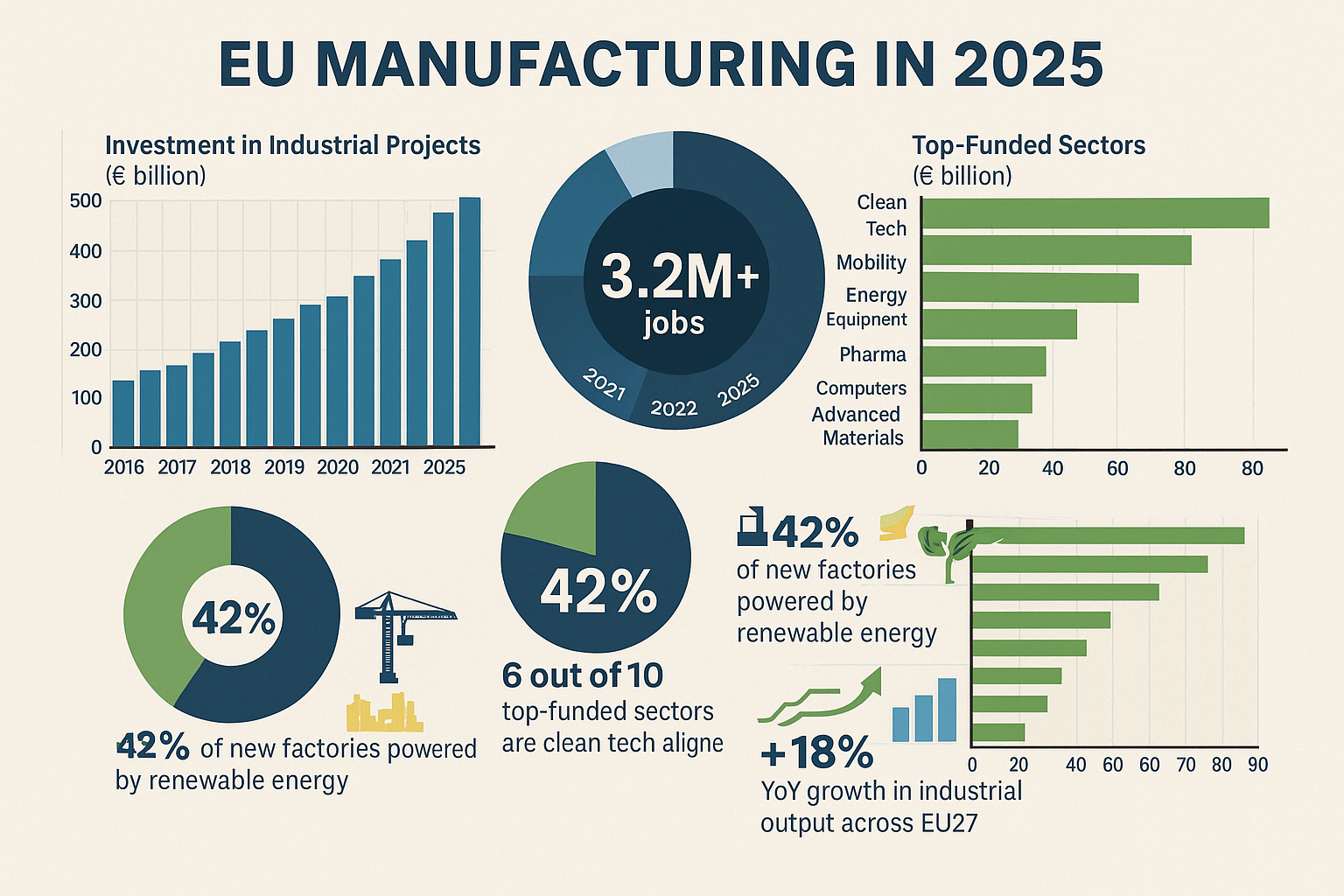

📊 By the Numbers: EU Manufacturing in 2025

The numbers behind Europe’s manufacturing renaissance in 2025 paint a clear picture: reshoring is real, green tech is rising, and industrial jobs are rebounding. From scale of investment to employment trends, data across the continent confirms a new industrial growth cycle in motion.

According to Eurostat and national trade ministries, Europe added over 3.2 million new manufacturing-related jobs since 2021, driven by clean tech, mobility, energy equipment, and advanced materials. Capital expenditure in industrial projects has reached its highest level in 15 years, with over €450 billion invested between 2023–2025.

- 🏗️ €450B+ in industrial project investments since 2023

- 👷 3.2M+ jobs created in manufacturing and allied services

- ⚡ 42% of new factories powered by renewable energy

- 🌱 6 out of 10 top-funded sectors are clean tech aligned

- 📈 +18% YoY growth in industrial output across EU27

These stats reveal a broader trend — Europe is not just recovering industrially, it’s reinventing its industrial base for the 21st century. For deeper metrics, check our full manufacturing dashboard here: EU Industrial Statistics 2025.

Internal source: Gazett.eu | Related: EU Industrial Dashboard 2025

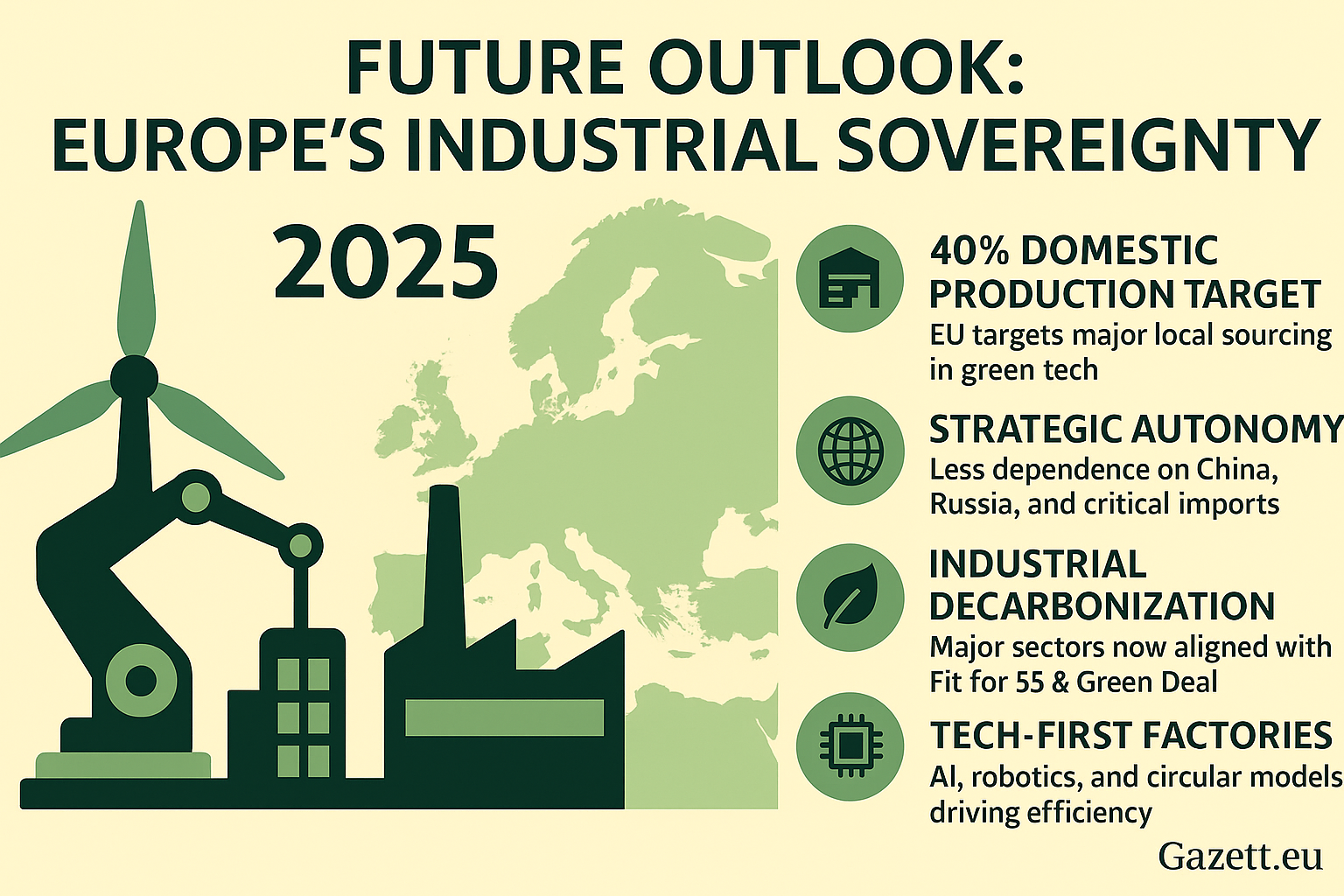

🚀 Future Outlook: Europe’s Industrial Sovereignty

Europe’s reshoring push is about more than just job creation — it’s about sovereignty, competitiveness, and climate leadership. By 2030, the EU aims to produce 40% of its green tech needs domestically and reduce reliance on foreign industrial inputs by a third.

The direction is clear: resilient supply chains, clean energy-backed manufacturing, and EU-aligned regulatory certainty. France, Germany, and the Nordics are doubling down on strategic autonomy, while Eastern Europe is evolving into the EU’s scaled production base for next-gen industrial technologies.

- 🏭 40% Domestic Production Target: EU targets major local sourcing in green tech

- 🌍 Strategic Autonomy: Less dependence on China, Russia, and critical imports

- 🔋 Industrial Decarbonization: Major sectors now aligned with Fit for 55 & Green Deal

- 🛡️ Resilience First: Supply chain redesigns across EV, pharma, and electronics

- 🤖 Tech-First Factories: AI, robotics, and circular models driving efficiency

Europe’s industrial comeback is no longer a policy ambition — it’s a reality. Read our forward-looking report on how sovereignty is shaping EU manufacturing strategy.

Internal source: Gazett.eu | Related: Future of EU Industrial Sovereignty

✅ Conclusion: Why “Made in Europe” Matters Again

Europe’s manufacturing revival is not a trend — it’s a tectonic shift. By combining reshoring, green industrial strategy, energy optimization, and regional innovation, the continent is rebuilding its industrial backbone for a more secure and sustainable future.

As new factories rise across the map and policy frameworks evolve, “Made in Europe” is becoming a symbol of quality, resilience, and climate alignment. This is not just about jobs or GDP — it’s about sovereignty, stability, and long-term competitiveness.

🔎 Key Takeaways at a Glance

| Strategic Driver | What’s Changing in 2025 |

|---|---|

| Reshoring | 38% of manufacturers relocating production to EU |

| Green Industrial Policy | €600B+ in green funding, carbon border laws active |

| Energy Sourcing | 42% of new EU factories powered by renewables |

| Regional Hotspots | France, Germany, Poland, Romania, Slovakia in focus |

| Job Creation | 3.2M+ jobs created in advanced manufacturing |